Registered User

Joined: 3/16/2006

Posts: 2,214

|

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

|

|

Registered User

Joined: 2/19/2008

Posts: 193

|

Thank you! Appreciate being kept informed here. Following you on Twitter too.

Jean

|

|

Registered User

Joined: 8/19/2009

Posts: 170

|

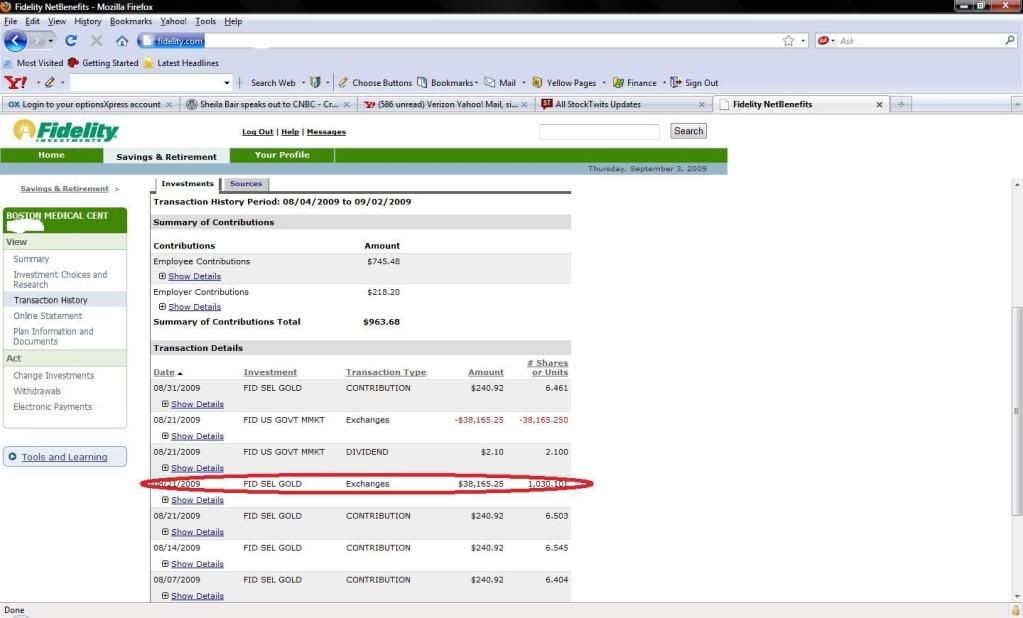

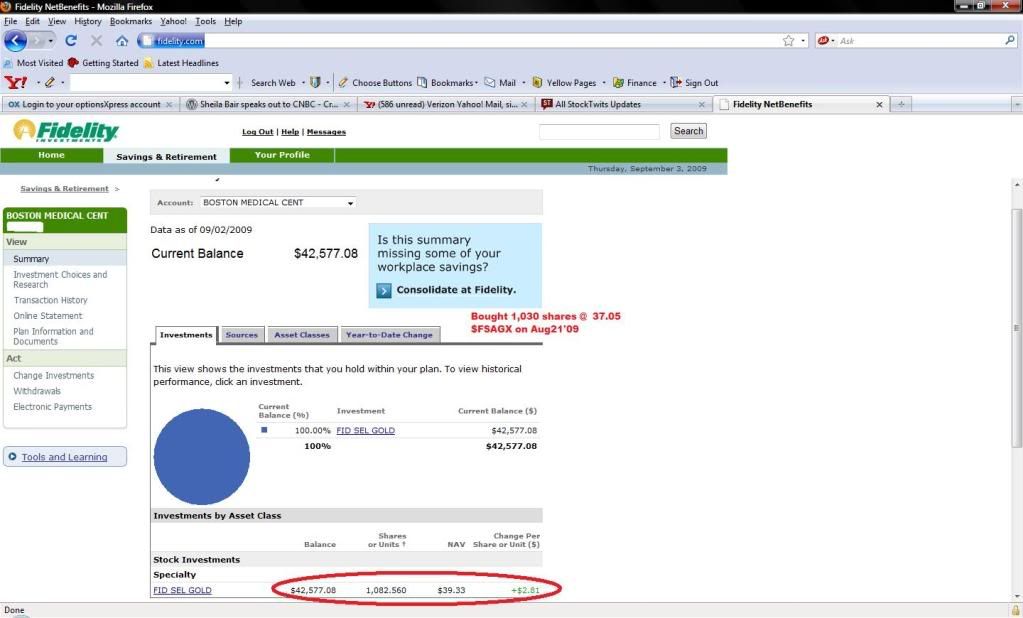

eh so you had practically your entire account in gold?

|

|

Registered User

Joined: 3/29/2005

Posts: 56

|

QUOTE (intothetrade) eh so you had practically your entire account in gold?

