Registered User

Joined: 12/31/2005

Posts: 2,499

|

see 4 Rules for High Probability Strategies

Just watched the 7/26/11 webinar and as a seasoned backtester I found his presentation to match my backtesting conclusions. At about the seven minute mark the idea of a 10 day pullback is presented. This is similar the the Short term timing trick post. He goes on to use limit orders to pullback even further

Toward the end stops a discussed, and his view is that backtest results indicate that stops hurt performance. The examples of 5 day hold and dynamic exit of crossing the 5-day ma being stop free trades.

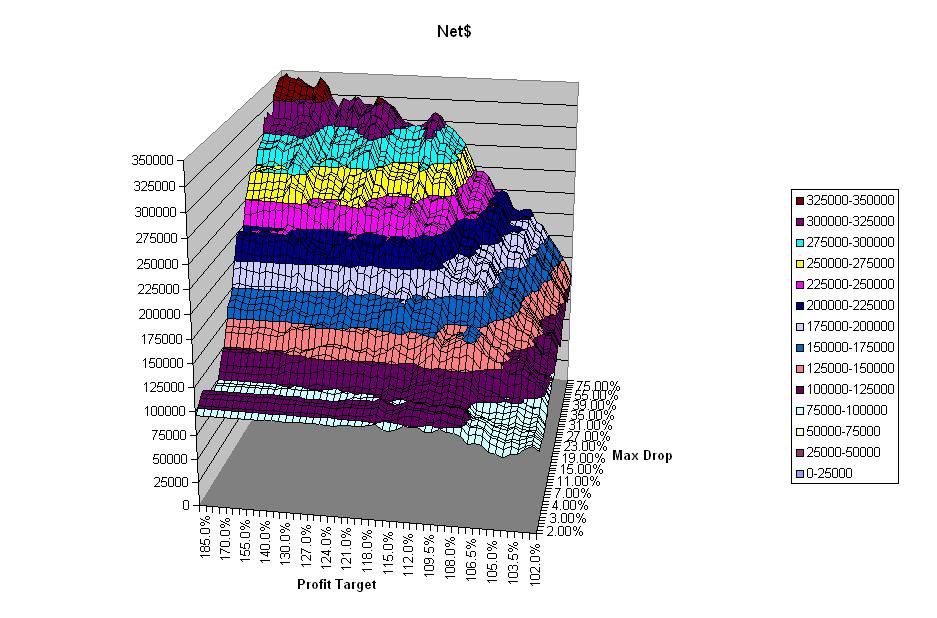

My studies have indicated the same, I call stops "loss capture" mechanisms. A 3-d chart of Profit target, Stop loss, and Profit shows the diminished profits and even shows an exaggerated loss trough between 3% and 8%. His philosophy is to avoid discresison and make the stategies simple and "mechanical".

The approach of having a set of strategies that divides ones portfolio by specific percentages to decrease risk, drawdown and volatility is an excellent idea. Doing this combined with the max number of open trades associated with each strategy provides a very simple trade sizing approach.

One of the last questions regarding entering multiple trades was not understood by Larry. If fact earlier he mentioned using volatility as the tiebreaker when a portion of multiple trades needed to be entered. I think he misunderstood the question.

----------------------------------------------------------

If only Stockfinder could...

If Worden is looking for what a top drawer backtesting system should do, supporting this type of money managment, portfolio managment backtesting capability would be it. If StockFinder was enhanced to support this, developing and testing various strategy combinations would be a backtester's dream come true.

The webinar does provide a very simple and clear model for what is needed in Stockfiner.

In addition entry at price would be another enhacement needed, and open trade count limits, and the use of tiebreaker for selection from a list of trades.

It would be so cool...

One can hope....

|

|

Registered User

Joined: 12/31/2005

Posts: 2,499

|

Here is the "capture loss" 3d chart. Each point is a backtest. Profit target from 102% to 185%, so 102% is a 2% gain. Max Drop from 2% to 75%, which is the stop loss exit. Starting balance of $100,000.

