Registered User

Joined: 8/3/2009

Posts: 11

|

I am using Stockfinder mainly because I thought I would be able to use a MACD Divergence scanner that Julia Ormond created. Unfortunately, the scanner doesn't show me any MACD Divergences that I can see anyway, or at least not the kind I am looking for. What I am looking for is a tool that will scan and show me when a symbol is exhibiting a double top or bottom, within an adjustable time frame of anywhere from 30 days and longer, and the MACD's tops or bottoms are trending in the opposite direction. I.e.; the price action is showing a double bottom (either flat and bottoming out at the same level, or even better, showing a lower second bottom) and the MACD is doing the opposite, i.e; showing a double top (with a higher second high). Is there such a scanning "tool" for Stockfinder? If not, is there anyone out there who can create one? I like Stockfinder - the look of it and the charts, and I would like to resolve this so that I can stay with it.

|

|

Administration

Joined: 9/30/2004

Posts: 9,187

|

Can you provide an example of a stock with the price and MACD pattern you're looking for as an example?

Typically, MACD divergences compare highs in price vs highs in MACD, or, conversely, lows in price with lows in MACD. Sounds like you're looking for a mix of the two.

|

|

Worden Trainer

Joined: 4/26/2007

Posts: 508

|

Hi All,

I've encouraged Mr. Fagerman to reach out to the StockFinder community to see if anyone has developed a variation of or improvement upon the standard MACD Divergence scan I use. If you have and don't mind sharing, please let us know what you've found.

Best,

Julia

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

Fagerman,

Here are some topics that might be of interest or at spark an idea:

Divergences

Rule for MACD Histogram divergence set-up

Price vs MACD Divergences

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

Hi and thank you all for replying so quickly.

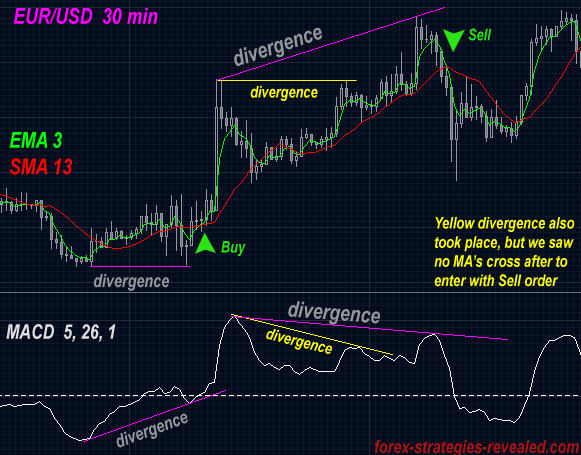

"Stockguy", to answer your question, here is a picture of an example. You see how the higher highs in the price is contradicting the lower highs in the MACD. They are in other words "diverging". This happens to be a Forex chart but it is the same principle. I can see if I can find some better examples if you need me to. Is this setup something that Stockfinder can be used to find?

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

Here is another chart that shows a couple of examples of divergences with lower lows in price and higher lows in the MACD:

|

|

Registered User

Joined: 12/31/2005

Posts: 2,499

|

Connecting the lows or highs and comparing the slopes can a complex coding task, given the variable nature of the distances between the points.

An alternate approach that might provide similar results would be to compare the linear regression slopes of price vs MACD.

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

jas0501 - I wouldn't know if that would work or not. But I of course don't really care what technical method is used as long as I can scan for and find these setups using Stockfinder. My question remains, is there anyone out there that can make this happen, or am I asking for something that Stockfinder can't do?

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

I am still looking for an answer to this. Is there a trainer that can instruct me on how to do it? Is there anyone out there who has developed a scan like this for Stockfinder? Anyone?

I have spent several months now trying to get an answer to this and I thought that Stockfinder was going to be the solution to automating this strategy.

Trainers and people educated on Stockfinder out there; please let me now if this is doable or not so that I can either pursue it or move on to some other product.

I just can't believe that I am the only person ever to ask for this scan here. That just can't be the case. This is not a "secret" strategy or anything of the sort. Many, many traders out there use this strategy as part of their arsenal of analytical tools, but it is an extremely time consuming process without a scanner. So, I'm asking you guys with Stockfinder - trainers, programmers, who ever you migtht be, please answer my question - can it be done with Stockfinder?

Thank you.

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

QUOTE (Fagerman) ...the price action is showing a double bottom (either flat and bottoming out at the same level, or even better, showing a lower second bottom) and the MACD is doing the opposite, i.e; showing a double top (with a higher second high).

