Registered User

Joined: 10/7/2004

Posts: 2,181

|

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Hi tobydad ...

I'm not sure what you mean by "Will we hold?"

Do you mean will this be the bottom of the bear market ?

If so ... I sort of doubt it ....

As I've said before ... these things seem to be as much of a function of time as they are depth ... and we're just not very far into it ... either measured by time ... or measured by working through the problems ... and their economic impact ...

Do you mean will hold for a tradeable bounce ?

I just don't know ....

Although the bottom of the 2000 bear market should offer some support ... I'd feel much better about "jumping in" for a few to several month bounce if the second line on the supercycle chart holds at about 7880 ....

It would seem that this line offered a measure of support ... and if it does not hold ... I will find myself wondering to what degree it mght offer resistance ... after all ... it is the nature to test as resistance what was support ...

But all of this is just my very humble opinion ...

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

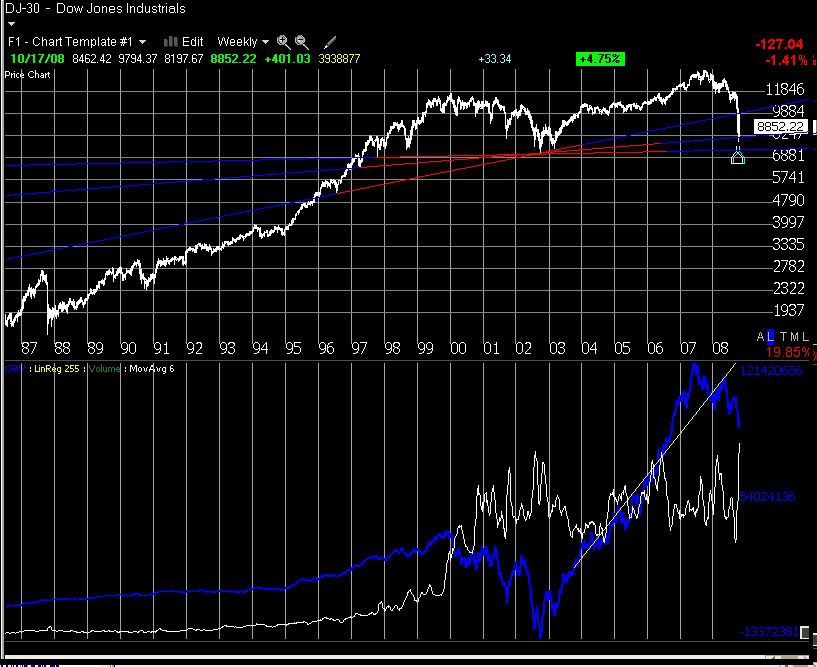

Here's a scary picture...

|

|

Registered User

Joined: 9/12/2008

Posts: 55

|

Wow, that is a complicated picture. No worder there is confusion in the air.

Kind of remains me the axis of failure.

By the way, the Whiskey index is up about 20% while the markets on average are about 40%.

May be we need to drink a little more whiskey and assess the chart again.

Exaclty what do the lines on the chart represent?

Exactly what are the OBV, Linear regression 255, and a MA(6) telling you?

Truly, I got right now a bunch of ?????????????flying out of my head.

|

|

Registered User

Joined: 9/12/2008

Posts: 55

|

by the way I meant "markets on the average are about 40% Down".

And I got no idea how that little devil got there. I sure didn't put him there. I typed MA(6) MA (6)

|

|

Registered User

Joined: 9/12/2008

Posts: 55

|

well you type MA and then a "(" a 6 and then ")" and you get a devil. Great.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Come on BB ....

It serves no useful purpose to be condescending or cryptic ...

What is your opinion as to where we will find some support for a meaningful bounce ?

And where might you speculate that we might find an eventual bottom ?

And when ?

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

just for fun: what would happen if price did hit and stop for a few days at any support level, whatever that level may be. and indicators look ready to reverse. so most surmise that the bottom is in place. then the next day GM announces massive plant closings, layoffs of 75% of the workforce. which then causes numerous companies to do the same.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

johnlc;

I think we will know that a bottom is in place once we can see an established uptrend in place. We will only know where the bottom "was"; not where it "is".

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Hushai;

Yes, I've been caught by that nutty devil face myself when trying to type the year 2006 by using an apostrophe and the numbers 0 and 6. Very frustrating.

To your question, sorry, I shouldn't have left the OBV, LR255 and the MA6 in there. They are significant to my trading style but only on a daily chart. Yes, they're quite confusing on the yearly chart there.

Should have just used the price chart. Thanks for pointing that out.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

QUOTE (realitycheck)

Come on BB ....

It serves no useful purpose to be condescending or cryptic ...

What is your opinion as to where we will find some support for a meaningful bounce ?

And where might you speculate that we might find an eventual bottom ?

And when ?

BB? Where? I thought that was Hushai.

Well, I'll be.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

You mean you guys don't no when the bottom

will be or its level?

What a disappointment.

Thanks

diceman

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

All I know is that I have to keep mine moving so I can keep putting beans on the table.

3 of the kids are out of the house and the grocery bill is still enormous. (Of course, the three that are out of the house are all in college...no wonder I'm just not getting ahead.)

Oh well, let me keep that bottom moving.

|

|

Registered User

Joined: 9/12/2008

Posts: 55

|

QUOTE (realitycheck)

Come on BB ....

It serves no useful purpose to be condescending or cryptic ...

What is your opinion as to where we will find some support for a meaningful bounce ?

