Registered User

Joined: 3/21/2006

Posts: 4,308

|

While looking for falling knives in response to Johns SNDA thread (By the way John your pick is moving well today), I had mentioned the stock HNSN. It caught my eye that what could be forming with this chart is a nice V bottom. I am aware that all V shaped bottoms start out as a falling knife but not all falling knives turn into V bottoms.

Anyway it looks to me like we could have a V bottom forming here and after studying many of these formations it occurred to me that why not try to catch them early on in the reversal? Many of them are just as volatile in the initial move going north as they did on the down side.

I am posting two charts here to show what could happen.

If anyone would care to comment on the mechanics of bottom formations I think it could make for some interesting dialog

===================================================================================================================================

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

Good post Apsll: On HNSN let's draw AGM's downward trend line, catch the upbreak. Vol. maybe a little low for maybe the break.

Maybe AGM will give us a volume post for this pattern.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

without looking up all the cup in handle parameters:

CDR break out of handle?

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

what the heck, while i'm begging, may as well go all the way.

I'll ask AGM about FIBS in trading importance.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

John, I appreciate all the hard work that you are putting in to get a rise out of me, but now that I have your number you will have to work harder. I do like the challenge when it is of a technical analysis nature though.

CDR; you might want to ask Fpetry about this one. He is more in tune with this pattern than I. Unless price can make a new high then I would use caution.

You miss-understand my intentions with HNSN. I am not looking for the "break". Just to capture a piece of the volatility should we get some. If we were to use your friends "trend line break" than we would already be in the stock.

I would not count on seeing him around here ever since he got caught in his twisted web of deceit.

Well how did I do? Probably not quit the reaction from me that you expected.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

I think you did quite well. Nicely done, my friend.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

QUOTE (johnlc) Good post Apsll: On HNSN let's draw AGM's downward trend line, catch the upbreak. Vol. maybe a little low for maybe the break.

Maybe AGM will give us a volume post for this pattern. These comments are not intended for me to enter the fray, rather to keep newer and learning traders from being confused. For those of you reading, sadly, there are some who will make comments (which can end up being confusing) because they are in competition with one another. The reality is that trendline breaks are not always perfect. A few charts were shown and discussion happened that might make one think that this is a failsafe system that works every time. Actually, it works about as often as any other system. Not taking sides, except with the truth.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

Very professional. Wasn't trying to pick entry on Hnsn,,,,, Just as you, just trying to add something to the post.

not into cup in handle myself, but just maybe bringing to attention to others. Although it must have merit, cause alot of people discuss cup in handle. Probably should practice looking at those patterns more often. I think that Bulkowski has a slightly different parameter, I'm going to check out his site.

So you don't think the Pats will go 0 - 16 this year?

I didn't get a chance to check out the news on Big Ben today. I know one thing, the Rooney's do not like this kind of stuff going on with their players. They expect the players to act in an appropriate way, as expected of a Pittsburgh Steeler. It would not surprise me, if they get rid of him, no matter what the court outcome is. Where's the worst he'll end up,,, Raiders.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

Did you check out LEAP & EEPT ?

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

QUOTE (tobydad) QUOTE (johnlc) Good post Apsll: On HNSN let's draw AGM's downward trend line, catch the upbreak. Vol. maybe a little low for maybe the break.

Maybe AGM will give us a volume post for this pattern. These comments are not intended for me to enter the fray, rather to keep newer and learning traders from being confused. For those of you reading, sadly, there are some who will make comments (which can end up being confusing) because they are in competition with one another. The reality is that trendline breaks are not always perfect. A few charts were shown and discussion happened that might make one think that this is a failsafe system that works every time. Actually, it works about as often as any other system. Not taking sides, except with the truth.

tobydad, actually the trend line breaks work better than other systems. you either did not read my description of the trend line breaks or you do not understand them. the charts posted above do not meet my criteria. failure rates are higher if you use setups like those charts. maybe I will post some more charts when I have time.

apsll, I warned you about snide remarks. maybe you should read your honor bound rules again. and tobydad, maybe you too should read them again before you say nicely done.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

agm, thanks. Yes, I probably need to spend a little more time understanding either your posts specifically or trendline breaks generally. I'd like very much for you to post some more so I can continue learning. I clearly do not understand it as well as you. As to my remarks to apsll, sorry, I cannot apologize for trying to encourage someone for taking steps in the right direction. My comment was not meant to take sides between the two of you. I was simply affirming him for working on something that I believe will just make him better. It really had nothing to do with whether his discussion / disagreement was with you, anyone else or me for that matter. All of these discussions don't have to turn into a big confrontation all the time. Thanks for you input and, again, I'd love to learn more from you on the trendline breaks.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I agree with my friend Tobydad. I too would like to learn more about your style of playing the trend line breaks. It might be helpfull to walk us through one of your live trades as showing past success models is not quite as dramatic.

