Registered User

Joined: 3/16/2006

Posts: 2,214

|

Oct. 10 (Bloomberg) -- Nouriel Roubini, the New York University professor who two years ago predicted the financial crisis, talks with Bloomberg's Betty Liu about the outlook for the global financial market and the economy. Roubini said world financial officials should orchestrate interest-rate cuts of at least 1.5 percentage points to help avert a depression. (Source: Bloomberg)

00:00 Need for "partial nationalization" of banks

01:07 Risk of "severe global depression"

Running time 02:57 - Here's the link!

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=ay3zxyyxAUgM and click where it says: "related video graphics"

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

here's a direct link to the video:

http://www.bloomberg.com/avp/avp.htm?clipSRC=mms://media2.bloomberg.com/cache/vp.kpIJs_zwY.asf

Sig

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

Gee, remember when Bloomberg and CNBC were

"cheerleaders".

Another bear myth debunked.

Thanks

diceman

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (diceman)

Gee, remember when Bloomberg and CNBC were

"cheerleaders".

Another bear myth debunked.

Thanks

diceman

Personally ...

I still think that they're cheerleaders ...

CNBC today headline ... "We Are Seeing Market Botton: Mark Mobius" ... but if you read the article ... Mobius says ... "You will probably see a few more declines but we're beginning to see the bottom of this and so the opportunities are quite interesting, quite attractive," he added.

So ... is the headline characteristic of what the man said ... or are they "cheerleading" ?

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

That dang video won't play for me sig ... tried it both ways ...

It does a lot of buffering ... and thinking about it ... but that about it ...

Thanks anyway ...

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"Personally ...

I still think that they're cheerleaders ..."

---------------------------------------------------

My point. Its difficult not to reach the conclusions

we want to.

(but what do we "choose" to analyze?)

Thanks

diceman

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

LONDON, Oct 17 - Investors who bought protection against a Lehman Brothers default in the credit default swaps market have little to worry about getting paid on Tuesday, when an estimated $8 billion in cash payments on Lehman CDS come due.

While these payments may push a few fragile hedge funds over the edge, analysts say, stringent collateral requirements mean most protection buyers will not be out of pocket.

Comment has circulated in the markets and in the media that CDS counterparties may not be able to come up with the cash.

"The big issue is whether they (CDS) will be settled successfully," wrote ING rate strategist Padraic Garvey on Friday. "The talk is that hedge funds sold protection on Lehman ... well now they will have to cough up."

Analysts at Citigroup and Barclays Capital said market fears about the Oct. 21 date have been overstated.

"This is more of a slow process, and people will have had to come up with the money long before the settlement date," said Michael Hampden-Turner, a Citigroup credit strategist.

The standard practice in the CDS market is that hedge funds and other counterparties must adjust collateral on a daily basis as the value of a contract changes.

As Lehman CDS fell in value, before and after it filed for bankruptcy, protection sellers would have had to provide increasing amounts of Treasury bonds or other cash-like investments as collateral for those contracts.

"The mark-to-market on the CDS is margined daily as a credit event draws near, and that mitigates a large, lumpy payment at the end," said Peter Goves, another Citigroup strategist.

In the Lehman case, the largest collateral payments would have been required in the four or five days following the bankruptcy filing in mid-September, when spreads on senior debt widened from around 700 basis points on the five-year contract to around 7,000 basis points, based on the then market view of an estimated 30 percent recovery, Hampden-Turner said.

NO NASTY SURPRISE

The cash settlement CDS auction on Oct. 10 set final recovery on the CDS at an even lower 8.625 percent.

But by that time, market expectations had already fallen to close to that level, around 10 cents on the dollar.

"The auction was not a huge surprise, worse than expected but only slightly," said Puneet Sharma, a credit strategist at Barclays Capital. "If you are a solvent institution or a counterparty to a solvent institution, then you would already have collateral close to that amount."

For a few hedge funds or other leveraged investors who sold protection on Lehman , however, Tuesday could prove to be a strain.

Funds typically use leverage to obtain the collateral they provide on CDS contracts.

So while the CDS counterparty is already holding collateral to cover his payment, other lenders to the hedge fund may end up the losers.

If the only event in the market were the Lehman failure and the resulting payment of $8 billion on its CDS, that alone would probably not be enough to cause any funds to collapse, Barcap's Sharma said.