That's not what's pictured in your examples.

QUOTE (Fagerman) Is there a trainer that can instruct me on how to do it?

...

I just can't believe that I am the only person ever to ask for this scan here.

You obviously aren't the only person interested in identifying MACD Divergences. Julia has explored the topic (even if you don't like her particular solution). I pointed out three topics that explored this subject that could be built upon to create something more to your liking. Since I'm assuming you have actually explored these topics, then no, I don't a solution that will identify your particular definition of a MACD divergence.

QUOTE (Fagerman) Is there anyone out there who has developed a scan like this for Stockfinder? Anyone?

When jas0501 (another customer) tried to be helpful, your response didn't seem geared towards encouraging his continued assistance or collaboration. You pretty much blew him off with, "My question remains, is there anyone out there that can make this happen, or am I asking for something that Stockfinder can't do?"

QUOTE (Fagerman) But I of course don't really care what technical method is used as long as I can scan for and find these setups using Stockfinder.

That's a problem unless you are willing to accept other people's definitions and the solutions based on those definitions. The first step in being able to automatically identify something is creating an unambiguous objective definition. Your descriptions and examples so far don't do so.

QUOTE (Fagerman) Trainers and people educated on Stockfinder out there; please let me now if this is doable or not so that I can either pursue it or move on to some other product.

It is almost certainly possible to create a MACD Divergence Condition given an unambiguous and objective definition.

Identifying something based on your definitions and examples alone can't be done however. There are some trend lines drawn between local extrema on the charts with absolutely no reason to choose those particular extrema besides that's where it looks right to draw them. You know it when you see it. The definition and examples are entirely subjective.

In both example charts there are intervening local extrema (be they local minima or local maxima) that were ignored between the chosen local extrema that could been chosen instead but weren't. Why not?

In both example charts there are local extrema beyond the bounds of the chosen extrema that could have been chosen instead but weren't. Why not?

You'd think at first glance that the trends are based on connecting local extrema with unviolated trend lines, but in the second chart, the trend lines are violated by intervening extrema or extended beyond the connected extrema. The trend lines certainly "look right", but objectively, why were they drawn that way?

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

Bruce - Thanks for your answers.

Okay, first of all, there is no disrespect to Julia meant here whatsoever. I am sure that her version of a divergence is something she can use. But if you try it yourself, you will very quickly see that it shows nothing even close to a divergence in trending higher highs or lower lows between the MACD and the price. As a matter of fact, I have tried since February some time to understand what it is supposed to actually show, and I still don't understand what it is, since in my scans there is no divergence at all that I can see. The MACD and the price moves in the same direction and the indicator is painting an area for some reason that is still unknown to me. I don't want to waste Julia's time with this anymore, since her indicator is obviously looking for something completely different than what I am looking for.

The picture of the type of divergence that I am looking for is not complex, at least in my opinion. It's not rocket science as far as the chart and the MACD goes. I'm sorry, but I think you might possibly be making what I'm looking for a lot more complex than it is. If you Google "MACD Divergence strategy", or simply "MACD Divergence", you are going to see many, many samples and page after page with people using or talking about the exact same thing that I am looking for. It seems to be more popular in the Forex community for some reason, but it applies just the same to almost any technical trading of financial instruments.

Maybe the programming itself is complex, that's not something I can have an opinion about since I'm not a programmer, but the concept of the combination of events I am looking for is not complex. I was hurrying to find a picture of a chart that would describe the idea to you, but in doing so I might not have found the "ideal" one. I was just assuming that these would do, since there are very clear diverging bottoms in the price vs the MACD, particularly in the Merrill Lynch chart. There are lower lows in the price and higher lows in the MACD - that's it. That is what I am looking for. That and the reverse of it.

And I was not trying to blow off jas0501 or anyone else for that matter. I'm not sure where you get that from in my reply. I was just answering the comment. I like to say what I think and get to the point. If I'm too direct, then I apologize, but there is no ill intent here. I just want a solution if at all possible so that I can start using it in my trading and save time.

I've spent a lot of time trying to get an answer to this question, and for some reason or another, I just don't seem to be able to get one. If I don't get the idea that there is a way to do this on Stockfinder in the next few days, I guess I will just have to cancel my subscription and try my luck elsewhere. If it can't be done, it can't be done. I'd just like to know either way.

