Registered User

Joined: 3/21/2006

Posts: 4,308

|

I have heard it said before that durring a market correction the sectors that performed well despite market direction will be the very sectors that lead the way out of the correction. I tested this theory by going back in time to the May 2006 market correction. And true to form these ancient words of wisdome were right on target.

In my first chart I show how despite the market correction that some sectors were doing very well. Just as one example I have highlighted the Telecom Services sector. It not only did well durring the market draw-down but that it continued strong well after the correction reversed.

Here is the chart.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

I used the Morning Star Industry groups for my research and more than one group or sector did well durring the correction and that also did well after the reversal. I did the same test on the current status of leading sectors. One only need do a custom date sort to reveal which sectors are doing well in the face of this current market correction.

Below is just one sector that is doing well - Health Services. You can then change your watch-list to the Industry components and do the same custom date sort to find the stocks that are doing well and are possible candidates for trading after the reversal.

Here is the chart. I would love to hear from the traders that have some interest and/or experience with "Sector Rotation"...

Thanks Apsll.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Another strong sector right now is "Consumer Durables- Sporting goods". I found that the leading stock in this Sector is NLS Below is the chart. I love the bottom formation on this one and it appears that price has broken free from its bottom range. I also like that this stock has great Instituional support and very low Debt.

Here is the chart.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Something to keep in mind right now is that we as traders are sitting in a very good situation. We need only wait out this correction. Patience can be a strong ally. I would rather be on the sidelines (not that I am) and waiting for a handfull of charts to mature than to be trying to force a trade only to have the third leg of this correction collaps on the market and put a dent in our confidence, because we are going to need a clear mind to be in the right place at the right time soon.

Just some food for thought. I am going to continue my scans and maybe post some more charts. that will be prime targets after this correction is over.................

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I wanted to mention three other indicators that are relevant. Notice the Money stream is tall and rising. Notice the Bollinger Band Squeeze showing the decrease in volatility. A sign that the selling pressure and buying pressure are just about even; a break-out to the North is a good sign for the Bulls. And finally Volume will be a good indicator to watch as price moves up.

I post this chart now but I will not be posting the results for a few months. That is how long if not sooner that these kinds of patterns take to play out.

Here is the chart.

|

|

Registered User

Joined: 11/7/2009

Posts: 14

|

Good afternoon APsll,

As trader, I tend to focus more so on ETFs than individual stocks and as a result, my watch list is primarily based on which SECTORS are performing the best (or worst). Additionally, because I like to get more bang for my buck, I've limited my MAIN watch list to the levaged (2x and 3x) ETFs as well as the often inherent bullish/bearish counter parts. So right now my list is close to about 30 different ETFs but I'm only watching about 12 sectors because I'm including the 2x and 3x bullish-bearish versions, etc.

To keep things simple, I just sort the whole list to see which ETFs have the best percentage return over daily, weekly, monthly and 3-month periods, and I go long on the winners or short the losers. Obviously, with the bullish and bearish ETFs on my list, everything gets polarized to the upside or downside, but if I stay focused on the ETFs/sectors than are making the largest percentage moves over ___X___ time period, then I can make some good profits.

I know this doesn't say much with regards to using Worden's charting or anything but strategically it's been something that I've found to work well at finding the strongest/weakest sectors.

|

|

Registered User

Joined: 12/21/2004

Posts: 26

|

I like your thinking and chart analysis, but if you look at a weekly chart NLS hit about 3.00 two other times and failed right there. Tight Stops in order until it can close above $3 for a couple days

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Hello Coubo, how are you. Thank you for seeing that. It makes me actually feel good that price has knocked twice before at $3.00 Now on the third try it appears that the door has opened up for us. I read some where long ago about this theory. I think that they called "three knocks is the charm". Recently I have also read theories about bottom charts from "Mike Swanson" He likes to play the bottoms the same way I do.

