Registered User

Joined: 3/21/2006

Posts: 4,308

|

I have heard it said before that durring a market correction the sectors that performed well despite market direction will be the very sectors that lead the way out of the correction. I tested this theory by going back in time to the May 2006 market correction. And true to form these ancient words of wisdome were right on target.

In my first chart I show how despite the market correction that some sectors were doing very well. Just as one example I have highlighted the Telecom Services sector. It not only did well durring the market draw-down but that it continued strong well after the correction reversed.

Here is the chart.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

I used the Morning Star Industry groups for my research and more than one group or sector did well durring the correction and that also did well after the reversal. I did the same test on the current status of leading sectors. One only need do a custom date sort to reveal which sectors are doing well in the face of this current market correction.

Below is just one sector that is doing well - Health Services. You can then change your watch-list to the Industry components and do the same custom date sort to find the stocks that are doing well and are possible candidates for trading after the reversal.

Here is the chart. I would love to hear from the traders that have some interest and/or experience with "Sector Rotation"...

Thanks Apsll.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Another strong sector right now is "Consumer Durables- Sporting goods". I found that the leading stock in this Sector is NLS Below is the chart. I love the bottom formation on this one and it appears that price has broken free from its bottom range. I also like that this stock has great Instituional support and very low Debt.

Here is the chart.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Something to keep in mind right now is that we as traders are sitting in a very good situation. We need only wait out this correction. Patience can be a strong ally. I would rather be on the sidelines (not that I am) and waiting for a handfull of charts to mature than to be trying to force a trade only to have the third leg of this correction collaps on the market and put a dent in our confidence, because we are going to need a clear mind to be in the right place at the right time soon.

Just some food for thought. I am going to continue my scans and maybe post some more charts. that will be prime targets after this correction is over.................

I wanted to mention three other indicators that are relevant. Notice the Money stream is tall and rising. Notice the Bollinger Band Squeeze showing the decrease in volatility. A sign that the selling pressure and buying pressure are just about even; a break-out to the North is a good sign for the Bulls. And finally Volume will be a good indicator to watch as price moves up.

I post this chart now but I will not be posting the results for a few months. That is how long if not sooner that these kinds of patterns take to play out.

Here is the chart.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

As stated in my first post, it is in my opinion that the strong sectors will lead us out of this Market Correction. The Media Sector Right now is the strongest of the Morning Star Industry Groups. The stock that I like the best from this group is Liberty Media Capital. The ticker for this one is LCAPA.

Bellow I have posted the chart. Price is making new highs as Money Stream is very strong. I whent long on this one just a little while ago @ $30.28 It is my intention to hold this one for some time. This is not a day trade.

I plan to continue buying the strongest stocks in the strongest sectors. I will share my picks with the forum. Here is the daily chart.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Sorry folks. This is the weekly chart....

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

NLS will be my next long term purchase. I am just looking for the best entry. I do expect price to come down and kiss the bottom formation trend line shown in the following chart. Price could also just continue North. Either way I will be on board.

Consumer Durables "Sporting Goods" is another very strong sector amidst this Market Correction.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Like RVBD this chart for LCAPA is also a work of art. I am one point on this one and will hold for a while...

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I would like to share another strong leader to the list of buy candidates. First I want to mention that Ben2k9 shared some good insights on a new thread that he started. I took from his analysis that he is currently bullish and I agree with him. (I hope that I did not mis-interpret his post). I admit that I invisioned the market correction as not quit over and that we might see another leg down in the markets, however the current price acion for the Index's leads me to believe otherwise.