The light blue area is a loss $75,000-$100,000. The underlying strategy is not important. The main point is that one can see an obvious trough. This is a backtest showing the profit based on price historical action. The stops are getting scooped capturing the loss. The bad zone appears to be in the 4-8%, indicating that setting stop of that size woould be the worse choice.

This was a derived from backtests back in the sping of 2008. The exact details are somewhere in a spreadsheet, on a recovered disk, that I can't put my hands on at the moment, The plot represent more than 250 backtests.

|

|

Registered User

Joined: 12/2/2004

Posts: 1,775

|

Excellent topic jas, interesting indeed. I too watched his recent Webinar and his comments on stops definitely grabbed my attention. Apparently this method of not using stops to increase performance is geared toward his specific and fine tuned reversion to the mean method. I don't think he was stating that stops don't work for different methods. For example, the turtle method made famous by Dennis and Eckhardt was very heavy on using frequent tight stops to achieve spectacular gains. That method of course nearly opposite of Connors', i.e. breakout vs. pullback. But the key similarity that both methods are for short term swing trading. Connors scales in by averaging lower, Dennis higher. I was so intrigued by what Connors had to say on stops that I googled his name and found several articles/sites in which Connors preaches the use of relatively tight stops, but for methods other than his reversion to mean.

If I read your grahic and comments right, Connors only exits when price drops 75%? Loose stop huh:) Another key point need to mention. Connors I believe states that he mitigates risk despite basically no stops by very small postion sizing, along with dozens of positions. Thus no big outsized winners with his profit exit rules if I understand. The power of compounding can work. And of course heavy on etfs which also lessens volatility.

|

|

Registered User

Joined: 12/2/2004

Posts: 1,775

|

Forgot to link a superb three part interview of Larry Connors by ace trader interviewer Charles Kirk:

http://www.tradingmarkets.com/.site/stocks/commentary/editorial/Charles-Kirk-QA-with-Larry-Connors-Part-1-81748.cfm

|

|

Registered User

Joined: 12/31/2005

Posts: 2,499

|

QUOTE (fpetry)

...

If I read your grahic and comments right, Connors only exits when price drops 75%? Loose stop huh:)

---

This was a strategy and backtest of my construction to survey the effect of stop loss with settings from 2% to 75%, It was a way of quantifying the "loss capture" effect. What is not shown, which is also important, but not the point of the post was:

o position size

o drawdown

o trade duration

o winning %

------------------------------------------

The undetlying strategy could very well be a reversion to the mean. Also you can see from the plot that there is a profitable region in the tight stop area. The little mound around 2.5 to 4%, when the profit target is > 8%.

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

this does not invalidate stop losses in general - only with respect to these mean-reversion strategies.

|

|

Registered User

Joined: 1/12/2009

Posts: 235

|

Mr. Connors certainly has an interesting trading strategy but backtesting is nothing more than looking in a rear view mirror. Real time is the only thing that matters but fact is, few if any can demonstrate their efficacy in real time. I'd be interested in seeing someone demonstrate Connor's method in real time.

|

|

Registered User

Joined: 1/12/2009

Posts: 235

|

I must also say that his thoughts on not using stops is bunk. Perhaps there may be some validity to that practice but it doesn't sound like prudent money management to me.

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

Listening to the webinar, I believe Larry said you "could use the 200-day SMA as a potential stop-loss". I think he also advocates hedging any "Reversion to the Mean"/RSI(2) position with a short in an Index ETF (i.e., SPY, QQQ, VTI, etc.). As someone else pointed out, his website stresses that their strategies are "not single" stock picking systems and that multiple positions are favored.I would say this on stops: if you have only been trading 1-5 years, stops are a must...at least a "stop of last resort" so you don't blow out your account.

|

|

Registered User

Joined: 12/2/2004

Posts: 1,775

|

I think it's important to note that Connors leaves a big hole in his backtesting of stops. He totally leaves out one of the major rules of stops that many successful investors employ, namely the reentry of position shortly after being stopped out. This tactic especially useful for tight stops which quite obviously have much higher odds of triggering. This is one of the cornerstones Richard Dennis employed in his turtle method and which many swing traders and even position traders use.