But in the current environment, "the stresses that hedge funds are facing because of volatility are unprecedented," he said. "The number of margin calls from the commodity, equity, credit, volatility and other positions are going to be enormous."

For some investors, Tuesday's payment "could be the final straw", he said.

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

Fitch cuts Ukraine's Naftogaz rating to 'B'

NEW YORK, Oct 17 - Fitch Ratings downgraded Ukrainian state-owned energy monopoly Naftogaz's long-term local and foreign currency issuer default ratings by one notch to 'B' from 'B+' after the sovereign ratings were cut earlier on Friday.

The ratings for Naftogaz remain on ratings watch negative, which is the distinction between itself and the sovereign. Ratings watch negative is Fitch's short-term view of what might happen in the next three to six months.

'It is notched one below the sovereign and the sovereign was downgraded today,' London-based Fitch credit analyst Anton Krawchenko told Reuters.

'We have to downgrade Naftogaz, otherwise we are saying it is the same credit quality as the sovereign, which is clearly not the case. Naftogaz has its problems of its own,' he said.

One main problem for Naftogaz is that its single $500 million international bond is in technical default because the company did not release 2007 financial accounts by the end of July this year.

'The company has been in this position before, but bond holders waved it. Now of course we are in a different situation,' said Krawchenko.

'They have asked for a bond holder meeting, but by no means is it certain that bond holders will wave the technical default. The financial situation at Naftogaz is in a much more precarious situation compared to the the beginning of the year,' he said.

That bond matures in 2009.

Other issues Fitch highlighted were still unarranged financing for winter gas storage purchases and the prospective gas price agreement between Ukraine and Russia could lead to a significant rise in gas import prices for 2009.

'Fitch believes the current level of government subsidisation is inadequate to fully compensate the company for losses in its residential sales business,' the firm said in a statement.

Earlier on Friday Fitch downgraded the sovereign for Ukraine to 'B+' from 'BB-,' citing concerns over the risk of a large depreciation of the currency, stress in the domestic banking system and significant damage to the Ukraine's real economy. That rating outlook is negative.

'It is much more difficult for companies to raise capital internationally and they cannot turn easily to domestic banks because the banking system itself is under stress,' said Krawchenko.

When it downgraded the sovereign, Fitch said it was unconvinced that depositors will remain confident despite central measures barring early withdrawals of term deposits and a potential credit of up to $14 billion from the International Monetary Fund.

A sizable and appropriately designed IMF program would be a positive factor, Fitch said, adding that it would wait to see precise details before drawing firm conclusions.

Politicians and the central bank have started talking about nationalizing the bank -- the only one so far that officials have said was in serious trouble.

IMF officials met the country's leaders on Friday and an adviser to the ex-Soviet state's president said two to three weeks were needed to clinch an agreement on a credit facility.

Other countries, like Hungary, Iceland and Serbia are also seeking help to find remedies to jolts sustained from the world financial crisis. Ukraine's approach is complicated by divisions in its leadership after a government break-up.

'The inter-linkage between the banking sector's health and U.S. dollar/hryvnia mean that it is now crucial for the state to shore up balance of payment sustainability,' Unicredit said in a note to clients.

'If this occurs, near-term through an IMF package, we'd see some near-term scope for stabilization, though the medium-term situation would remain fragile given a messy political backdrop and a likely hard landing in growth,' the firm said.

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

These economists are hit or miss. They're like broken clocks - which are right even twice a day. A few of these guys nail it and are considered to be gods until they miss the next big thing. The economy is difficult if not impossible to predict. Many of the best got it wrong in a big way this go around. Now they're revising their previous predictions to add in the gloom & doom. They'll likely be wrong again. The most important thing to know is that the stock market is a leading economic indicator. One should never use an economic opinion to color their trading lense. ben2k9

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

|

South Korean jitters may make matters worse in China

|

After a 4.2% drop Thursday on the SSE Composite the Chinese stock market turned around yesterday to close the day up, with the SSE Composite rising 1.1% to close at 1931. In spite of Monday’s global-sympathy surge the week turned out to be another bad one for Chinese stock markets, with the SSE Composite losing more than 3% over the week.

Friday’s modest rise seems to have come in response to comments by Shang Fulin, the chairman of the China Securities Regulatory Commission, who told a conference in Beijing Friday the government would unveil new incentives to stabilize the markets. This is the first time he has commented on the markets since before the Olympics, and this suggests – not for the first time – that the government is increasingly worried about the rapid decline in the stock market and is trying to talk its way back into confidence.