Thank you very much for your offer to help us better understand the mechanics of your system.

Apsll.

|

|

Registered User

Joined: 12/2/2004

Posts: 1,775

|

QUOTE (johnlc) not into cup in handle myself, but just maybe bringing to attention to others. Although it must have merit, cause alot of people discuss cup in handle. Probably should practice looking at those patterns more often.

CDR does have a 7 week cup with handle pattern. BTW, 7 weeks the minimum per O'Neil. I believe Bulkowski does indeed have a different take on the pattern, but I have to give nod to O'Neil because he's the guy who popularized it decades ago. FWIW, he says it's the number one pattern every single year for almost 50 consecutive years, for the stocks making the biggest multi bagger gains, and he proves it in his books and articles and speeches with detailed historical charts. So that's why it's discussed a lot in some quarters. Back to CDR, the pattern has mix of strong and weak points. Strong points, I especially like the last two days of above average volume on the handle's breakout, and fact that money stream and BOP looking good now. The cup portion nicely rounded and its depth near ideal at 19%. Overall longer term pattern going back several months in strong uptrend is good, and price currently above 50 and 200 moving avg. Required prior uptrend (starting early Dec) leading to start of pattern meets the required 25-30% gain, and volume did increase with several above avg volume days (looking at 50 day avg. A weak point I see is the huge volume gap down on 2/2 but it was good that price found support at the 200 ema and a few weeks later reclaimed the 50 ema. The handle has a flaw, its body located in lower half of cup, but does have required minimum five days. Since the depth of cup of not excessive, a little lee way given to handle's location. In closing, O'Neil often states that a perfect cup with handle with all the criteria in place is extremely rare, the key being that the pattern simply has a majority of the criteria passing, the more the better. A side note, I've seen several negative comments about the cup and handle over the years on this forum with the common denominator being the high number of points or criteria that make up a proper cup/handle and how it's crazy to have to go over point by point. The cup/handle has about 10 technical criteria, and if that sounds like a lot check out number of Bulkowski's points for what constitues his ideal high tight flag....13 points. If a trader studies a pattern in detail from an author and pores over hundreds of chart examples, it doesn't take long until he's able to quicky look at a chart and deduct in a few seconds whether or not the pattern is worthy of consideration. Sorry to got longwinded on the subject. BTW, I am not a cup and handle fanatic...I simply have it in my tool bag along with most all the other common patterns.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

fpetry: Nice info.

How about this: Everyone's opinions about patterns after the crash. Are they holding up as the same patterns that were around for years before the crash? I know, haven't had alot of time for new evolutions but some may be failing while some are still true.

Anyone seen big differences?

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

QUOTE (Apsll) I agree with my friend Tobydad. I too would like to learn more about your style of playing the trend line breaks. It might be helpfull to walk us through one of your live trades as showing past success models is not quite as dramatic.

Thank you very much for your offer to help us better understand the mechanics of your system.

Apsll.

you should be able to figure it out from this thread.

http://forums.worden.com/Default.aspx?g=posts&t=45056

I posted a few charts that are easy to understand

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

agm; well, it shows how sad I am! I still have some questions even though you tried to bring it down to my level. Could you tell me how you decide when and where to draw a trendline? Are there specifics or is it gut? Do you have a proven method for selecting your points that create the line or do you pick your line and manage the entry/exit based on how the price reacts after the line is drawn? Or both? I'd love some additional insight. thanks

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

Glad to have someone else begging instead of me.

Now if Apsll would ask AGM for forgiveness, we may get to have AGM bless us with some super good stuff.

APSLL??????????? Where forth arth thou? Time to eat some crow.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

John, you may be getting a little carried away.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

Go for the gusto.

I bet if you took a poll : AGM to post or AGM not to post -------- posting wins. However I'll leave the voting poll up to you.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Thanks Agm for your in depth analysis. Looking at those charts really inspired me. Do not worry Tobydad. John is not getting carried away, although he soon might be. I hear they are doing wonderful things with dopamine these days.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

John, you misunderstood me. I am all for agm posting, he offers good stuff. I was referencing the "begging", the "apsll asking for forgiveness" and all that stuff. Not sure we need to get to that level; it just doesn't help anything we're trying to do here. But agm posting? Absolutely, the more the merrier.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Tobydad, I do not want you to take this wrong but you are waisting breath on these two. They have both come right out and admit that for them it is more fun to try and pull my strings than to be part of an informed and intelligent community.