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

If someone is in danger of blowing out their account from any single position, whether a stop is used or not, then I don't think they should have that position on to begin with.

Even if you don't have an actual stop on, you still have a stop. It's the entire position size. If you have your equity devided up so that each position is 1/10 of your account then your stop loss is 10% of equity.

It's a very valid way to trade. Position size is very, very important. I see a lot of traders who go from one fully loaded trade to the next. In that case no stop can help you. If you place the wrong trade and news comes out in after hours and your stock opens down -50%, then 1/2 of your account is gone.

If your trade is 1/10th of equity and the next day the company goes bankrupt, then you have lost -10%.

No stops is a very feasable strategy when coupled with correct position sizing. I think connors also mentioned that you should diversify strategies as well. Mix in some trend following strategies with some mean reversion strategies.

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

I think days like today prove the worth of stops for some market conditions. What back testing doesn't factor in is the massive psychologically toll big drawdowns can inflict upon a trader.

That said, I do think there are strategies that work better without stops, but that's because the people trading them can handle massive drawdowns on days like today.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

QUOTE (Ryoko) I think days like today prove the worth of stops for some market conditions. What back testing doesn't factor in is the massive psychologically toll big drawdowns can inflict upon a trader.

That said, I do think there are strategies that work better without stops, but that's because the people trading them can handle massive drawdowns on days like today.

Out of Larry’s 19 “pet’ ETF’s GLD was the only one you could use

(of course there was no signal)

because it was above its 200 day moving average.

The others are “turned off” because we are in bear market mode.

(under the 200 day)

Thanks

diceman

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

Gonna trade without any stop losses for a month using Larry's 5-day SMA as a profit target on my RSI(2) trades. I'll also make sure to have a hedge in on the balance of my direction (using the SPY or QQQ or some other non-leveraged vehicle).

|

|

Registered User

Joined: 5/11/2009

Posts: 120

|

Ryoko, are you talking about one of Larry Conners systems from his High Probability book or something different?

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

QUOTE (Ryoko) Gonna trade without any stop losses for a month using Larry's 5-day SMA as a profit target on my RSI(2) trades. I'll also make sure to have a hedge in on the balance of my direction (using the SPY or QQQ or some other non-leveraged vehicle).

With stocks?

Thanks

diceman

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (Ryoko) Gonna trade without any stop losses for a month using Larry's 5-day SMA as a profit target on my RSI(2) trades. I'll also make sure to have a hedge in on the balance of my direction (using the SPY or QQQ or some other non-leveraged vehicle).

ya, make sure you report back to the board on your results. i'm very interested on whether larry conner's strategies are actually useful, or he's just another dweeb out to promote his products.

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

QUOTE (tomson10) Ryoko, are you talking about one of Larry Conners systems from his High Probability book or something different?

Kind of. I'll use one of my own RSI(2) scans based on his work and his PowerRating system on his web-site. I signed up last week for the free 30-day trial and paper traded signals from it all last week.

QUOTE (diceman) With stocks?

Thanks

diceman

Yes, stocks only for now. No ETFs unless I take one as a hedge which, after more testing this weekend, I may not do.

QUOTE (funnymony) ya, make sure you report back to the board on your results. i'm very interested on whether larry conner's strategies are actually useful, or he's just another dweeb out to promote his products.

I might post it all to one of my blogs...either here, http://kagi.tumblr.com/ or here http://kas.tumblr.com/ ... it's easier to add images and format on a Tumblr or Wordpress blog than these forums.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

QUOTE (Ryoko)

QUOTE (diceman) With stocks?