Actually the stock market is too small in China to have too much of a direct impact on the economy. Without checking the numbers I would say that total market cap is around 50% of GDP, and less than two-fifth’s of the listed stock really “float” in any meaningful way. This isn’t a big market relative to GDP, at least not compared to most other major economies, so losses on the stock market are unlikely to have anywhere near the same wealth effect (although this loss will be somewhat increased by its sheer magnitude – 70% in less than one year). My guess is that what drives government concern is the impact further declines might have on what is almost certain to be waning consumer confidence.

Unfortunately Shang did not say exactly what measures would be taken – besides demanding that Chinese commercial banks refrain from “excessive” financial innovation, although I am not sure “innovation” is the best word to describe the ways banks seem to be getting around regulatory constraints. He did warn, however, that the US credit crisis “poses grave challenges to China”.

I would agree, but I am beginning to think that it may very well do so via an unexpected channel. I am beginning to wonder if it is through its impact on South Korea that we should be most worried. So far there seems to be a widespread (and mistaken, I think) belief in much of East Asia that the region will emerge from the crisis in relatively good shape – perhaps even in great shape. Consequently anything that seriously strikes at that belief could cause a panicked reaction. For example, I think the brief run on the Hong Kong branches (and Singaporean and Japanese branches too) of Bank of East Asia struck real fear into the hearts of policy-makers here. A very visible bank collapse anywhere in the region would almost certainly undermine confidence in the banking system – especially in those countries where the banking system is relatively opaque.

South Korea is one of the largest economies in the region and often considered, in spite of the 1997 Asian crisis, to be relatively robust. But for now things do not seem to be going well there. According to an in Saturday’s Bloomberg:

South Korea may guarantee bank debts and offer tax breaks for investors to bolster confidence after shares plunged to a three-year low and the won, Asia's worst- performing currency, slumped the most since the 1997 crisis.

Saturday’s South China Morning Post had an equally pessimistic on banks in Asia in general, with South Korea meriting special mention:

South Korea, which has more negative rating outlooks on its banks than any other country in Asia, said on Thursday it planned to inject more foreign exchange liquidity to local banks to keep financing in its export-reliant economy working smoothly. But government moves did little to calm investors, with the country’s stock index falling over 9 per cent, led by top lender Kookmin’s parent, which plunged 15 per cent.

Many analysts fear South Korea’s banks could be the next victims of the global financial crisis, with their heavy exposure to the ailing property sectors and inadequate funding structures. The global credit crunch has also jacked up their funding costs and non-performing loans are likely to rise.

Kang Man-soo, the South Korean finance minister, announced measures on Friday, to address the plummeting confidence, including plans to raise spending and cut taxes as part of emergency measures to stabilize its economy, and to tackle a shortage of US dollars in the banking system. The announcements helped the Korean won, but not the stock markets, and according to yesterday’s Financial Times, more measures are expected over the weekend. Today South Korea announced the government will provide as much as $100 billion to secure the refinancing of external bank debts from now until next June 30. They said recapitalizing the banks and guaranteeing all deposits was not necessary “at the moment.”

The Bloomberg article goes on to say that South Korea relies on exports to China, Europe and the Middle East to drive growth as domestic consumer spending dries up. I don’t know much about Middle Eastern demand, but European demand is probably declining, and I am not sure Chinese demand is likely to be nearly as robust as everyone outside China seems to assume.

That could create an interesting and potentially dangerous feedback process if problems in the South Korean markets undermine confidence generally in Asia’s ability to withstand the crisis and, in so doing, further increase consumer nervousness in China, thus exacerbating Korean problems. My many years banking and trading experience in Latin America have made me very wary of these feedback loops since they can degenerate so quickly and so violently.

Trying to understand China is so difficult and complicated that in the past few years I have tended to neglect most of the rest of world and just focus on the Chinese monetary and financial systems. Now, however, I think it makes sense to get a better understanding of what is happening in neighboring countries. South Korea could prove to be a real problem for China. Remember that the 1997 Asian crisis saw large hot money outflows from China and real problems develop in its banking system, even though China had none of the balance sheet vulnerabilities that caused the crises in the afflicted countries. This time it does – most significantly heavy exposure to the real estate sector (as much as 40% of all loans, according to a senior CSRC official, even though only half of them are classified that way), excessive credit expansion, and too much capacity.