I can tell you one thing for sure though; if you can find a solution to creating a scan like this, I know you would have a ton of subscribers ready to sign up with you, even if they had no other use for Stockfinder whatsoever. This would be an enormous time saver for a lot of traders using this strategy. And right now I know of no other way than to manually look through hundreds of charts to find this particular setup, depending on your trading style of course. But it takes a looooong time to do manually. That's probably why this strategy is so popular with the Forex community, because they might only be covering 10 charts or so, which makes it possible to do manually. Imagine doing the same with the Russell 3000....or just the S&P 500 for that matter....

Anyhow, if there is a solution on Stockfinder, please let me know. And if there isn't, please let me know that as well.

Thank you.

Fagerman

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

QUOTE (Fagerman) The picture of the type of divergence that I am looking for is not complex, at least in my opinion. It's not rocket science as far as the chart and the MACD goes.

The basic concept may not seem complex. Look for "highs" or "lows" in both Price and MACD and if one is going up while the other is going down they are divergent. I get it. Really.

That said, the choice of what constitutes these "highs" and "lows" and which to choose seems entirely to be a subjective judgment in the eye of whoever is drawing the trendlines connecting them. Just look at the charts. There are plenty of "highs" and "lows" on the charts that are completely ignored.

There may be an objective reason for choosing those particular "highs" and "lows" beyond it resulting in trendlines that "look good", but I don't know what it is and none of the numerous references I've found on the web seem to discuss it.

QUOTE (Fagerman) I'm sorry, but I think you might possibly be making what I'm looking for a lot more complex than it is. If you Google "MACD Divergence strategy", or simply "MACD Divergence", you are going to see many, many samples and page after page with people using or talking about the exact same thing that I am looking for.

Yes, there is page after page of people drawing lines connecting arbitrary points with no real objective reason given for why those particular points were chosen.

I'm not making it more complex than it is. In order to create an automated method of detecting a pattern, that pattern needs to be objectively defined. It can't just be "I know it when I see it." Even the smallest hint at why particular "highs" and "lows" are chosen beyond them looking right would be a big step in the right direction.

It is trivial to determine if the slopes of the trendlines connecting two points have opposite signs if the positions of the points being connected are known.

In Rule for MACD Histogram divergence set-up, spdudek started a serious attempt at working on an objective definition, but did not pursue it far enough to result in a working MACD Divergence scan.

QUOTE (Fagerman) Maybe the programming itself is complex, that's not something I can have an opinion about since I'm not a programmer, but the concept of the combination of events I am looking for is not complex. I was hurrying to find a picture of a chart that would describe the idea to you, but in doing so I might not have found the "ideal" one. I was just assuming that these would do, since there are very clear diverging bottoms in the price vs the MACD, particularly in the Merrill Lynch chart. There are lower lows in the price and higher lows in the MACD - that's it. That is what I am looking for. That and the reverse of it.

It's not the programming. It's the lack of an objective definition (even if the subjective definition doesn't "seem" complex).

QUOTE (Fagerman) Anyhow, if there is a solution on Stockfinder, please let me know. And if there isn't, please let me know that as well.

As already stated, I don't currently have a solution that would meet your needs.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

Okay Bruce, I will try to define the definition.

Let's pick a time fram - let's say 30 days. Looking back from todays date, with today's date being included of course, we want to find chart setups where in today's value of the price vs the MACD (in the charts I posted above, earlier dates are shown where this occured) there is a lower low pivot, or a higher high pivot in the price, but the MACD is showing higher low pivots or lower high pivots. I.e, the pivots are trending in opposite directions, and we want to find charts where this is occuring right now. And ideally the time frame from today's date, scanning backwards, can be adjusted to include a variable amount of time.

I don't think I know how to say this any better. Hopefully it's good enough.

Best,

Fagerman

PS. I tried to find some better charts showing this setup but I couldn't spend more time on it right this minute, but here is one that has a few really clear examples on it I think. We want to find the chart when the setup is currently occuring of course, and not later.

http://forex-indicators.net/files/indicators/macd_divergence.png http://forex-indicators.net/files/indicators/macd_divergence.png

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

Pivot can means lots of things. Some of them are subjective and others are objective. I'm going to choose the most common objective definition of which I am aware. A Pivot High is a High surrounded by two lower Highs on each side and a Pivot Low is a Low surrounded by two higher Lows on each side.

If I'm using this definition, I'm really not sure what to do with the 30 days. I can compare the most recent two Pivot Highs to each other no matter how long ago the previous Pivot High occurred.

