| Welcome Guest, please sign in to participate in a discussion. | Search | Active Topics | |

Registered User

Joined: 4/10/2006

Posts: 954

|

This is another play on the TD profile with a substitution of CCI new high for TSV BB breakout.

Here you can see the setup as a break below the

1 LBB20 followed by a crossing up of the LBB20

2 CCI today greater than CCI 20 days ago.

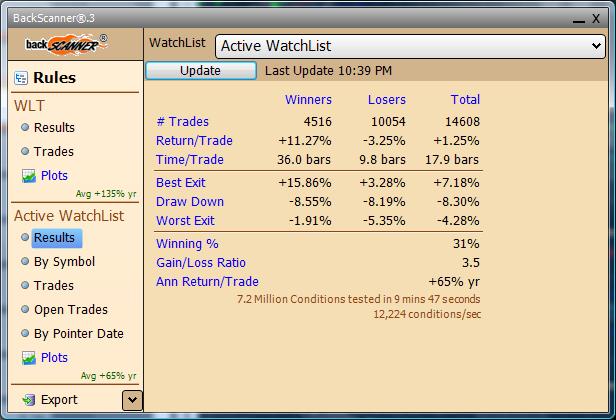

The backtest shows 350 stocks from the Russel 1000, 96% - however not adjusted as JAS would have done...He makes some type of adjustment due to the backtest results not computed properly.

3.8 winning ratio 5662 trades. with 1849 wins, 3803 losers

My intent was to run it against russell 1000, filtered by price > 10 (50d ma) , and volume > 500000 (50d, ma) about 765 items. Here is that avg yearly return = post that below.

|

|

Registered User

Joined: 4/10/2006

Posts: 954

|

Russell 1000 backtest filtered for volume, price

|

|

Registered User

Joined: 12/31/2005

Posts: 2,499

|

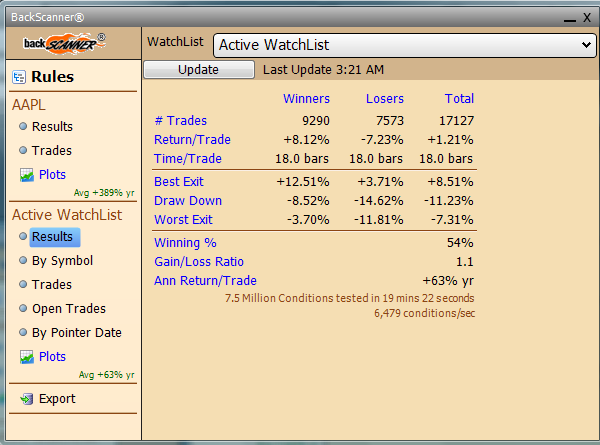

As a point of comparison here is a run against the Russell 1000 of random trade, exit after 18 days.

So it appears they are pretty close in performance. I would prefer to see a strategy beating the Random bechmark by a wider margin.

|

|

Registered User

Joined: 4/10/2006

Posts: 954

|

Jas,

How do you construct the random trade, backtest ?

Thanks.

|

|

Registered User

Joined: 12/31/2005

Posts: 2,499

|

QUOTE (wwrightjuly4)

Jas,

How do you construct the random trade, backtest ?

Thanks.

I use a random number condition as the entry signal. Below is the code, where percent is the chance that the condition passes. For the random benchmark in the previous post, percent was 0.0055 or .55%, to get the approximate count of the original backscan.

'

'# percent = userinput.Single = 5.0

'

Static objRandom As System.Random

Static pastFirstTime As Boolean

Dim val As Integer

Static max As Integer

Dim newMax As Integer

Const range As Integer = 1000

If Me.isFirstBar Then

newMax = range * (100 - percent) / 100

If Not pastFirstTime Or newMax <> max Then

objRandom = New system.random( _

CType(System.DateTime.Now.Ticks _

Mod System.Int32.MaxValue, Integer))

max = range * (100 - percent) / 100

'log.info(currentsymbol & "===== Max=" & max.ToString("0"))

pastFirstTime = True

End If

End If

val = objRandom.Next(range)

If val > max Then

pass

'log.info(" +++ Rand ====" & val)

End If

|

|

Registered User

Joined: 4/10/2006

Posts: 954

|

Thanks. I appreciate your help.

|

|

|

Guest-1 |