The Chinese government meanwhile is putting on a brave face and preparing measures. In fact I have heard from three different sources that one regulatory body (I prefer not to say who) has circulated a list of Chinese analysts who may no longer be interviewed on TV because their views are considered too alarmist. There are also lots of plans being announced about how to deal with the crisis. At a news briefing Thursday, for example, the NDRC made a series of announcement about their own plans. According to an in Friday’s South China Morning Post:

Du Ying, deputy director of the National Development and Reform Commission, the mainland's top economic planning agency, said foreign trade volume, value-added output and profit growth of manufacturers in coastal areas had been falling since July. “The State Council is studying a series of measures and is ready to announce them, as the downward trend has already caught the government's attention,” Mr Du told a news briefing in Beijing yesterday.

He said the full impact of the global financial crisis had not yet been felt and the government “should have a full estimation of the difficulties and challenges [ahead]”. However, he was confident China could overcome the crisis.

As part of their crisis prevention the PBOC has taken a number of monetary measures already, but for the reasons I have discussed ad nauseum in this blog I do not think they will have had any major useful impact. For example in he past month or two the PBoC has relaxed lending constraints, reduced minimum reserve requirements twice, and cut interest rates twice, but just as their previous tightening policies probably had very limited impact (they mainly pushed credit activity outside the regulated areas into possibly even riskier ones), I don’t think their loosening policies will have much impact either – partly for the same reasons and partly because in a crisis lenders just don’t want to take risk. Caijing’s chief economist, Shen Minggao, has something similar to say, according to an in last week’s edition of Caijing.

Shen thinks internal and external factors were behind this policy shift. Externally, the likelihood of negative economic growth next year in the United States and the European Union is escalating. As a result, a downward trend for China’s exports will be hard to reverse in the short term. Meanwhile, domestic inflation pressure is easing, leaving room for monetary loosening.

However, in Shen’s view, the effectiveness of rate cuts may be limited. A new trend is that a market-based credit shortage in China is replacing a credit crunch tied to monetary policy. Initially, tight credit was mainly caused by strict loan quota controls, or “window guidance,” implemented by the central bank. But since the second half of this year, signs of a credit shortage tied to natural market reactions have emerged. Financial institutions have become reluctant to lend due to fears of default by borrowers with deteriorating prospects for profits.

I disagree with Shen on some of these points. I do not believe there was either tight monetary policy or tight credit. PBoC actions had an impact only on limited parts of the financial system, with the rest of the system acting partly as a residual to counteract that impact. Still, his point that banks have been reluctant to lend, thus making credit relaxation somewhat moo,t is an important one.

Analysts with greater faith than I have in the merits of a state-owned banking system will argue that the PBoC can simply mandate the banks to increase credit and make loans, but in my opinion that creates a very distorted incentive to lend, and will almost certainly result in non-economic lending. It might nonetheless create some credit relaxation immediately, but probably at the cost of storing up more problem loans, and anyway any relaxation in credit may be more than offset by the shifting of off-balance sheet transactions back onto the balance sheet and by a more rapid contraction in the informal banking sector.

I am not saying that this must happen, but simply that we have no idea whether or not it will happen (I think it probably will), so we should not place too much hope in PBoC measures. As my readers can easily see, I am very prejudiced in favor of the idea that markets do what they do in reaction to underlying conditions, and policy-based distortions often make things worse, not better. I can list so many Latin America cases in which what seemed an effective policy to distort conditions, in order to address an immediate problem, only made matters worse. I am by no means a market fundamentalist, and never have been, but I would argue that successful intervention is often much harder than we think, especially in a system that is rigid and opaque.

Shen also points out several other problems that constrain the PBoC’s ability to ease China’s way out of a crisis:

Other factors also will constrain future monetary policy. First, interest rate cuts by central banks in major industrial economies will have a direct impact on China’s monetary policy. After the latest cut by the Federal Reserve, the U.S. federal benchmark interest rate fell to 1.5 percent. Further cuts may lead to a zero rate. As a result, global markets may again experience excess liquidity, and the amount of capital flowing into China may rise. If yuan appreciation fails to curtail the flow, excess liquidity could again drive China’s inflation rate higher.