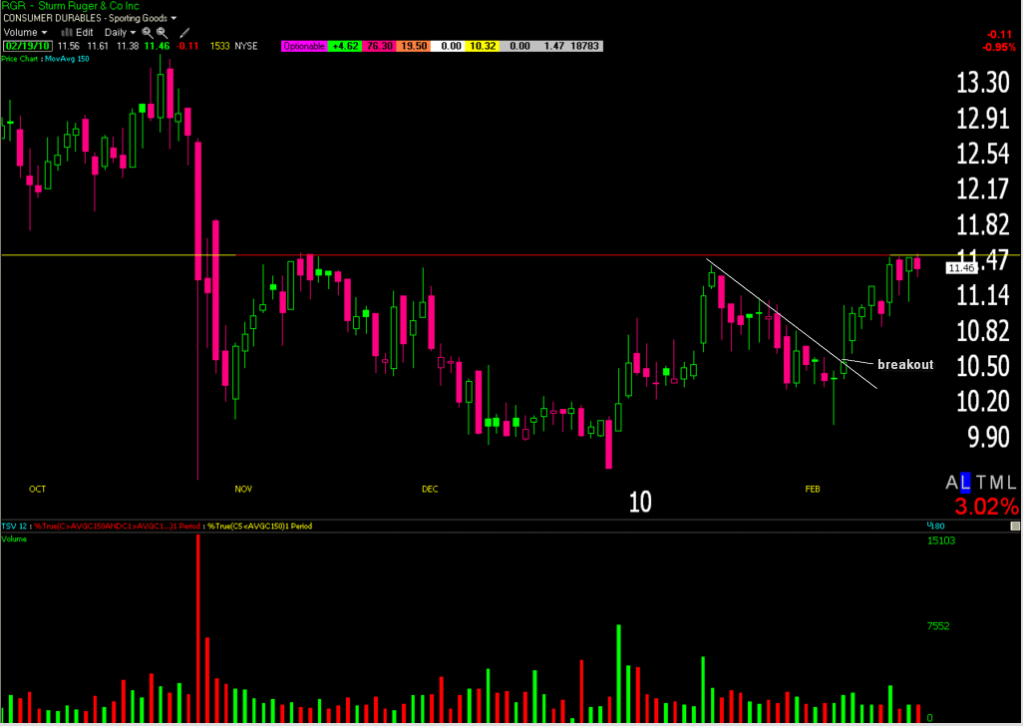

Along with NLS I like the chart for RGR they both are in the same sector and are strong leaders. RGR also has a very high earnings growth rate 5 years. Here is the chart. I will wait for the break-out to buy this one. NLS also is almost ripe for a buy very soon.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

apsll, I hope you do not take this as criticism as I do not want to start trouble by getting you angry, but take this as a different way to trade. this is my opinion on how to trade stocks like rgr.

the time to buy this has already came and gone. you need to brush up on your trend lines and pay less attention to support and resistance. I promise you will make a lot more money if you do. it's not really all that hard to do. just scan or search for pullbacks that are in the process of a higher swing low and draw the trend line where applicable and put them in a watch list. if you are trading daily, then each day check for price breaking that trend line. you will not win then all but the ones that you do will look similar to this marked up rgr chart, almost a 10% winner already.

the reward to risk is very high in your favor. I have been trading like this for several years and it is very profitable. like tobydad says, it is one of the simplest (which usually equals best) ways to trade a pattern like this one.

you do not have to abandon your method; just do not overlook the obvious trend lines

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

The above post was from Agm32. I appreciate his input and sharing his ideas about trading the trend line break. I hope that he will share some of his strategies and charts with us.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Another industry leader LCAV is challenging the bottom ressistance levels. Here is the weekly chart. I plan to buy this one also when/if there is a break-out above ressistance.

Here is the chart:

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Another Industry leader, I like this chart for a more long term approach. Price looks like it has already broke free from the double bottom and is now consolidating.

The chart for SRZ

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I wish that I had kept a closer eye on this one today. NLS is one of the Industry leaders that I like but going all cash this morning I did not bother to look at it. I will see if this takes off or comes back down to kiss the support line one more time.

I am torn over wich analysis to trust. I see that the SPX is retreating and yet there were some stocks on the move today. I spent most of the day doing research when I should have been watching my lists. Research can wait for after hours.

Here is the chart, the first white line shows when price first broke through and the second white line shows price bouncing right off that support line.

|

|

Registered User

Joined: 12/21/2004

Posts: 26

|

Aps....too bad you missed the NLS move....nice pick. Here is one I am accumulating. Daily and Weekly chart. Feel free to give comments, good or bad. Aps....too bad you missed the NLS move....nice pick. Here is one I am accumulating. Daily and Weekly chart. Feel free to give comments, good or bad.

WEEKLY CHART

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

How are you Coubo?

I am a little reticent to say yes on this one. I know that you are looking more for an analysis so here we go. First I like to see stocks with at least a three year history in order to make a complete analysis. That is not to say that this stock will not rise. You might want to ask Fpetry how this measures up on the IBD charts. My job is made easier because I need only plug in two indicators to see a huge negative divergence.

In my following chart you can see that about a year ago on the weekly charts that price was at a lower low than it is now and yet the Money Stream and the TSV indicators were very much higher. I usually do not give to much credit to small or negligible differences but this one is huge and glaring. The says Distribution to me. Now on the bright side on the daily chart it appears that things are improving. I migh give this a second look if price can break $4.50

Here is the chart. Good luck.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Correction, This chart does have exactly three years of history. I would still ask Fpetry about the IBD charts however. He does top notch analysis on the newer companies.