I plan to buy a lot of stocks when I am convinced that this market correction is over and the bottom stocks start to move. I am bringing more money into my trading portfolio in antispation.

Again thanks for your post.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Apsll, great points and, seemingly, good timing. Of course, we shall see. Everyone, excellent contributions. Some very good review here and some excellent new stuff for me to learn. thanks all.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

As stated in my first post, it is in my opinion that the strong sectors will lead us out of this Market Correction. The Media Sector Right now is the strongest of the Morning Star Industry Groups. The stock that I like the best from this group is Liberty Media Capital. The ticker for this one is LCAPA.

Bellow I have posted the chart. Price is making new highs as Money Stream is very strong. I whent long on this one just a little while ago @ $30.28 It is my intention to hold this one for some time. This is not a day trade.

I plan to continue buying the strongest stocks in the strongest sectors. I will share my picks with the forum. Here is the daily chart.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Sorry folks. This is the weekly chart....

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

NLS will be my next long term purchase. I am just looking for the best entry. I do expect price to come down and kiss the bottom formation trend line shown in the following chart. Price could also just continue North. Either way I will be on board.

Consumer Durables "Sporting Goods" is another very strong sector amidst this Market Correction.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Like RVBD this chart for LCAPA is also a work of art. I am one point on this one and will hold for a while...

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I would like to share another strong leader to the list of buy candidates. First I want to mention that Ben2k9 shared some good insights on a new thread that he started. I took from his analysis that he is currently bullish and I agree with him. (I hope that I did not mis-interpret his post). I admit that I invisioned the market correction as not quit over and that we might see another leg down in the markets, however the current price acion for the Index's leads me to believe otherwise.

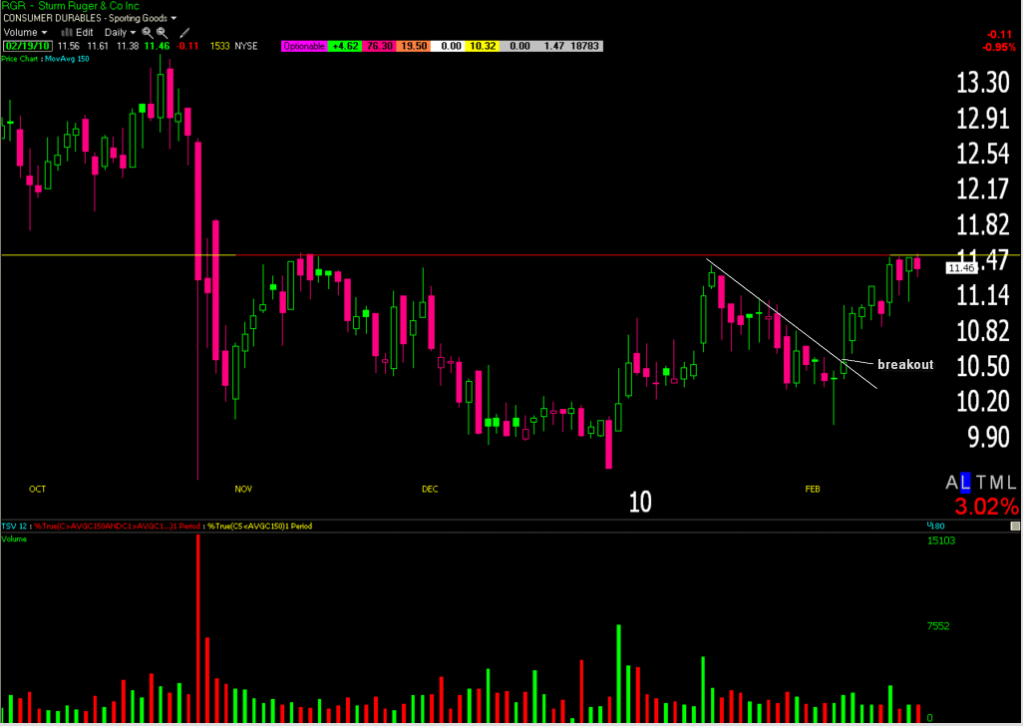

Along with NLS I like the chart for RGR they both are in the same sector and are strong leaders. RGR also has a very high earnings growth rate 5 years. Here is the chart. I will wait for the break-out to buy this one. NLS also is almost ripe for a buy very soon.

