| Fagerman |

|

Member

|

| Registered User |

|

|

|

|

| Gender: |

|

| Monday, August 3, 2009 |

| Wednesday, May 5, 2010 5:48:13 PM |

11

[0.00% of all post / 0.00 posts per day] |

|

Thanks a bunch Roscon. I'm greatful for that lead. I just got off the phone with Ms. Patterson and it seems that she has the scan issue solved, both with Stockfinder and TradeStation. She showed me some other pictures of scans that her setup performs and it seems to be exactly what I am looking for. So, I am going to end the post here and buy her layout setup and see what happens.

Thanks again everyone for your help.

Best,

F

|

It might be that a "pivot" with your definition is the only thing we can use. I am saying that because I am trying to understand how the program would know to look for a new low that is just not an immediate new low right after the previous bar? We want to look for tops or bottoms, preceded by a period of a swing in the opposite direction, and then a comeback to a higher (or lower) level than the previous top (or bottom). So, for instance, if you have a top, then a drop to a lower level, and then a swing back to a new top, higher than the previous one, what programming specs would you use to tell it what to look for in between the tops? That might be hard to do I guess....

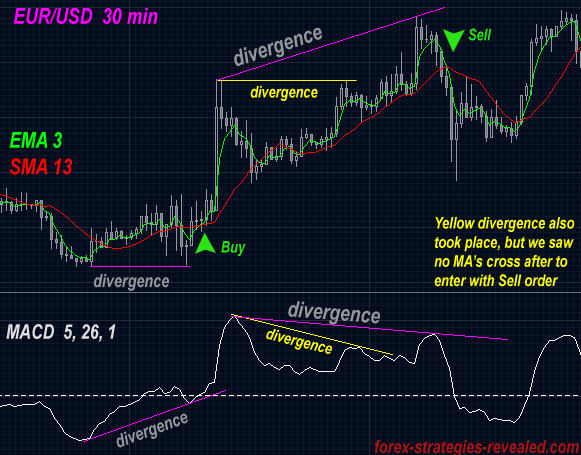

Would it be better or easier to use diverging trend lines between the MACD and the Price? And could you combine this somehow with the programming you did for the layout you just set up?

F

|

You are definitely on to something here Bruce! This looks closer to what I am looking for than anything else I have seen so far! This is promising for sure. I see definite divergences in the charts that are marked as such. It seems, like you say, that it just needs to get fine tuned.

On the definition of pivot, yes, I think you are correct in your assumption of how that is generally interpreted. But for our purposes with this programming, the wording "higher high" or "lower low" is probably more appropriate. We don't really care about having two surrounding lower highs or lows. We really only care about seeing two different "peaks", or "bottoms", trending in two different directions between the MACD and the Price. And we want to find that symbol when it is in the middle of having one of these two scenarios occuring.

You got me excited now! I'm seeing something that looks like a solution here at last. Do you have any idea of how to "tweak" this further?

Best,

Fagerman

|

Okay Bruce, I will try to define the definition.

Let's pick a time fram - let's say 30 days. Looking back from todays date, with today's date being included of course, we want to find chart setups where in today's value of the price vs the MACD (in the charts I posted above, earlier dates are shown where this occured) there is a lower low pivot, or a higher high pivot in the price, but the MACD is showing higher low pivots or lower high pivots. I.e, the pivots are trending in opposite directions, and we want to find charts where this is occuring right now. And ideally the time frame from today's date, scanning backwards, can be adjusted to include a variable amount of time.

I don't think I know how to say this any better. Hopefully it's good enough.

Best,

Fagerman

PS. I tried to find some better charts showing this setup but I couldn't spend more time on it right this minute, but here is one that has a few really clear examples on it I think. We want to find the chart when the setup is currently occuring of course, and not later.

http://forex-indicators.net/files/indicators/macd_divergence.png http://forex-indicators.net/files/indicators/macd_divergence.png

|

Bruce - Thanks for your answers.

Okay, first of all, there is no disrespect to Julia meant here whatsoever. I am sure that her version of a divergence is something she can use. But if you try it yourself, you will very quickly see that it shows nothing even close to a divergence in trending higher highs or lower lows between the MACD and the price. As a matter of fact, I have tried since February some time to understand what it is supposed to actually show, and I still don't understand what it is, since in my scans there is no divergence at all that I can see. The MACD and the price moves in the same direction and the indicator is painting an area for some reason that is still unknown to me. I don't want to waste Julia's time with this anymore, since her indicator is obviously looking for something completely different than what I am looking for.