Thanks Apsll.

|

|

Registered User

Joined: 12/21/2004

Posts: 26

|

ApsII,

I have never really considered such a long term divergence on weekly charts in the way you describe. I do look at shorter term divergences like this stock does have. My target is actually the 4.60-4.80 level. I see your point and will study some charts to see if it helps me get into stronger stocks even for shorter term trades.

Thanks,

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

MPEL actually popped up in my scans recently and I think it looks interesting to the upside as well.

Strong volume, looks like a bottom base in progress. Here's my take on it:

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Awsome chart Ben, I am still in my early stages with the clouds. Learning them that is. I was waiting for your next post Coubo, I was going to say that you could play some short term situations on this but I am just not completely sure. You see I have a checklist, and if a stock fails to meet certain criteria or guidlines than I just move on to another stock. I am sure that at some point this one did pop up on one of my bottom scans but I must have moved on. (sometimes to my detriment) these stocks that I take a pass on will suprise me and I will wonder how it ever got by me but those are the breaks and part of my screening process. Now from what I have learned from friends that use the clouds is that you need to wait for a break-out from the clouds, up or down. Ben might have some different info on that. If so than I too would have an interest.

A chart that I view as similar in its price action that did pass all my criteria is RUTH. I am currently waiting to see where this small retreat in price will lead to. And I hope to get in at around the low $3 range. We all have our methods and Benk is a respected chart reader. So get as many opinions as you can. You have some good teachers here on this site.

Good luck

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

honestly I don't use clouds too much...I just had it loaded on my freestockcharts template to take a look at it. I've examined them in the past and couldn't find anything compelling enough about them to rely on them. They seem to try to serve the same purpose as a moving avg or support/resistence zone, only more esoteric...

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I agree Ben. From what I have been told they are thought of as support/resistance zones. The jury is still out for me as well.

Coubo, this situation here gives me a chance to discuss the dreaded VSA it was not to popular back when I started a few threads on the theory, and it is just a theory. Then again all of technical analysis is just a theory. I like it when a theory seems to work so well.

Anyway I show in my chart below the same situation that we have already looked at from a different perspective. It is fun to do so I think. Tiger1220 says it so well in another thread That "The glass is half empty if you are pouring the liguid out & The glass is half full if you are pouring the water in". Funny; all these years and I never thought that there was a right answer to that question...But it shows how you can view a situation with open eyes and an open mind.

Ok now back to the chart. I have already showed above in my chart how I believed that because of the glaring divergence in the volume indicators to the price action that to me this indicates severe distribution. To make it easier, if you look at the draw down from April 2008 to November 2008 and you compare the volume to that of the October 2009 to December 2009 (a much shorter and less steep drawdown than 2008). You will see that although the 2008 draw down was much more sever than in 2009 but inversely the volume was through the roof in 2009. You have to ask why?

This is where VSA comes in. VSA says that the reason for all that volume is because there was not only selling taking place during the 2009 sell-off but that there was also great buying presure. One might wonder how there can be buying pressure durring a draw down? well it works like this (theory), what better way for "smart money" to disquise their buying presure than to hide it within the backround of such great selling. They can slowly build their positions but not enough to make price go up, they can hide their actions as price is tumbling. Ah but they cannot hide the extream volume that is created with this duel type of action (Sellers and buyers at the same time) and who are the paniced sellers selling to? They are selling to the smart money who like this stock and can manipulate this great situation of buying so many shares at bargain prices and not even affect the price.

Now the dilema... Well now we have to ask; then if there is all that buying going on, hidden into the selling pressure, than why do the volume indicators like BOP, TSV, and Money Stream all show distribution and they do not reflect the buying pressure also? That is what I ask myself. I do not know because these indicators are proprietary and we do not know how they are constructed. If price action is hidden within the formula then that is the answer.

Ok sorry about the long wind. You can google Volume Spread Analysis and do some research. I am posting right above the chart a link to some of my videos. The first one is about VSA and discusses the stock PAET I had suspected VSA in this one but because of personal business matters I was not able to catch the action after the video was made. PAET still looks good to me today. I believe that Tobydad introduced this chart to the forum back then.

http://www.screencast.com/users/castleme21/folders/Default/media/fea10b58-7dc6-4532-b4b0-6ba300b38ef5

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

One last point that I show in this next chart. You notice where I have detailed in red that the minor drawdown from late December 2008 to early January 2009 showed almost no volume as price re-tested the lows from the larger drawdown from October/November 2008. That means that there is no more selling pressure. So now price rises as does volume. The fact that we still see high levels of volume right now leads me to believe that we are not ready for the run-up yet. We need to see that quiet before the storm.