Thanks

diceman

Yes, stocks only for now. No ETFs unless I take one as a hedge which, after more testing this weekend, I may not do.

As long as you know stocks are riskeir than ETF's.

Thanks

diceman

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

QUOTE (diceman) QUOTE (Ryoko) QUOTE (diceman) With stocks?

Thanks

diceman

Yes, stocks only for now. No ETFs unless I take one as a hedge which, after more testing this weekend, I may not do. As long as you know stocks are riskeir than ETF's.

Yep. I'm good. Thanks. :)

|

|

Registered User

Joined: 6/13/2011

Posts: 88

|

You may want to take a look at this.

http://www.incrediblecharts.com/trading/stoploss-trading-1.php

Like I said all along, stops are not the answer - option leverage is. There is nothing for free.

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

Very cool. Thanks for the link. :)

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

Update: I have been trading signals off Larry Connor's "PowerRatings" web-site for the past few weeks without stops or Options. Some thoughts:

► Some great signals, some total rubbish. Many times, there are too many signals. Lots of ETF correlation, but you only need about 5-6 ETFs to swing trade anyway.

► Running without stops is fine even without the use of Options, but drawdowns are hellish in in some cases with ETFs, seem never ending as the "out" signal appears to be a cross above 70 on a 2-period RSI.

► ETFs are safer in some regards, but the PowerRating signals for Stocks are far better from my limited experience.

► The algo used to generate the PowerRating scores is pretty much a variation of his published RSI(2) work. It works well, but reading his books will give you a similar, though not exact, strategy.

► Monthly fee is too much. Would be a good value at about 1/2 the cost.

► Web-site is poor and clunky, and lacks some basic functionality that you'd expect from a $60 a month subscription.

Overall, I find the service to be "so-so" (not great, but not a rip-off). Some good signals, but the monthly cost is too high for the tools provided.

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

I should also mention that the "out" signal for PowerRating stocks is a close above a 5-period SMA ... different from the ETF signals.

|

|

Registered User

Joined: 1/12/2009

Posts: 235

|

Typical webinars. Buch of would be traders that make more selling their crappy service than they do actually trading.

|

|

Registered User

Joined: 12/31/2005

Posts: 2,499

|

QUOTE (traderm30) Typical webinars. Buch of would be traders that make more selling their crappy service than they do actually trading.

traderm30 may I suggest you rearrange your bedroom funiture so that you can get up on the other side....

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

QUOTE (traderm30) Typical webinars. Buch of would be traders that make more selling their crappy service than they do actually trading.

Actually, Connor's RSI2 and RSI4 systems back tests very well. I don't think he's a hack at all. I do agree that the latest webinar has almost nothing to do with TC2000 though. It's mostly a selling job for his hideously expensive "Machine" service and very little use to TC2000 users.

However, I have been back testing his theories all weekend using Nirvana Systems "OmniTrader" (without curve fitting) and the results are quite good if you're willing to take some serious draw downs once in a while. There are some serious, serious blowouts from not using Stop Losses. For example, this most recent move down was a massive loss to anyone using his TPS system without stops or options. But in a "normal" market, the use of stops did/does indeed hurt profits.

Anyway, I have culled a quiver of 20 ETFs that I plan to trade for 3-months using two of his systems: TPS and RSI 10/6 & RSI 90/94. His %B strategy also tests out well. The Webinar is of little value, but his latest book on ETFs is useful. Give it a spin.

|

|

Registered User

Joined: 1/19/2011

Posts: 23

|

Also...Bruce L. coded up the TPS scans awhile back for TC2000 in this thread:

- http://forums.worden.com/default.aspx?g=posts&t=50383

As well as the 3-day pullback discussed in the webinar:

C > AVGC200 AND AVGV21 > 1000000 AND C < C1 AND C1 < C2 AND C2 < C3 AND C / C1 <= .97 AND RSI2 < 10

|

|

|

Guest-1 |