We weren't able to buy gold/PM funds in our retirement accts at work for a long time. They have been put back into the Vgd and Fid selections as of some time ago, but having been burned in gold funds before I have stayed out so far. It takes big brass ones to go all in like that, good luck to signaltap.

|

|

Registered User

Joined: 6/8/2007

Posts: 31

|

It is nice to show your recent gains from buying Gold.How can one put all money in gold espy retirement fund???. Gold gone up because of commodity speculation and short coverage.There is no inflation now. Consumer has no money or credit or income to pump the prices of anything in the market at this time.It might be in future. Watch Gold wil correct in near future. I will take the profits???

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

kshere ...

Although there may not be much evidence of current inflation ... there is plenty of evidence of USD devaluation ... and the traditional hedges have been gold and dirt ...

And with real estate prices still falling ... dirt isn't all that attractive ...

If the USD continues to fall ... oil will continue to rise .... and the inflation will eventually come ...

US demand is not the 800 lb gorilla that it used to be ... able to set world commodity prices by the health of only our economy ...

Growth in China and India will more than make up for any reduced demand in the US ....

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

http://www.screencast.com/users/sirgiyan/folders/Jing/media/5efd58a6-30ce-47cd-80a0-b52d23150a5d

The chart above looks bullish to me. This could prove to be bad for commodities. Might even give rise to a Bear or two or three.....

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

uup consolidating after a 5 month downtrend is bullish? lol.

although, i do think gold needs to break decisively above $1000 before we can declare the bull run, in gold, on.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Yes Funnymony, that is my opinion. The pattern looks to me to be a bullish triangle bottom formation. The increasing volume was another clue in my analysis. Could I be wrong? Yes. I have played the break out on these triangles in the past and had success doing so. I have also seen them break down. My bet is up though....

I only responded to your post because I saw a question marke following your first sentence. It is nice to get a good mix of opinions.....

|

|

Registered User

Joined: 8/19/2009

Posts: 170

|

QUOTE (kshere75) It is nice to show your recent gains from buying Gold.How can one put all money in gold espy retirement fund???. Gold gone up because of commodity speculation and short coverage.There is no inflation now. Consumer has no money or credit or income to pump the prices of anything in the market at this time.It might be in future. Watch Gold wil correct in near future. I will take the profits???

in some 401k you can speak to the manager and have them purchase X amount... and in IRA you have pretty much full control unless its a SEP then it can be limited

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Just to throw in one more opinion on UUP, I'm going to have to part company with my long time friend, Apsll, and say that I would look for a drop to somewhere around 22.70 before going up, If it drops through that, next support is around 22.

That's my take, anyway.

|

|

Registered User

Joined: 12/31/2005

Posts: 266

|

a trend is trend until its broken.

http://stockcharts.com/c-sc/sc?s=$USD&p=W&yr=5&mn=10&dy=0&i=p91750659506&a=173731770&r=644

|

|

Registered User

Joined: 7/17/2009

Posts: 42

|

It is possible that Gold moves without the dollar. I dont see much more downside in the buck maybe a poke down to the lows or even the lower trendline of that wedge but i dont see it fall of the plate. In the two Last weeks the DSI on the dollar registered only 3% dollar bulls , this weeks consolidation figure brings that up to 16% , basically the world and his brother is bearish on the dollar and i reckon the smart shorts are getting out. UUP shows a different pattern to the DX even though UUP is supposed to track the DX so i would take my final decision there. The short british pound seems the best long dollar trade to me.