I've added a simultaneity requirement, albeit an approximate one (within two Bars of each other). There is no need to check for Pivot Highs or Pivot Lows in Price if a similar Pivot has not occurred in MACD and vice versa. If we did track all Pivot Highs and Pivot Lows without regard for something similar happening in the other Indicator, we would be comparing disparate time ranges (which is not something that happens in examples I have seen).

You should be able to Open the attached Layout directly into a running copy of StockFinder. You should also be able to Save the attached Layout to the \My Documents\StockFinder (or StockFinder5)\(Your Username)\My Layouts\ folder and then Load it into StockFinder by selecting File | Open Layout.

It is a work in progress and is quite inefficient. Any optimizations will happen only after the basic functionality has been finalized. Some of the Indicators and Rules may not be necessary in the final version and are there mostly to illustrate the basic definitions so any alterations may be more efficiently contemplated.

A small blue circle is drawn on both Price and MACD at the point when a Pivot High has been detected in both Price and MACD. A small red circle is drawn on both Price and MACD at the point when a Pivot Low has been detected in both Price and MACD.

The Blue Pivot High Divergence Rule will return True and Plot a hash on the Chart if the signs of the Net Changes between the small blue circles is different for Price and MACD. The Red Pivot High Divergence Rule will return True and Plot a hash on the Chart if the signs of the Net Changes between the small red circles is different for Price and MACD. The Purple Pivot Divergence ORs these two Rules and will Paint Price History if either Rule returns True. This Combo Rule is also used as a Scan in the WatchList.Attachments:

MACD Pivot Divergence.sfLayout - 53 KB, downloaded 1,345 time(s).

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

You are definitely on to something here Bruce! This looks closer to what I am looking for than anything else I have seen so far! This is promising for sure. I see definite divergences in the charts that are marked as such. It seems, like you say, that it just needs to get fine tuned.

On the definition of pivot, yes, I think you are correct in your assumption of how that is generally interpreted. But for our purposes with this programming, the wording "higher high" or "lower low" is probably more appropriate. We don't really care about having two surrounding lower highs or lows. We really only care about seeing two different "peaks", or "bottoms", trending in two different directions between the MACD and the Price. And we want to find that symbol when it is in the middle of having one of these two scenarios occuring.

You got me excited now! I'm seeing something that looks like a solution here at last. Do you have any idea of how to "tweak" this further?

Best,

Fagerman

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

QUOTE (Fagerman) On the definition of pivot, yes, I think you are correct in your assumption of how that is generally interpreted.

You suggested a Pivot. As indicated, this could mean many different things. I used that particular definition of Pivot because it was the most common objective definition of Pivot which would seem to apply. To change things, we need to either refine that definition of Pivot in an objective manner or come up with an entirely different but objective definition to use instead.

Here are two other objective methods of identifying extrema that may or may not be workable (there are many others). The "highs" and "lows" in MACD are frequently identified by when the raw MACD crosses through its Moving Average (sometimes with restrictions as to where the MACD is relative to the zero line). A Stochastic of an Indicator (including Price) might be used to identify "highs" or "lows" in that Indicator when the %K crosses through 20, 80 and/or the %D.

Instead of searching for extrema in both Price and MACD, you might want to search for extrema in just one of the two and use that point to draw the trendlines for both Price and MACD (I'm suspecting MACD might be the better choice).

QUOTE (Fagerman) But for our purposes with this programming, the wording "higher high" or "lower low" is probably more appropriate. We don't really care about having two surrounding lower highs or lows. We really only care about seeing two different "peaks", or "bottoms", trending in two different directions between the MACD and the Price.

This moves the definion of Pivot from the objective to the subjective. We're back to a "you know it when you see it" sort of thing. What objectively makes something a "peak" or a "bottom"? It's just different words for a "high" or a "low" without any additional clarification as to their meaning.

It goes back to the why questions I asked earlier. I haven't seen any MACD divergence examples that don't pick and choose which "highs" or "lows" to use. Some are chosen, some are ignored. Which are which seems to be entirely in the eye of the person drawing the trendlines because it "looks right". We need something unambiguous that objectively defines why it "looks right".

QUOTE (Fagerman) Do you have any idea of how to "tweak" this further?

The trainers can't give setting, interpretation or investment advice. I'm certainly open to any objective suggestions you might have.

As stated previously, once the extrema are chosen, determining if they are divergent is trivial if the definition of divergence is simply opposite slopes between those extrema.