Ok I am done. This is all just theory and now I will be watching this chart for educational purposses. I hope that you can make some $$$ on this good luck.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I should have done this stuff in my strategies thread, but thats ok. I feel that this stuff is relevant and I just want to show a good example of VSA. In action. This is called the "retest of the lows.

|

|

Registered User

Joined: 10/7/2004

Posts: 816

|

Thanks for all the sharing, Apsll

Regards

BobMc

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

They will have you in your jump suit soon enough. Hurry now and post as fast as you can. I am sure that you have missed some of my threads

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Ok I promised not to indulge myself any more I am done

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Apsll, thanks. Good stuff. Don't respond to Bigblock, none of us have any idea what is wrong with him. Let's just stay focused.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

You are right Tobydad. And this is the guy that Joncl wants to emulate......

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

To late Millerol. He has made his mess and now the moderators are left to change his diaper. You will get your chance in another two weeks. Now you know what I have been talking about all this time.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Michael and Wayne do not post here any more because of his kind that still remain. You can never fully sterilize.

|

|

Registered User

Joined: 1/12/2009

Posts: 235

|

Ah, yes, the illustrious Big Block returns. You see Apsll, the first strike against Big Block is his lack of a spelling ability. I don't think anyone has even witnessed Big Block's method of investing. His presence on these forums is nothing more than an ostentatious attempt at impressing others. His posts contain the usual dearth of any subject matter. And from the flagrant grammatical errors that his posts contain, the question is, how can anyone take him seriously?

|

|

Registered User

Joined: 12/21/2004

Posts: 26

|

Think I found the reason MPEL is seeing interest.

FEB. 23 - Seeking Alpha

Implied Volatility Movers

Melco Crown Entertainment (MPEL) is seeing relative strength and active call buying on takeover chatter Tuesday. Wynn Resorts (WYNN) is mentioned as a possible bidder. Shares are up and 5,200 calls traded, or about 18X the expected volume for the first two hours of trading. Mar 5, Apr 5, and Apr 7.5 calls are the most actives and, with about three-quarters trading at the asking price, it seems that buyers are dominating the action. In addition, implied volatility is up about 15 percent to roughly 100.

I'm not really into buying take over speculation because it seems the odds are low it actually happens. I will hold my small postion for now. Even if it pops it will definitely stop short of $5.00 to screw the option players at that level. My plan will be to sell at about $4.60 without an actual buy out offer and see how the retrace back to the break out area looks. On the downside, it already triple bottomed so it shouldn't go below $3.70 again.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Coubo, I just had to come on and give you your well deserved koudos. MPEL broke out today and now I like it. Welcome to the bottom fedders club. If Tobydad can ever forgive me then we will conduct the proper ceremonies......

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Apsll, you have not wronged me so there is nothing for me to forgive.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Thanks Tobydad. Your forgivness means a lot to me.

I think that we have a good bottom feeder her in Coubo. I even like his views on SFI in a different thread. Some one else to bounce some of our ideas off of. Since he has been using Telechart ever since 2004 then I am sure that he must have learned a lot from reading your threads.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

QUOTE (Apsll) Awsome chart Ben, I am still in my early stages with the clouds. Learning them that is. I was waiting for your next post Coubo, I was going to say that you could play some short term situations on this but I am just not completely sure. You see I have a checklist, and if a stock fails to meet certain criteria or guidlines than I just move on to another stock. I am sure that at some point this one did pop up on one of my bottom scans but I must have moved on. (sometimes to my detriment) these stocks that I take a pass on will suprise me and I will wonder how it ever got by me but those are the breaks and part of my screening process. Now from what I have learned from friends that use the clouds is that you need to wait for a break-out from the clouds, up or down. Ben might have some different info on that. If so than I too would have an interest.

A chart that I view as similar in its price action that did pass all my criteria is RUTH. I am currently waiting to see where this small retreat in price will lead to. And I hope to get in at around the low $3 range. We all have our methods and Benk is a respected chart reader. So get as many opinions as you can. You have some good teachers here on this site.

Good luck

RUTH is having a fine day today. I was comparing this one to Coubo's fine pick "MPEL" on February 25. The strange part about this move is the low volume.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Wow, beautiful move. Nice pick Apsll. Thanks for all your contributions.

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

QUOTE (ben2k9) MPEL actually popped up in my scans recently and I think it looks interesting to the upside as well.

Strong volume, looks like a bottom base in progress. Here's my take on it:

This train has left the station:

|

|

|

Guest-1 |