Second, in the latest adjustments, China’s central bank applied “asymmetric” rate cuts. Concerned about the vulnerability of commercial bank profit growth, the bank may hesitate to continue this approach. The latest move reduced both deposit and lending rates by 27 basis points, while the Ministry of Finance abolished a 5 percent personal income tax on interest income. For a depositor, the effective savings rate was cut by 6 basis points, not 27. If the central bank continues asymmetric rate cuts to stimulate consumption, the profit margins of commercial banks -- which rely heavily on lending-deposit rate gaps -- will be further squeezed.

Third, rate cuts may encourage large enterprises to increase investments. The current credit shortage is mainly affecting small companies. Without a turnaround in external demand, increases in investment may worsen the problem of excess capacity.

His third point is, I think, the most significant – at least to somewhat like me who worries about inventory buildup. It is also interesting what Shen has to say about inflation because of his concerns about actions that might lead to a resurgence of inflation – forcing the banks to expands their balance sheet may reverse the monetary contraction that brought inflation down in the first place.

On Monday the National Bureau of Statistics is slated to release inflation numbers. They were originally supposed to be released Tuesday, and the one-day-early release is being interpreted as indicating very good news. CPI may come in around 4% or not much higher – largely, I think, because of falling pork prices. That would be good news – and something I clearly misjudged big time in my inflation hawk days. I was pretty certain that the huge mismatch in monetary growth and economic growth would necessarily result in higher inflation, and I doubted (a tad too forcefully, I think) that there was any way that policy-makers were going to achieve their 4.5% target by year end. Actually no one seemed to believe the target – even Premier Wen more or less told us that the target was for symbolic reasons, and not a serious expectation.

But at this rate the authorities are going to hit the target. What seemed almost impossible just six months ago now seems easily achievable. How could that be? The worrier in me says that if excess monetary growth made inflation seem almost inevitable, then the collapse of inflation must also indicate a collapse in money supply. After all, for several years there has been a major mismatch between money growth and the needs of the economy, and as I see it there are only two ways for them to get back into line. Either the nominal value of the economy rises to meet the money supply (i.e. inflation) or the money supply contracts to meet the value of the economy (e.g. a bank contraction)

So what is really going on? Around the rest of the world it is pretty easy to see that the collapse in the balance sheets of financial institutions is causing a drop (perhaps only temporary) in underlying liquidity. Is that happening here? I wish I had some real sense of what was happening in the informal banking sector. Commercial banks seem reluctant to lend – are the informal banks drawing in loans even more quickly? I am honestly puzzled.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

QUOTE (ben2k9) These economists are hit or miss. They're like broken clocks - which are right even twice a day. A few of these guys nail it and are considered to be gods until they miss the next big thing. The economy is difficult if not impossible to predict. Many of the best got it wrong in a big way this go around. Now they're revising their previous predictions to add in the gloom & doom. They'll likely be wrong again. The most important thing to know is that the stock market is a leading economic indicator. One should never use an economic opinion to color their trading lense. ben2k9

Beat me to the point I was going to make.

Yes. and I've seen studies that showed soem hugely recovering or even soaring stocks DURING the depression. Not as many obviously.

Personaly i'll welcome the drop in volitility.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (diceman)

(but what do we "choose" to analyze?)

Thanks

diceman

Or ... what are we allowed to analyze ?

QUOTE (signaltap)

The Chinese government meanwhile is putting on a brave face and preparing measures. In fact I have heard from three different sources that one regulatory body (I prefer not to say who) has circulated a list of Chinese analysts who may no longer be interviewed on TV because their views are considered too alarmist.

Censorship is not only imposed by governments ...

But by anyone with something at stake ...