|

|

Registered User

Joined: 7/17/2009

Posts: 42

|

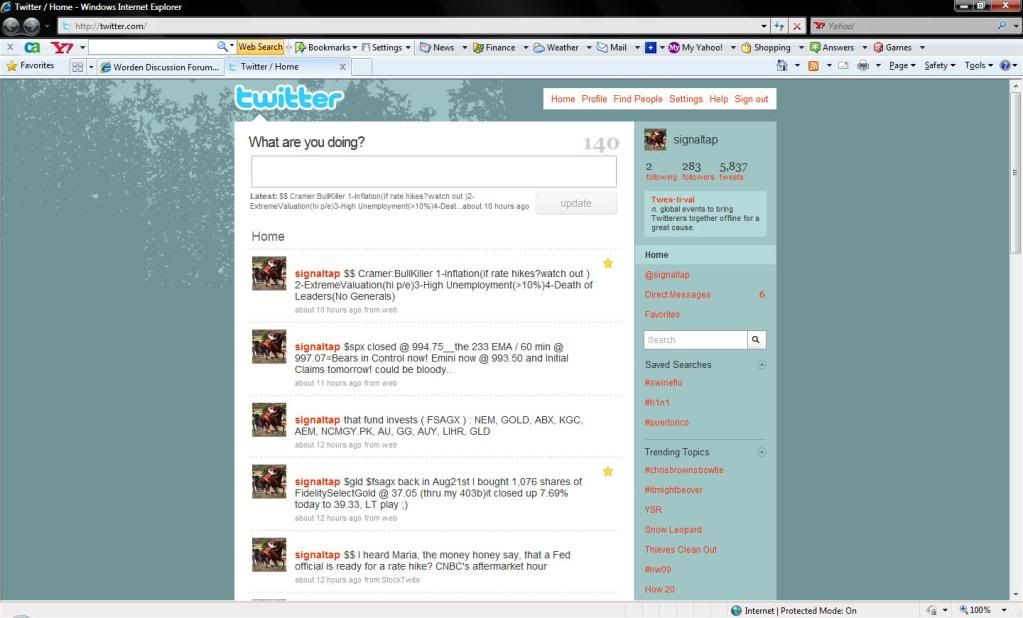

By the way congratulations on your trade , i think i mentioned eslewhere that silver leads well for gold and the COTC report on Silver shows massive short interest before the move in both. By massive short interest i mean 25% of annual production is short. Its a bit more neutral in gold but on the whole the longs in Gold are institutional.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (davidcmadrid) It is possible that Gold moves without the dollar.

Sure it is ....

And contrarian indicators are great .... as the "herd" is generally wrong ...

On the other hand ....

Do ya reckon that there was a contrarian who stepped out onto the deck of the Titanic and said ...

"Hey ... everybody is trying to get off the boat ... now's probably a dandy time to visit the engine room ... it shouldn't be crowded at all .... "

We have an $11.6 Trillion debt right now .... and the White House's "rosey" scenario promises to add $9 Trillion to that over the next 10 years ...

And this allows nothing for the notes that will be called from Social Security as it goes cash flow negative in the next year or so ...

Or the insolvency that Medicare faces around 2017 (or earlier) ....

And let's don't forget that before you can be in debt ... someone has to loan you the money ...

The US's largest debtholders ... China, Japan, and the UK .... are already having to be coaxed to buy more .... and our debt is at about 80% of GDP ....

Who will be buying it at over 150% of GDP ??

No one ... there probably won't be anyone buying it at 100% of GDP ....

These debtholders are already moving their holdings from longer maturities to much shorter maturities ...

So what is the end game ??

|

|

Registered User

Joined: 1/12/2009

Posts: 235

|

QUOTE (realitycheck) QUOTE (davidcmadrid) It is possible that Gold moves without the dollar.

Sure it is ....

And contrarian indicators are great .... as the "herd" is generally wrong ...

On the other hand ....

Do ya reckon that there was a contrarian who stepped out onto the deck of the Titanic and said ...

"Hey ... everybody is trying to get off the boat ... now's probably a dandy time to visit the engine room ... it shouldn't be crowded at all .... "

We have an $11.6 Trillion debt right now .... and the White House's "rosey" scenario promises to add $9 Trillion to that over the next 10 years ...

And this allows nothing for the notes that will be called from Social Security as it goes cash flow negative in the next year or so ...

Or the insolvency that Medicare faces around 2017 (or earlier) ....

And let's don't forget that before you can be in debt ... someone has to loan you the money ...

The US's largest debtholders ... China, Japan, and the UK .... are already having to be coaxed to buy more .... and our debt is at about 80% of GDP ....

Who will be buying it at over 150% of GDP ??

No one ... there probably won't be anyone buying it at 100% of GDP ....