They are like a tag team and they only see with tunnel vision. They are like Bigblock, the more damage that we do to them the more they feel the need to strike out. Bigblock strikes out the way he does because he was rejected by Mangement and the forum in general. All three see me as their nemesis. Maybe because I have the biggest mouth. That is why John wants Agm around so that he will have a partner that he shares his passion with. If only that passion were trading stocks......

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

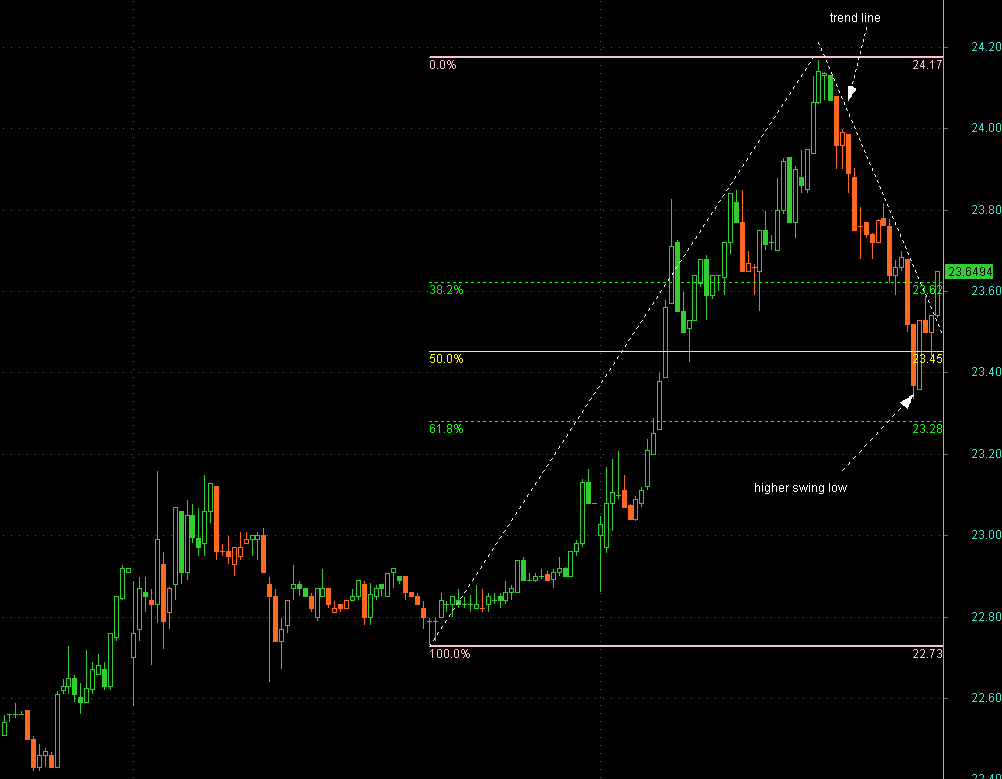

tobydad and apsll; I am not sure if you are being factious or really do not know; I will assume the later. I am really surprised that you and apsll could not disentangle the charts that I pointed to. I know that both of you are strictly indicator traders but I cannot describe this method using bollinger bands, linear regression, or moving averages so bear with me. I will be using words like pull back, fib retracement, and higher swing low and trend lines. if you do not understand the meaning of these, then please look them up before continuing. this method is widely used by many traders and is by no means a secret trading system.

the values I will use are not etched in stone, but have been tested to improve the winning percent. there are many other trend line methods, but this is my favorite.

this first chart shows a stock that has the earmarks of a worthy trade. notice that a pullback has developed and is now within the desirable fibonacci retracement values of 38.2% to 61.8%. so we will now draw a trend line and put this in a watch list.

this chart shows that price has broken the trend line and is just short of the preferable 61.8%. also notice that a higher swing low has formed. I assume you know that a higher swing low means that the stock is in an uptrend and it is beneficial to trade with the trend. this is the time to buy.

this chart shows where I would sell. this is where all traders have there own exit methods. there is no right or wrong way, just be creative. as you can see, I paint my candles according to the trend and will exit on the first red candle.

I hope that I do not have to go into money management on how many shares to buy, where to place a stop, or how to figure the r/r of this trade. surely you can do that.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Agm32, this is all stuff that you learn in chart reading 101. I want to see you pick a stock now that looks good to you in the real time world. I have many charts that I could show with fibonacci retrace lines that went on to do great things.