|

|

Registered User

Joined: 9/12/2008

Posts: 55

|

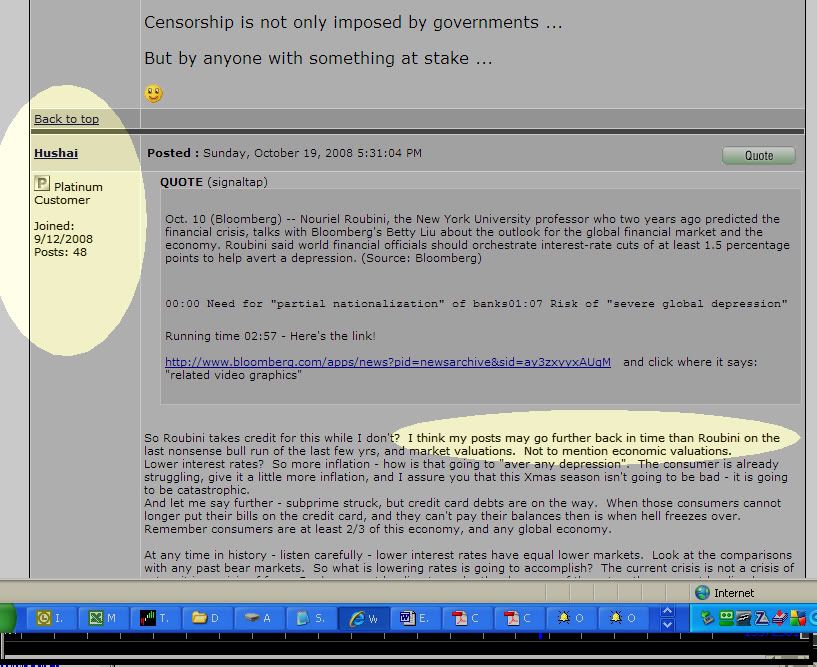

QUOTE (signaltap)

Oct. 10 (Bloomberg) -- Nouriel Roubini, the New York University professor who two years ago predicted the financial crisis, talks with Bloomberg's Betty Liu about the outlook for the global financial market and the economy. Roubini said world financial officials should orchestrate interest-rate cuts of at least 1.5 percentage points to help avert a depression. (Source: Bloomberg)

00:00 Need for "partial nationalization" of banks01:07 Risk of "severe global depression"

Running time 02:57 - Here's the link!

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=ay3zxyyxAUgM and click where it says: "related video graphics"

So Roubini takes credit for this while I don't? I think my posts may go further back in time than Roubini on the last nonsense bull run of the last few yrs, and market valuations. Not to mention economic valuations.

Lower interest rates? So more inflation - how is that going to "aver any depression". The consumer is already struggling, give it a little more inflation, and I assure you that this Xmas season isn't going to be bad - it is going to be catastrophic.

And let me say further - subprime struck, but credit card debts are on the way. When those consumers cannot longer put their bills on the credit card, and they can't pay their balances then is when hell freezes over.

Remember consumers are at least 2/3 of this economy, and any global economy.

At any time in history - listen carefully - lower interest rates have equal lower markets. Look at the comparisons with any past bear markets. So what is lowering rates is going to accomplish? The current crisis is not a crisis of rates, it is a crisis of fear. Banks are not lending to each other because of the rates, they are not lending because they do not trust each other anymore. They don't know how bad the other bank books really are.

This crisis is not going to go away until let to work itself out. Noone can change that laws of nature - not even Bernake with the help of the US government. The more they delay it the worst is going to be.

By the way, What is the US government doing? It is doing the same thing that got is into this mess in the first place. They are lending money that they don't have, and that cannot be repaid. For years I have complain on the ongoing printing of M3 and the devaluation of our assess as a consequense - Look where we are now - yes go ahead a check my post (you know who to look for), and will have to continue to do so as the Fed with the approval of your goverment CONTINUES to print , and this time actually is actually just plainly telling you - what you will be responsible for - that has just added $700 Billion to the tab.

Most important this is not going to solve this crisis - You can never take out more than you are putting in -

any accountant will tell you that. You can cheat, lie, and whatever you want to do to hide it. At the end, it always surfaces, it always does.

You were just told by the crooks of your administration that perhaps we can hide it a little longer at the expense of the retirement of many, exploitation of the middle class, and an unprecedented amount of debt that will be pass on to our children.

I think Roubini needs a little more than lower interest rate by 1.5. He is going to need a miracle.

|

|

Registered User

Joined: 9/12/2008

Posts: 55

|

QUOTE (diceman)

Gee, remember when Bloomberg and CNBC were

"cheerleaders".

Another bear myth debunked.

Thanks

diceman

Yeah, what about JIM CRAMER? Decramerized.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Bigblock! Welcome back!

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (Hushai) QUOTE (diceman)

Gee, remember when Bloomberg and CNBC were

"cheerleaders".

Another bear myth debunked.

Thanks

diceman

Yeah, what about JIM CRAMER? Decramerized.

Cramer is one of those people that you just love to hate ...

It was just about a year ago when he was calling for 14,500 on the Dow by the end of the year ....

Remember his four horsemen ?

Sort of ironic that the four horse signaled the apocalypse ... isn't it ?

But ... Cramer lately has been singing a very different tune ...

Urging his followers to sell into rallies ... and to get out any money that they might need in the next 5 years ....