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

apsll, I hope you do not take this as criticism as I do not want to start trouble by getting you angry, but take this as a different way to trade. this is my opinion on how to trade stocks like rgr.

the time to buy this has already came and gone. you need to brush up on your trend lines and pay less attention to support and resistance. I promise you will make a lot more money if you do. it's not really all that hard to do. just scan or search for pullbacks that are in the process of a higher swing low and draw the trend line where applicable and put them in a watch list. if you are trading daily, then each day check for price breaking that trend line. you will not win then all but the ones that you do will look similar to this marked up rgr chart, almost a 10% winner already.

the reward to risk is very high in your favor. I have been trading like this for several years and it is very profitable. like tobydad says, it is one of the simplest (which usually equals best) ways to trade a pattern like this one.

you do not have to abandon your method; just do not overlook the obvious trend lines

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

How are you Agm32. Thanks for the advice.

|

|

Registered User

Joined: 12/21/2004

Posts: 26

|

Aps....just want to say that your analysis on NLS is right on and my little commentary the other day was way off as the chart posted was a weekly plus i had already had a couple beers....lol

As for AGM...i have seen several other posts asking him to kindly list a few of these so called great trendline breaks before they actually happen and of coarse they never materialize. It is very immature to constantly criticize honest effort. I enjoy Aps, tobydad, and others that post often. I would also enjoy learning from AGM if he would like to share a few from his golden watchlist.

|

|

Registered User

Joined: 3/6/2009

Posts: 78

|

Well coubo,

It's obvious to me what AGM is talking about. If you are not capable of understanding how to draw simple trend lines, then maybe you should not be trading.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Coubo, Thanks for the support. Never let others words have power over you. Dryfess you know nothing of Coubo so your words are meaningless. We have all agreed to stop fighting with each other over such minor details. Agm32 has chosen to attempt to pick the absolute bottoms by playing the trend breaks. He says that he has made a fortune doing so. I prefer to play the run up on the ressistance break-away, I too have made my fortune doing so. So Agm32 has the bottoms covered, I have the run-up covered now all we need is a trader that can pick the tops. You see now we can all get along. I am sure that Agm32 will share some live trades with us soon, we just have to be patient.

I will show a chart to demonstrate why I prefer to trade the run-ups rather than trying to pick the absolute reversal point. (The main reason for me is that I am just more comfortable trading that way, I have spent years reaserching my methods).

Here is an example chart that shows a trend break that failed, while the run up was a success. It is not all in the chart but this particular run-up whent to $17.00 I too am not trying to start any trouble Agm32. I do appreciate your advice but I will stay with my methods.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

Maybe a few less beers. But isn't trading like fishing, beer or bait. I prefer beer AND trading. I guess you can always tell a persons age when sex isn't on the list.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

Maybe a few less beers. But isn't trading like fishing, beer or bait. I prefer beer AND trading. I guess you can always tell a persons age when sex isn't on the list.

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

actually the trend break didn't fail. it broke out and quickly retraced 50% of the decline, then consolidated, but stayed above near term support, before finally breaking above resistance and into the run up.

QUOTE (Apsll) Coubo, Thanks for the support. Never let others words have power over you. Dryfess you know nothing of Coubo so your words are meaningless. We have all agreed to stop fighting with each other over such minor details. Agm32 has chosen to attempt to pick the absolute bottoms by playing the trend breaks. He says that he has made a fortune doing so. I prefer to play the run up on the ressistance break-away, I too have made my fortune doing so. So Agm32 has the bottoms covered, I have the run-up covered now all we need is a trader that can pick the tops. You see now we can all get along. I am sure that Agm32 will share some live trades with us soon, we just have to be patient.