Know one knows when a bottom is actually in. You give new traders false hope that this is the way to find a reversal. The one thing that I agree with you on is the Money Management aspects. They are going to need to know that part in most casses because cotrary to your earlier words, most profesional traders do not buy in a downtrend. Also chart reading 101.

It is smarter to identify bottoms and wait for confirmation of a new trend. If traders do it your way then they are going to run into a lot of these thanks to you.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

agm; thanks for the good information. I know everyone on the forum appreciates you sharing. And, no, I was not being either fractious or facetious (not sure which you meant...maybe you were just being efficient and covering both bases with one word, well done. Now, I'm just kidding around, so, please, take no offense :). I have no axe to grind with anyone here so you are free to drop your defenses with me. I know enough to know what I know and to know that I can always learn. And I know I'm only wise when I don't mind asking for the insights of others. Aside from knowing that, although I may already know 95% of something that someone is going to tell me, it's that extra 5% that they may add to my knowledge base, it's the little tweak of an idea, a slightly different way of doing things that might be the spark for a new idea for me. That always keeps me going and growing. So thank you so much for your time; it is very much appreciated.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Lastly, I just want to say to the new traders that this is not about right or wrong.

You should exlplore this style of trading and keep a log book on the results. You should do that with all trading styles presented here. That is how you will eventually find your style. You will see wich one best suits your personality. Agm is not all wrong because all stocks will eventually change trend of course, but trying to time it down this close so that you are right there at ground zero is a very risky game. All to often you will see the chart above and you will be caught in a stock that is simpl continuing its down-trend. My example VISN did just that. It went down to $4

Just be careful is all that I am saying....

Good luck. Apsll.

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

QUOTE (Apsll) Agm32, this is all stuff that you learn in chart reading 101. I want to see you pick a stock now that looks good to you in the real time world. I have many charts that I could show with fibonacci retrace lines that went on to do great things.

Know one knows when a bottom is actually in. You give new traders false hope that this is the way to find a reversal. The one thing that I agree with you on is the Money Management aspects. They are going to need to know that part in most casses because cotrary to your earlier words, most profesional traders do not buy in a downtrend. Also chart reading 101.

It is smarter to identify bottoms and wait for confirmation of a new trend. If traders do it your way then they are going to run into a lot of these thanks to you.

if you would expand your chart, you would see that your tend line is on an obvious down trend following a lower swing high. if anyone wishes to see this then apsll's buy candle is on 1/27/2010

you have a lot to learn grass-hopper

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

agm; question: as I want to understand better how you are doing things, with respect to your first chart shown, why would a trader not enter a buy order at that 4th candle in from the right hand side, the first bullish candle after the big drop from the swing high (sorry, you didn't list the stock, time frame or anything else so I have to describe it that way) as the price was just short of the 38.2% line and this one broke a possible trend line? What tips would help someone avoid that dilemma? (This is not a challenge to you, it's a question, and, by the way, for me, I'd love to have to stop typing these disclaimers.)

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

No where in your last example (RVBD thead) do you mention anything about only drawing a trend line on a pullback, infact on the 5 minute chart that you used in your example (again for RVBD) you draw your trend line within the context of a downtrend. Now you change your story.

I am done with you. It is exasperating trying to keep up with your ever evolving lunacy. We all play the pull-backs and use Fibbonacci lines. Now you are trying to fit your argument into a new package.

Like I said I am done.

Now that you have everyones attention then follow through and start making stock picks to the right of the screen. That is what Tobydad and I do so welcome to the club. I look foward to your first pick!!!!!!!!

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

apsll, question for you, on your VISN example, where would you have drawn the Fib lines?

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

QUOTE (tobydad) agm; question: as I want to understand better how you are doing things, with respect to your first chart shown, why would a trader not enter a buy order at that 4th candle in from the right hand side, the first bullish candle after the big drop from the swing high (sorry, you didn't list the stock, time frame or anything else so I have to describe it that way) as the price was just short of the 38.2% line and this one broke a possible trend line? What tips would help someone avoid that dilemma? (This is not a challenge to you, it's a question, and, by the way, for me, I'd love to have to stop typing these disclaimers.)

first off, studies have shown that buying on that candle is not very profitable. that is the reason that I wait for price to pull back more than 38.2% and then drawing a trend line. a good friend of mine named maverick from another board was kind enough to run backtests to determine the optimal pull back range and it has proven to be so.