These debtholders are already moving their holdings from longer maturities to much shorter maturities ...

So what is the end game ??

Zimbabwe?

|

|

Registered User

Joined: 1/30/2009

Posts: 267

|

QUOTE (realitycheck) QUOTE (davidcmadrid) It is possible that Gold moves without the dollar.

Sure it is ....

And contrarian indicators are great .... as the "herd" is generally wrong ...

On the other hand ....

Do ya reckon that there was a contrarian who stepped out onto the deck of the Titanic and said ...

"Hey ... everybody is trying to get off the boat ... now's probably a dandy time to visit the engine room ... it shouldn't be crowded at all .... "

We have an $11.6 Trillion debt right now .... and the White House's "rosey" scenario promises to add $9 Trillion to that over the next 10 years ...

And this allows nothing for the notes that will be called from Social Security as it goes cash flow negative in the next year or so ...

Or the insolvency that Medicare faces around 2017 (or earlier) ....

And let's don't forget that before you can be in debt ... someone has to loan you the money ...

The US's largest debtholders ... China, Japan, and the UK .... are already having to be coaxed to buy more .... and our debt is at about 80% of GDP ....

Who will be buying it at over 150% of GDP ??

No one ... there probably won't be anyone buying it at 100% of GDP ....

These debtholders are already moving their holdings from longer maturities to much shorter maturities ...

So what is the end game ??

And Japan's debt is already 180% of it's GDP so how much longer can Japan afford to keep loaning money to the US?

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

The US is still the premier reserve currency but with the ambitious plans for further indebtedness and prosperity killing ideas that the POTUS and Democratic congress would like to achieve...we won't be for much longer.

The world will demand higher interest rates on our debt, this will push inflation, the dollar will weaken and this is all bullish for commodities.

|

|

Registered User

Joined: 1/30/2009

Posts: 267

|

QUOTE (ben2k9) The US is still the premier reserve currency but with the ambitious plans for further indebtedness and prosperity killing ideas that the POTUS and Democratic congress would like to achieve...we won't be for much longer.

The world will demand higher interest rates on our debt, this will push inflation, the dollar will weaken and this is all bullish for commodities.

Exactly. And don't forget more and higher taxes to cover this debt.

|

|

Registered User

Joined: 1/30/2009

Posts: 267

|

To anyone that is still on. This is good.

http://www.youtube(dot)com/watch?v=yqkn1tviGMM&feature=player_embedded

|

|

Registered User

Joined: 7/17/2009

Posts: 42

|

QUOTE (realitycheck) QUOTE (davidcmadrid) It is possible that Gold moves without the dollar.

Sure it is ....

And contrarian indicators are great .... as the "herd" is generally wrong ...

On the other hand ....

Do ya reckon that there was a contrarian who stepped out onto the deck of the Titanic and said ...

"Hey ... everybody is trying to get off the boat ... now's probably a dandy time to visit the engine room ... it shouldn't be crowded at all .... "

We have an $11.6 Trillion debt right now .... and the White House's "rosey" scenario promises to add $9 Trillion to that over the next 10 years ...

And this allows nothing for the notes that will be called from Social Security as it goes cash flow negative in the next year or so ...

Or the insolvency that Medicare faces around 2017 (or earlier) ....

And let's don't forget that before you can be in debt ... someone has to loan you the money ...

The US's largest debtholders ... China, Japan, and the UK .... are already having to be coaxed to buy more .... and our debt is at about 80% of GDP ....

Who will be buying it at over 150% of GDP ??

No one ... there probably won't be anyone buying it at 100% of GDP ....

These debtholders are already moving their holdings from longer maturities to much shorter maturities ...

So what is the end game ??

I deal with gold bugs every day and listen to ( and long ago stopped ) with the debate on the dollar but there are 2 sides to the fundamental argument and the winner will be very clear soon enough imho. Speaking of the pound it looks are great short against the dollar at the moment.

|

|

Registered User

Joined: 7/17/2009

Posts: 42

|

QUOTE (ben2k9)

The world will demand higher interest rates on our debt, this will push inflation, the dollar will weaken and this is all bullish for commodities.

Energy ( and not some lump of metal ) is the true gauge imvho and i all i can see in commod stocks and oil at the moment is weakness , so there is a bit of a paradox in the market at the moment.