I will show a chart to demonstrate why I prefer to trade the run-ups rather than trying to pick the absolute reversal point. (The main reason for me is that I am just more comfortable trading that way, I have spent years reaserching my methods).

Here is an example chart that shows a trend break that failed, while the run up was a success. It is not all in the chart but this particular run-up whent to $17.00 I too am not trying to start any trouble Agm32. I do appreciate your advice but I will stay with my methods.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

I'd like to suggest that there would be no market in which we could each make our mark and make our fortune, were we all to trade the same way. I am frankly grateful for those that trade successfully in ways quite different from my own. I do not want everyone to trade my way. I'm quite thrilled when people think my way is peculiar and unworthy of their attention. I sometimes feel uncomfortable sharing it here but then I am relieved when someone mentions a different way to trade and everyone's attention is immediately diverted to the new and the shiny (thanks Davidjohnhall). So, let the trendlines break; let the resistance resist and the support support. Without various ways to trade, we would rapidly lose the beauty of the market. I like bottom fishing. But if there is no one interested in the stock at yet higher prices, I would have no one to whom I could hand off the stock and my system would wane and die.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

It is not that important to me but funnymony show me the 50% retrace. I see a 100% retrace and a fool that would have held all through the retrace, then the two month consolidation and finally as price whent up to challenge the ressistance. Please stop spewing for the sake of just taking the apposing side that I am on and showing your lack of ability.

Agm32 I still do not want any trouble but why don't you just start your own threads that demonstrate your prowess with trading the trend breaks. Coubo is right that it is more effective to put yourself on the line by making your own stock picks and letting the forum see the end result. I have done this many times. Not always with great results but in most cases they do. It is a proven strategy for one to buy during the "run-up" phase. Instead of attempting to discredit the theory why not spend the time showing us how well your strategies work. I say this not to fight but to give you the chance to prove yourself.

Tobydad is right that there is more than one way to trade. Just let me make my stock picks and see what happens, good or bad I will live with the results.

|

|

Registered User

Joined: 3/6/2009

Posts: 78

|

Funnymony is correct. Price never did take out the original stop so It did not fail. It looks like Apsll's chart proves that trend breaks work better than Support and Resistance.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Well thats two people that do not actually trade. Anyone else? I did not see that anyone mentioned a stop. I will help you out based on Agm32's previous examples. The trend was broken and the buy was made at .73 the previous swng low was at .55 (a 25% risk not to healthy) the new up trend was broken to the down side at .85 and price withdrew back to .71 wich is .02 below the buy. Yes your stop was not breached but this trade is not going well and now you want us to believe that you would have held for two more months durring wich price consolidated sideways.

I cannot wait for your book to come out.

I will waste no more time with the two of you.

|

|

Registered User

Joined: 3/6/2009

Posts: 78

|

Apsll, you are wrong and you know it. That would have been a very profitable trade. You think that price going .02 below the buy price and not hitting a stop and then quadruple in price is bad? You only wish you could trade like that.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