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

QUOTE (Apsll) No where in your last example (RVBD thead) do you mention anything about only drawing a trend line on a pullback, infact on the 5 minute chart that you used in your example (again for RVBD) you draw your trend line within the context of a downtrend. Now you change your story.

I am done with you. It is exasperating trying to keep up with your ever evolving lunacy. We all play the pull-backs and use Fibbonacci lines. Now you are trying to fit your argument into a new package.

Like I said I am done.

Now that you have everyones attention then follow through and start making stock picks to the right of the screen. That is what Tobydad and I do so welcome to the club. I look foward to your first pick!!!!!!!!

apsll, you need to read up on what determines a trend, swing highs and swing lows, otherwise known as peaks and throughs. until you do, you will never understand price action or dow theory.

you asked that I explain how I trade trend line breaks and I have done so. however, I will not go into the finer details as you do not even understand what I have told you.

oh and please be done with me

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

TB how are you? I know that you are playing the good diplomat but now he has changed his story to using trendline breaks only in an up-trend. His first mention of trend line breaks were on the chart for RGR a stock that was in a bottom formation that I was waiting for the break-out. He stated that I had already missed the big play on the very bottom of the chart. Now RGR is breaking out from the bottom and I am doing very well with this one thank you....

I also would not have plotted any Fibonacci levels on VISN I only used the chart as an example to the new traders what can happen to you if you try to pick bottoms.

Now I will leave it alone. He is just gong to keep posting past charts and changing his story to fit the chart. I have challenged him to pick a realtime trade and I know that he is just not going to do it.

I caught him lying twice, one about using your name on FTV to lure me into a trap and then about this. You cannot argue with a sick mind so I give up.

Tobydad I did draw some fibonacci arcs, fans and levels on APWR here is the chart. This is how I use them. And I am not always right.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

AGM I am through with you. I proved you a lier twice. Speak to the hand.....

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

QUOTE (agm32) QUOTE (tobydad) agm; question: as I want to understand better how you are doing things, with respect to your first chart shown, why would a trader not enter a buy order at that 4th candle in from the right hand side, the first bullish candle after the big drop from the swing high (sorry, you didn't list the stock, time frame or anything else so I have to describe it that way) as the price was just short of the 38.2% line and this one broke a possible trend line? What tips would help someone avoid that dilemma? (This is not a challenge to you, it's a question, and, by the way, for me, I'd love to have to stop typing these disclaimers.) first off, studies have shown that buying on that candle is not very profitable. that is the reason that I wait for price to pull back more than 38.2% and then drawing a trend line. a good friend of mine named maverick from another board was kind enough to run backtests to determine the optimal pull back range and it has proven to be so. OK, that's the part I missed on the first read through, (even though you said it, I just didn't pick up on it the first time), you draw your trendline after the pullback is below the 38.2% line but above the 61.8%. Very nice, thank you agm.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

QUOTE (Apsll) TB how are you? I know that you are playing the good diplomat but now he has changed his story to using trendline breaks only in an up-trend. His first mention of trend line breaks were on the chart for RGR a stock that was in a bottom formation that I was waiting for the break-out. He stated that I had already missed the big play on the very bottom of the chart. Now RGR is breaking out from the bottom and I am doing very well with this one thank you....

I also would not have plotted any Fibonacci levels on VISN I only used the chart as an example to the new traders what can happen to you if you try to pick bottoms.

Now I will leave it alone. He is just gong to keep posting past charts and changing his story to fit the chart. I have challenged him to pick a realtime trade and I know that he is just not going to do it.

I caught him lying twice, one about using your name on FTV to lure me into a trap and then about this. You cannot argue with a sick mind so I give up.

Tobydad I did draw some fibonacci arcs, fans and levels on APWR here is the chart. This is how I use them. And I am not always right.

It always amazes me with what reliability the Fib lines are "obeyed". Thanks apsll.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

You are welcome Tobydad. It is funny. You and I have been trading pull-backs for a long time and he makes it sound like it is a new idea.........

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

QUOTE (Apsll) You are welcome Tobydad. It is funny. You and I have been trading pull-backs for a long time and he makes it sound like it is a new idea.........

wrong again. did you not read my post from the first chart?

I said "this method is widely used by many traders and is by no means a secret trading system."

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Tobydad, take a look at Walgreens Company. WAG

This one has nice fundimentals and according to the Wall Street Journal is being accumulated. You would not know that by looking at the chart. But us chart readers we can see things that others may miss. For one thing, price is bouncing off the support from the early February, also take a look at the Fibonacci levels here in my chart.

I just thought that you might like to see some good Fib retracment candidates.

|

|

|

Guest-1 |