The nice thing about using Pivot Highs and Pivot Lows is that they are objective. The not so nice thing about using Pivot Highs and Pivot Lows is that they aren't necessarily the extrema a human would think "look right" when drawing trendlines.

QUOTE (Fagerman) And we want to find that symbol when it is in the middle of having one of these two scenarios occuring.

If by "in the middle of having one of these two scenarios occuring" you mean before the second "peak" or "bottom" can be definitively identified, that's probably not going to happen. I'm not psychic and neither is your computer.

We might be able to find situations that are potentially divergent before the extrema are definitively identified, but I do not have even the slightest clue as to what objective criteria might be predictive of such an occurance before it happens. There will certainly be cases where such potential is not realized even if a predictive setup of this sort can be identified.

For example, one might guess that where Price and MACD are relative to their range might be predictive of divergent extrema. So if we put that 30-Bar suggestion mentioned previously as the basis of a Stochastic of both Price and MACD, we might get something like the following (which will only work in SF5):

'|******************************************************************

'|*** StockFinder RealCode Indicator - Version 5.0 www.worden.com

'|*** Copy and paste this header and code into StockFinder *********

'|*** Indicator:MACD Divergence Potential

'|******************************************************************

'# MACD = indicator.Library.MACD

'# StocPeriod = UserInput.Integer = 30

'# SK = UserInput.Integer = 5

Plot = Math.Abs(Price.STOC(StocPeriod, SK) - MACD.STOC(StocPeriod, SK))

While high values might indicate a divergence of sorts between Price and MACD (in general, the trends of the underlying indicators over thirty or so Bars do seem to be in opposite directions when this is the case), these higher values do not seem to be particular predictive of extrema or of opposite slopes in the trendlines that might connect any extrema that do occur.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

It might be that a "pivot" with your definition is the only thing we can use. I am saying that because I am trying to understand how the program would know to look for a new low that is just not an immediate new low right after the previous bar? We want to look for tops or bottoms, preceded by a period of a swing in the opposite direction, and then a comeback to a higher (or lower) level than the previous top (or bottom). So, for instance, if you have a top, then a drop to a lower level, and then a swing back to a new top, higher than the previous one, what programming specs would you use to tell it what to look for in between the tops? That might be hard to do I guess....

Would it be better or easier to use diverging trend lines between the MACD and the Price? And could you combine this somehow with the programming you did for the layout you just set up?

F

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

QUOTE (Fagerman) It might be that a "pivot" with your definition is the only thing we can use.

I can assure you it is not. I mentioned other methods that are used to identify extrema in my previous post. That said, any other definition must come from you or another user.

QUOTE (Fagerman) We want to look for tops or bottoms, preceded by a period of a swing in the opposite direction, and then a comeback to a higher (or lower) level than the previous top (or bottom).

Again, this is a matter of objective definition. You've described what it looks like. What characterizes a "a period of a swing in the opposite direction"?

Is the swing measured by the size of the move, the period of time over which the move occurs or both?

If it is measured by the size of the move (like in the Zig Zag Indicator), compared to what? If the size is too large, you will miss extrema entirely or won't catch them until well after they form. If the size is too small, you will get false positives.

If it is the period of time, how long? If it is too long, you won't identify extrema until well after they formed. If it is too short, you will get false positives (btw, the Pivot Highs and Pivot Lows we used are essentially using a change in direction with a period of time of two bars on each side).

QUOTE (Fagerman) So, for instance, if you have a top, then a drop to a lower level, and then a swing back to a new top, higher than the previous one, what programming specs would you use to tell it what to look for in between the tops?

As I said before, it's not a matter of programming. It is a matter of coming up with an unambiguous objective definiton that you can use to create the algorithm. The algorithm is simple once you have the definition.

QUOTE (Fagerman) Would it be better or easier to use diverging trend lines between the MACD and the Price?

It's a chicken and egg problem with both the chicken and egg being subjective. You can get the "highs" and "lows" from a drawn trendline or you can draw a trendline between the "highs" and "lows". In either case, the trendline that results is because it "looks right" to the person drawing the trendline.

Drawing trendlines algorithmically is generally a matter of defining the endpoints between which you draw the lines. One method of determining the endpoints is determining the very "highs" and "lows" we have been talking about (which means the "highs" and "lows" come first).

One algorithmic method that determines these endpoints without regard to the "highs" and "lows" is the Linear Regression Trendline that was suggested by jas0501.