I think we may have a number of people not really listening to one another. Apsll, I think funnymony was talking about an upward retracement that ended just before Feb (or so it looks). That indeed was a 50% retracement of the most recent decline. I think you were seeing a 100% retracement after the small breakout there. Dryfess seemed to have jumped in and talked about a stop that no one really mentioned (or, at least, I didn't see it mentioned anywhere). Funnymony, I think Apsll may have been referring to the fact that the breakout went up a couple of day and then stopped and consolidated for some time rather than continuing the big run-up that came later. My point being that, really, no one here is incorrect in their assertions. They just don't all have to be correct in the same context. We are discussing quite a number of things that are correct independent of the other facts and do not appear to be mutually exclusive. I'm not sure why a group of obviously intelligent people must have these discussions that invariably degenerate into a verbal brawl. I'm not suggesting we all have to agree. As Patton said, "if we're all thinking the same thing, somebody here is unnecessary"; but, we can disagree without it having to become a pissing contest. I, for one, intend to use as many of each of your ideas as I can. Law #11 derived from an interview with the wealthiest people across the country says, "Borrow from the best." You each have great ideas; pardon me while I steal them all and use them....you guys go ahead and keep arguing. :) Have a good night.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Tobydad. You have the heart of a saint there is no doubt. I wish that others did as well. They know the score well enough to know that they are full of it. Also everyone is not who we think they are, isn't that right "Dryfess". No trader in their right mind would have stayed in that trade since the trend break on 1/29/08. They would have felt good for a few days but soon the fact that they could have sold for a 25% gain on 1/31/08 would be eating away at them. Had they still been in the stock by 2/12/08 then the long two month consolidation would surely ware them down. I myself would have sold out, there was no clue by then that this stock would break through the resistance and then run up to $17.00 plus.

This situation is actually a good lesson for the new traders to study. Tear this whole price action apart day by day and judge for your selves. This is why I prefer to wait for the break-out for confirmation. I have studied these kinds of bottoms for years. And no I am not saying that it makes me imune to failure just like everyone else. But I know when to exit a losing trade with my confidence intact.

Funnymony & "Dryfess" if you really want to help the new traders then you will cease this obsetion that you have with discrediting me and give sincere analysis. We all know that you do not know how though, it is clear in your statements.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I only need make one more point on this matter. I will use Agm32's own trend line breaks as an example. In my chart below I show when he would have bought on the trendline break at .73 and when he would have sold on the draw down trend line break on 2/04/08

Dryfuss just saying that I am wrong is no proof. You need to show a detailed argument with charts and coherant analysis.

My only point in this matter is that of wich Tobydad speaks to that we all have our own methods for trading stocks. Tobydad is a proven success at buying the bottom bounces. I like to play the momentum runs that break through ressistance.

Here is a chart that shows the trend breaks on this stock. Agm32 could have shorted this stock on the trendline line break draw down. Since he is adept at timing the breaks so well than why not play them both ways?

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Funnymony, I owe you an appology. I have re-read your post and Tobydad is correct in that I did not read it correctly. My intent is to just post my charts and let the forum watch the results of my reasoning for choosing the stocks. I am not apposed to others posting their opinions but there is a difference between giving ones opinion and then pointed statements such as the following by Agm32 - the time to buy this has already came and gone. you need to brush up on your trend lines and pay less attention to support and resistance.

If we were to use this logic on the chart for KIRK then, well I do not have to say it, the results of the run-up speaks for itself. I suspect that Dryfess is playing a duel role (Not BB) and that my threads are nothing more than a target for Him. I have been councled to just ignor such behavoir but I fall into his trap repeatedly as he enjoys my reactions. You would think that me knowing that he is setting these traps that I would just avoid them. I need to stop playing his game.

Again I am sorry Funnymony. I will just try and post the picks and let the results speak for themselves.

I still plan to buy RGR when it breaks the resisstance and NLS appears to already have done so. Agm32 I will not respond to would have could have should have. I will respond to opinions based on real-time current data. It is easy to sumorize past events.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Do what Coubo and I have repeatedly asked you to do and instead of your comantery on my charts how about posting charts that you are trading now and not past events that have already come and gone.