The picture of the type of divergence that I am looking for is not complex, at least in my opinion. It's not rocket science as far as the chart and the MACD goes. I'm sorry, but I think you might possibly be making what I'm looking for a lot more complex than it is. If you Google "MACD Divergence strategy", or simply "MACD Divergence", you are going to see many, many samples and page after page with people using or talking about the exact same thing that I am looking for. It seems to be more popular in the Forex community for some reason, but it applies just the same to almost any technical trading of financial instruments.

Maybe the programming itself is complex, that's not something I can have an opinion about since I'm not a programmer, but the concept of the combination of events I am looking for is not complex. I was hurrying to find a picture of a chart that would describe the idea to you, but in doing so I might not have found the "ideal" one. I was just assuming that these would do, since there are very clear diverging bottoms in the price vs the MACD, particularly in the Merrill Lynch chart. There are lower lows in the price and higher lows in the MACD - that's it. That is what I am looking for. That and the reverse of it.

And I was not trying to blow off jas0501 or anyone else for that matter. I'm not sure where you get that from in my reply. I was just answering the comment. I like to say what I think and get to the point. If I'm too direct, then I apologize, but there is no ill intent here. I just want a solution if at all possible so that I can start using it in my trading and save time.

I've spent a lot of time trying to get an answer to this question, and for some reason or another, I just don't seem to be able to get one. If I don't get the idea that there is a way to do this on Stockfinder in the next few days, I guess I will just have to cancel my subscription and try my luck elsewhere. If it can't be done, it can't be done. I'd just like to know either way.

I can tell you one thing for sure though; if you can find a solution to creating a scan like this, I know you would have a ton of subscribers ready to sign up with you, even if they had no other use for Stockfinder whatsoever. This would be an enormous time saver for a lot of traders using this strategy. And right now I know of no other way than to manually look through hundreds of charts to find this particular setup, depending on your trading style of course. But it takes a looooong time to do manually. That's probably why this strategy is so popular with the Forex community, because they might only be covering 10 charts or so, which makes it possible to do manually. Imagine doing the same with the Russell 3000....or just the S&P 500 for that matter....

Anyhow, if there is a solution on Stockfinder, please let me know. And if there isn't, please let me know that as well.

Thank you.

Fagerman

|

evanm - Did you ever get this resolved? I have been trying to find a way to use Stockfinder to scan for MACD to Price negative and positive divergences, but so far to no avail. If you have a script that works for this in Stockfinder, I would be extremely greatful for a copy.

Best,

Fagerman

|

I am still looking for an answer to this. Is there a trainer that can instruct me on how to do it? Is there anyone out there who has developed a scan like this for Stockfinder? Anyone?

I have spent several months now trying to get an answer to this and I thought that Stockfinder was going to be the solution to automating this strategy.

Trainers and people educated on Stockfinder out there; please let me now if this is doable or not so that I can either pursue it or move on to some other product.

I just can't believe that I am the only person ever to ask for this scan here. That just can't be the case. This is not a "secret" strategy or anything of the sort. Many, many traders out there use this strategy as part of their arsenal of analytical tools, but it is an extremely time consuming process without a scanner. So, I'm asking you guys with Stockfinder - trainers, programmers, who ever you migtht be, please answer my question - can it be done with Stockfinder?

Thank you.

|

|

jas0501 - I wouldn't know if that would work or not. But I of course don't really care what technical method is used as long as I can scan for and find these setups using Stockfinder. My question remains, is there anyone out there that can make this happen, or am I asking for something that Stockfinder can't do?

|

Here is another chart that shows a couple of examples of divergences with lower lows in price and higher lows in the MACD:

|

Hi and thank you all for replying so quickly.

"Stockguy", to answer your question, here is a picture of an example. You see how the higher highs in the price is contradicting the lower highs in the MACD. They are in other words "diverging". This happens to be a Forex chart but it is the same principle. I can see if I can find some better examples if you need me to. Is this setup something that Stockfinder can be used to find?

|

|