You should be able to Open the attached Layout directly into a running copy of StockFinder. You should also be able to Save the attached Layout to the \My Documents\StockFinder (or StockFinder5)\(Your Username)\My Layouts\ folder and then Load it into StockFinder by selecting File | Open Layout.

It adds LR Trendlines to Price and MACD the previous Layout (they uses the 30-Period time frame you have suggested previously). It also has Linear Regression Slope Indicators with the same Period. You can multiply these Slopes and if the result is negative, the Slopes have opposite signs.

QUOTE (Fagerman) And could you combine this somehow with the programming you did for the layout you just set up?

I've added them to the Layout, but they aren't really related to the original approach and I don't know how you would "combine" them beyond possibly requiring that both Rules be True.Attachments:

MACD Pivot and LR Divergence.sfLayout - 61 KB, downloaded 1,144 time(s).

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 10/7/2004

Posts: 364

|

As traders we are ONLY interested in what is happening at the right edge of the chart for making trade decisions. Of course, we like to view the rest of the chart for clues as to what might happen next.

Only Divergence at the right edge means anything.

So if one starts at the last bar and works backward it is easy to find the pivot points. I use the same definition Bruce has stated earlier. One must save the pivot points in order to compare them to the previous one. I tried for many months to plot meaningful pivot points and finally decided that I had to add other parms, such as, minimum wave size, minimum divergnce value, minimum price diference.

I am still working on plotting negative and positivedivergence so I can use them as "One" of my setup requirements for entering a trade. But it is only a part of my total trading strategy. I posted a response earlier in http://forums.worden.com/Default.aspx?g=posts&t=44734 on Divergence. That discussion seems to be making more headway than this one.

By the way, once you have those list of pivots you can now check for all kind of chart patterns, double bottoms, double tops, triple bottoms and tops are even better than doubles, triangles,wedges.

As was posted back on Tuesday, April 27, 2010 3:36:25 PM by Fagerman:

I can tell you one thing for sure though; if you can find a solution to creating a scan like this, I know you would have a ton of subscribers ready to sign up with you, even if they had no other use for Stockfinder whatsoever. This would be an enormous time saver for a lot of traders using this strategy

Fagerman - is exactly right and that is why people won't share it once we have it. Unfortunately, Stockfinder does not provide the creator with the ability to protect their intellectually property. I have been working on this for over a year and now have it almost ready to production and trading.

|

|

Registered User

Joined: 4/17/2010

Posts: 1

|

Hi Fagerman,

Checkout Jackie Ann Patterson of backtesting report.com. She has a scan for finding MACD divergence for stockfinder and tradestation.

|

|

Registered User

Joined: 10/7/2004

Posts: 364

|

First, I am not expressing an opinion one way or the other on the backtesttesting site.

I did a quick check of the site and I was impressed with the "Free report". I have been a supporter of Backtesting for years. The best backtesting software I found was TC-Companion but it only works on Telechart. However, this person seems to know all the things one needs to consider in backtesting.

I, also, checked the backtest blog and I was not able to confirm the MACD divergence reported of April 16 on weekly data. Not that it is wrong or I am wrong it just we apparrantly test differently and I did not purchase any reports to confirm a difference.

I did not find enough information as to what was in the Stockfinder report to make me want to purchase the report. But that's just me. As Don Worden says "Think for yourself" and make your own decisions. If anyone does purchase the report it would be interesting to have your opinion on its value. That is without sharing its content.

|

|

Registered User

Joined: 8/3/2009

Posts: 11

|

Thanks a bunch Roscon. I'm greatful for that lead. I just got off the phone with Ms. Patterson and it seems that she has the scan issue solved, both with Stockfinder and TradeStation. She showed me some other pictures of scans that her setup performs and it seems to be exactly what I am looking for. So, I am going to end the post here and buy her layout setup and see what happens.

Thanks again everyone for your help.

Best,

F

|

|

Registered User

Joined: 2/14/2006

Posts: 117

|

Fagerman,

Would you mind sharing your experince. I also emailed Ms Patterson and got from her some screen shots and a lot of sales stuff. I could not find reviews other than the ones on her own website. If you can tell us whether you are making money after investing in her program, then others at stockfinder will be able benefit from it.

Thanks in advance.

|

|

Registered User

Joined: 2/14/2006

Posts: 117

|

Hi everyone,

I am looking for people who have used this software and are willing to share their experiences. So if you use this software please post your comments here for the benefit of others too.

Thanks in adavnce

|

|

|

Guest-1 |