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

let me clear up some confusion about how I would have traded this stock.

if I had to trade for the sake of argument then apsll would have been correct on one thing. I would have sold on a second trend line break at about .85

but apsll I wish to again point out that you are over looking the power of trend line breaks. while the stock was consolidating, I would have drawn a horizontal line at the high on jan 31 and feb 29 and also a horizontal line of the low on feb 12, 13, 21, mar 10, and 19. remember that consolidating stocks will usually break one trend line or the other. in this case price it broke the upper trend line on higher volume. I would have entered a long trade again on mar 25 at about .98 on another trend line break.

first you say that I do not post charts, and then you welcome my opinion, now you are upset again. I am trying to help new people as tobydad has suggested. Why are you so against trend lines? or is it just me you are against? you are trying to make this into a pi$$ing match. I am just suggesting a way to trade that you do not show to help new people.

and yes I do think you need to brush up on your trend lines. of the many charting tools available, the trend line is most widely used by technicians. they are money in the bank.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"I think we may have a number of people not really listening to one another."

==================================================

You expect Leopards to change their spots? (heh, heh)

I find it hard to believe anyone bought anything.

Folks are showing charts from Feb/March 2009 however, they don't show the emotion.

Remember when everyone knew of the coming 1000, 2000 point decline?

Remember when folks were asking why anyone would be bullish?

Remember when folks said their TA had failed them?

Remember when they talked of waiting for calmer waters?

Remember when I was called a liar for talk of buying on March 9,10?

Remember when I put up list of stock returns tobydad and I had mentioned. (it was called bragging)

Remember when I compared the performance to March 2003 and was warned of the retracement?

Remember when Ben was ridiculed for being bullish?

On 2/19/2010 you can draw all the purdy trendlines you like.

Making me think you had the guts (or open mind) to pull the trigger.

Lets just say that's another story.

I only believe tobydad, and davidjohnhall were buying.

(of course folks who don't spend their time bragging here may have also)

You see.

That's what a reputation/credibility is.

Thanks

diceman

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I am not against trend lines. I use them in some of my analysis, not all. I do have a problem with you but we can keep it melow so as not to get the thread locked. Infact I like it when you are not spinning your self serving statements such as that I should not focus so much on support & resistance but instead I should learn more about trend lines. This kind of discussion can be of benefit to new traders so on that we agree.

First off in this chart I show how one can just pick a stock and make a living trading nothing else but the trend line breaks, first long and then short. Of course this is past history so I am sure to the new trader that (like you said) it all looks very easy. Keep it simple right....

When I asked you to post charts I had more in mind of you sharing current real time or even end of day data. I mention already that I could post hundreds of past charts and show how I would have traded them. This is a point that you do not seem to want to address.

We are in complete agreement that the best way to play a consolidation is to draw a trendline above (resistance)and below (support) to see wich way the stock will break. You have made my most important point for me, thank you. You will be able to research many many posts by me where I say exactly that.

I studied charts for five to six years before I even made my first trade. Mostly for educational purposes but also to raise capital other than my realestate and retirement holdings. I have been at the chart analysis thing for 14 to 15 years now. You think that at some point I studied trend lines.

95 out of 100 people that take up trading fail at it. The reason that the five become successfull is because they have found their niche. They apply their own unique personality; some settle into using fundimental analysis and others settle on technical analysis. Those that are technical and rely on charts do not all trade the same way. Some are counter trend traders, others are trend traders, Some like to study Eliot Wave while others rely on indicators. You like to trade trend line breaks to time the bottoms and the tops. I trade momentum stocks that are making new highs and I also like to bottom fish (looking for stocks that I believe are breaking out of their bottom formations into the run-up). So just because I do not trade like you do and the chart from above does not mean that I do not understand trend line breaks. I understand MACDH but I choose not to use it, I understand trend line breaks but I choose not to trade that way.

I understand that you and I are not in competition. If you can trad the trend lines as well as you say you can then I probably would not be able to compete with you. I cannot bottom feed as well as Tobydad does but I do not challenge him in his threads. You chose to challenge my trading style in favor of trading the trend line break. I only ask why you would do this? I actually know why but we are keeping things melow so I will not go there.