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (davidcmadrid) QUOTE (ben2k9)

The world will demand higher interest rates on our debt, this will push inflation, the dollar will weaken and this is all bullish for commodities.

Energy ( and not some lump of metal ) is the true gauge imvho and i all i can see in commod stocks and oil at the moment is weakness , so there is a bit of a paradox in the market at the moment.

sure, its called creating money out of thin air.

that lump of metal has been used as money since 700 b.c.

now, whats the oldest currency you can think of?

|

|

Registered User

Joined: 1/30/2009

Posts: 267

|

Gold futures over $1000 now.

|

|

Registered User

Joined: 7/17/2009

Posts: 42

|

Im still watching I can see both sides to the coin but hold the view the short dollar trade is crowded. I do see that oil has popped hardish though and the DX seems destined to test its lower trendline. I outlined my miners positions i think on Thursday.

|

|

Registered User

Joined: 6/8/2007

Posts: 31

|

When the dollar falls, traders moving into commodities

See gold is correcting

No inflation yet.

Conumers have no money to bid the prices of daily needs yet. Economic situation is different this time.

Money is floating with big banks trading centers. 6 million out of jobs , where they get the money to bid prices of anything.They are merely surviving .

|

|

Registered User

Joined: 8/19/2009

Posts: 170

|

i don think putting it that way is a great way to say it.. there have been several consecutive years where commodities have had positive correlation or negative correlation to the stock market. a study was actually done a while back where they backtested the correlation and found that most of the time there was no correlation at all - the same goes with the $ (relative to the eur) to the stock market

however, studies showed that there is usually a negative correlation when comparing commodities to the $ (relative to the euro) but then again.. commodities are expressed in dollars and basic economics tells you that a lower dollar equals higher prices

i think if you want to compare commodities to the stock market - id only use it to diversify (if youre planning on investing, not trading)

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

signaltap Sep. 08 at 6:16 PM #

reply

signaltap Sep. 08 at 6:16 PM #

reply

Ticker: GLD

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

click on the link for this image!

http://i196.photobucket.com/albums/aa104/signaltap2/SELL_GLD.gif

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

China is increasing its reserves allocation into gold. Buying the dips.

|

|

Registered User

Joined: 7/17/2009

Posts: 42

|

Yeah that as a ugly candle on gold today .I bailed on some of the miners and took a partial exit on all related positions but for it come back that far i think would almost leave it at a failed breakout. The thing about todays consumer credit report is interesting to the inflationists/ deflationsists also , the question that one has to ask is if we are to see inflation how or where is it being lent into the system.

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

I don't view gold just through the lense of inflation. I look macro, where soveriegn wealth funds around the world are concerned about the US's balance sheet and fiscal & monetary policy. I see rising interest rates. I see weaker currencies versus hard assets. Rising hard assets pushes inflation and siimultanously chokes the economy. Balooning deficits push interest rates higher and the dollar weaker.

Davidmadrid, look at the US in the 70's - high inflation, high interest rates, weak dollar, strong gold. Economic stagnation. Stagflation. Where was the demand? High inflation choked it out.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Very true ben ....

There is growing speculation that the Chinese starting to accumulate gold ... as they see the $2 Trillion that they have in US govt debt in serious jeprody ...

There was a story out yesterday in UK on the Telegraph entitled "China Alarmed By US Money Printing" ... in which a high-ranking Chinese official states that they are going to have to start divesifying their interests away from the USD ...

Mr Cheng said the root cause of global imbalances is spending patterns in US (and UK) and China.

"The US spends tomorrow's money today," he said. "We Chinese spend today's money tomorrow. That's why we have this financial crisis."

Yet the consequences are not symmetric.

"He who goes borrowing, goes sorrowing," said Mr Cheng.

A quote from Benjamin Franklin ...

|

|

Registered User

Joined: 7/17/2009

Posts: 42

|

Ben2k9 i posted a link to the fundemantal argument in the fundamental section of the other site. Its food for thought.

|

|

Registered User

Joined: 1/30/2009

Posts: 267

|

Gold back above $1000 again.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"He who goes borrowing, goes sorrowing," said Mr Cheng.

A quote from Benjamin Franklin ...

-----------------------------------------------------------------------

He who oppresses his people should be hung from a rope.

A quote from diceman...

Thanks

diceman

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

give some people enough rope, and they will hang themselves...

-source unknown

|

|

|

Guest-1 |