And where might you speculate that we might find an eventual bottom ?

And when ?

Reality my views on market analysis can be found here

http://www.worden.com/training/default.aspx?g=posts&t=35214

what you see there now is what my especulation is. The bottom hasn't arrived just yet.

Just my opinion.

I am not sure why so many threads about the same thing just keep coming up - I think there is a lot of anxiety around.

|

|

Registered User

Joined: 9/22/2005

Posts: 849

|

There have been six bear markets since 1916 during which the Dow lost more than 20%

1916 down 64%

1919 down 42%

1929 down 84%

1975 down 45%

1987 down 29%

2007 down 51% (so far)

Here are Support/Resistance levels for 1996 to 2000

Here are Support/Resistance levels for 2004 to 2008

Here are the current prices and Support/Resistance levels

Here is the way I see the Dow currently.

It is hovering around a S/R level of 9012 (down 37% from last years high) ranging from a low of 7882 to a high of 9794. It may trade in this channel for some time before it decides what it wants to do.

This 37% drop would make a respectable bear market, but I think it will go lower, possibly to the 7014 (down 51%) support.

Those who count waves seem to be of the opinion that it will go higher. If that is the case, it may rise to either the 10779 or the 11866 resistance level then stop and turn around before moving to one of the support levels. It appears to me that 11866 level is the stronger of the two so that it will probably be the turn around level, in which case it will be a 16% rise.

On the other hand, it may decide to go down more in which case the likely support will be at 7473 a 17% drop from current levels and a drop of 47% from the October of 2007 high.

Just the way I see it.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Personally ... I don't believe that 1987 belongs on the list ...

The market found it's low within a couple of months of finding it's all time high ...

I tend to classify bear markets by a change in trend ...

1987 impresses me more as a market shock ...

I'm not sure where this magical "20%" number came from ...

When was the last time you saw someone running down the street screaming ...

"The market is up 20% ... it's a Bull Market !"

|

|

Registered User

Joined: 9/22/2005

Posts: 849

|

The 20% came from one or two mentions in Worden reports, and they didn't specifically call a 20% drop a bear.

You may be right when you say 1987 should not be classified as a bear, but it sure felt like one.

I was on vacation in Florida and not paying attention to the market. On October th my broker tracked me down and gave me the news that I had lost half of my capital. I panicked and sold out. That scared me out of the market until just recently.

btw I neglected to mention that I consider the placement of the S/R levels to be accurate to within +/- 2%.

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

Hey Hushai,

I think you're mistaking anxiety for interest. At least on this board. Go to yahoo message boards if you want to see anxiety. Every other post is someone cussing someone out (kind of like the way this message board was for a few weeks there). Every other post is about someone who went long with their life savings right before WAMU tanked. It's not pretty and a great sentiment indicator.

Here I see a group of rational traders doing what they love to do, discussing marcket mechanics at a trully historic time in the market. Just my take. Who knows, maybe everyone is losing their shirt and just not talking about it. LOL

David John Hall

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Losing their shirts? How in the world could you miss shorting these days? I mean, I"m not usually big on shorting but this is like shooting fish in a barrel. Let's push a rock off of a cliff and then place bets that it will drop.

Anyway, Hushai, Bigblock, whoever you are (and that little comment is one to which you may really want to apply yourself), you try a bit too hard to generate anxiety so that you can come to the rescue. Frankly, my question about holding at 7400, or whatever I asked up there, was just a conversation starter to keep everyone thinking, analyzing and learning. I didn't make comments about the trendlines drawn because I wanted to see what conclusions others might reach on their own.

So, please, bring your considerable knowledge to this board and participate with us; but leave your considerable insecurities at home.

|

|

Registered User

Joined: 9/12/2008

Posts: 55

|

QUOTE (tobydad) Losing their shirts? How in the world could you miss shorting these days? I mean, I"m not usually big on shorting but this is like shooting fish in a barrel. Let's push a rock off of a cliff and then place bets that it will drop.

Anyway, Hushai, Bigblock, whoever you are (and that little comment is one to which you may really want to apply yourself), you try a bit too hard to generate anxiety so that you can come to the rescue. Frankly, my question about holding at 7400, or whatever I asked up there, was just a conversation starter to keep everyone thinking, analyzing and learning. I didn't make comments about the trendlines drawn because I wanted to see what conclusions others might reach on their own.

So, please, bring your considerable knowledge to this board and participate with us; but leave your considerable insecurities at home.

I have little insecurities. Your trend lines made no sense - at least to me.

My questions had a sacastic context.

If you like to know my take on the 7400 level - my take is none - especulation only has two sides.

7400 is a critical level that is all we know. Whether it will hold or not nobody knows until we get there. The markets are far from there still - so what is the point worring about that level now.

Just getting there is a bad sign. If we do I would think that support there will break just because of the fact that we got there.

Nothing has change fundamentally in this economic crisis. Unless something has really changed by the time we get there - there is no reason for that level to hold and a lot of reasons for the level to break.

By the way, I am BIGBLOCK (I think I was clear on that - I am not hiding anything) so we are clear on that. Hushai is a forced on Bigblock by the board management.

Happy now?

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Been happy all along. I'm trying to help you join me.

|

|

Registered User

Joined: 2/21/2007

Posts: 797

|

HUSHAI: nice having you back and for your informed analysis. i think people need to realize that one can either take or leave your opinions, just the same as anyone who posts here. every one has a right to ones own opinion, it can be either right or wrong. even when analyzing a future movment of a stock chart.

|

|

|

Guest-1 |