I hope that I have addressed all your points. I do not need to brush up on my skills to use a tool that I choose not to use in favor of my own style of trading. Next time you want to chime in on one of my threads then you are welcome. Instead of making statments that I need to trade the way you do, why not instead say "hey Apsll I like that trend line break last month. I wish that I had seen this stock back then". You see how I would not take offense to that? Then you could post a chart saying that "this is a chart that I am currently looking at, and when the trend line breaks then I will buy this stock". I would not take offense, I might even engage you in a meaningfull dialog for the benefit of the new traders.

Lastly. Are you aware of how many folks read these posts but are to afraid to speak up for fear of being ridiculed by you or bigblock. I know this because (to my detriment) I recieve a lot of emails (maybe I should not have shared my address). I do get some nasty ones but I also get a lot of good ones. Also folks that I talk with on skype have a problem with giving their opinions based on the same fears. folks like coubo are not afraid to speak up. I have doubts about the non registered members such as "Dryfess" and a few other characters that pop up from time to time.

That is all I have to say. I hope that all our future dialog will be as easy as this one.

Apsll.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

You are right Diceman. Tobydad & Davidjohnhall are very credible in my book. They share their trades with the forum before they are buying or as they are buying. That is the way to share so that maybe others can share in their success.

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

if you are going to paint a picture then by all means let's use some of your brush strokes. and this is just from this thread.

"I see a 100% retrace and a fool that would have held all through the retrace"

"Well thats two people that do not actually trade"

"I cannot wait for your book to come out"

"I will waste no more time with the two of you"

"they are full of it"

"We all know that you do not know how though"

and then you have the gall to say something like this

"Are you aware of how many folks read these posts but are to afraid to speak up for fear of being ridiculed by you or bigblock"

|

|

Registered User

Joined: 4/23/2008

Posts: 214

|

sorry apsll but I don't think that diceman mentioned your name along with tobydad and davidjohnhall.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

The trend line is mostly used by technicians" Thanks for that AGM

APS: LIGHTEN UP. TAKE SOME PROZAC. YOU DO THIS ALL THE TIME WHEN SOMEONE REFUTES ANY STATEMENT THAT YOU MAKE. I DON'T RECALL ANY ABSOLUTE RULES OR METHODS THAT WORK ALL THE TIME AND OR FOR EVERYONE.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Agm32, please show me where I say that Diceman mentioned me? I think that you should hire an interpreter as I am begining to wonder if English is your first lanquage. You seem to just make things up as you go.

I know how Diceman feels about me. I lost my credibility when I decided to do the tango with you and Bigblock. I made my decision and I can live with the results. I do not seek Dicemans seal of aproval, I merely stated that I agree with him about Tobydad & Davidjohnhall.

I know that I am a hot head and that my tonque can be quit acidic at times. I get reminded of this from my friends and a few choice words from members via e-mail.

I also know that my stock picks are helpfull to members and have been for years. I also am reminded of this via e-mail and other sources. 99% of your posts are wraped around your strange obsetion with me. I have yet to figure that part out. One might think that you are interested in ways that I cannot reciprocate. I like women....

Do the forum a favor. If you really want to help out the new traders (and we both know that you could care less) than start your own threads and post your own stock picks. Then you can measure your success and help the newbies make money by following your advice.

You and bigblock say that you only post on my threads to protect the new traders from my trading methods. Well I will help you with that right now. -

To every new trader. I only post charts that I am considering for trade. I will show you how I find my charts and what I like about them. In no way should you blindly follow my picks without doing your own analysis. Keep track of how many of my picks do well and how many of them I sell for a loss. Then make up your own mind on wether or not you want to continue to read my threads or trust my judgement......

There that should ease your mind Agm... I look foward to reading your threads....

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

John relax, Agm32 is going to start his own threads. He cares about the new traders. Let me know john how the trend lines work out for you. Most technicians use them you know.

I DON'T RECALL ANY ABSOLUTE RULES OR METHODS THAT WORK ALL THE TIME AND OR FOR EVERYONE.

Nor do I john. Thanks for that tidbit though.

|

|

|

Guest-1 |