Telling folks to move back in with their relatives ... and get real small in their spending as the economic conditons that we are about to see will be worse than anything just about everybody has ever seen in their lifetime ...

And it only took him about 5000 points on the Dow to come to those startling revelations ....

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"Remember his four horsemen ?"

-----------------------------------------

Yes I made a lot of money off them.

Remember when Microsoft and Wal-Mart were super growth stocks?

Just because the great depression happened. Doesn't mean the

roaring 20's didn't.

Thanks

diceman

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Fascinating, Hushai, fascinating.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"Bigblock! Welcome back!"

-----------------------------------

Uhhh tobydad. I think Hushai is Hushai.

BigBlock was too much of a gentleman and

a scholar to resort to such tactics.

Don't you remember when he called Apsll out

for such tactics?

I don't think BigBlock would follow in Apsll's

footsteps.

Thanks

diceman

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Of course, Sorry, Diceman. What was I thinking?!

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

I thought I recognized the writing style.

I guess we should all be flattered that we have such a draw.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (diceman)

Just because the great depression happened. Doesn't mean the

roaring 20's didn't.

Thanks

diceman

Of course it doesn't ....

And it really has nothing to do with my assertion ...

My point was really .... How long should it take a person ... after seeing a sprinter get run over by a freight train ... to realize that he's probably not going to be running a 4 minute mile any time soon ?

A year seems a bit excessive ...

But that's me ....

|

|

Registered User

Joined: 9/12/2008

Posts: 55

|

Heck me too. I always thought, and think that that guy is a JOKE. But you know, I don't feel bad for those who lost their shirt listening to the nonsense. After all we all make our own choices.

CNBC should be a shame, along with all the talking heads they broadcast. That is a circus.

But again we all have a choice (on or off).

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

Oct 21 Fitch: The financial crisis will halve real growth in credit this year as financial firms reduce leverage, investors' appetite for risk declines and the worldwide economy slows. In particular, real global credit growth, which peaked at almost 16 percent in 2007, will slow to 7 percent by year-end and shrink to nearer 5 percent next year. ``The slowdown will continue to be most pronounced in emerging Europe but will spread to all regions."

- Oct 13: George Magnus: Even if a financial meltdown is averted, we should be under no illusion that the deleveraging in the financial and household sectors will stop. As a result, four big battlegrounds remain. First, there is a high possibility of further bouts of financial stress and failures. Money markets are still broken and recovery will take time. Second, illiquidity, a preference for cash-type instruments, even over government bonds, and a considerably expanded supply of government bonds raise the threat of an untimely increase in bond yields. Third, the global recession that has started may yet turn out to be sharper than expected – and certainly longer. This will bring sustained, and some new, credit risks. Fourth, much slower growth and the risk of some home-made financial crises in emerging markets warrant close scrutiny.

- Roubini before coordinated G7 action: Urgent and immediate necessary actions that need to be done globally include:

1) another rapid round of policy rate cuts of the order of at least 150 basis points on average globally;

2) a temporary blanket guarantee of all deposits while a triage between insolvent financial institutions that need to be shut down and distressed but solvent institutions that need to be partially nationalized with injections of public capital is made;

3) a rapid reduction of the debt burden of insolvent households preceded by a temporary freeze on all foreclosures;

4) massive and unlimited provision of liquidity to solvent financial institutions;

5) public provision of credit to the solvent parts of the corporate sector to avoid a short-term debt refinancing crisis for solvent but illiquid corporations and small businesses;

6) a massive direct government fiscal stimulus packages that includes public works, infrastructure spending, unemployment benefits, tax rebates to lower income households and provision of grants to strapped and crunched state and local government;

7) a rapid resolution of the banking problems via triage, public recapitalization of financial institutions and reduction of the debt burden of distressed households and borrowers;

8) an agreement between lender and creditor countries running current account surpluses and borrowing and debtor countries running current account deficits to maintain an orderly financing of deficits and a recycling of the surpluses of creditors to avoid a disorderly adjustment of such imbalances.

- Total U.S. credit market debt as % of GDP started to shoot up in the early 1980s and reached 350% of GDP in 2008. The only other spike in the series is in the 1930s during the Great Depression--> this series tends to be mean-reverting, meaning that deleveraging from current record levels could be protracted and painful. (nc)

- Bill Gross: What Happens During Deleveraging? 1) All risk spreads go up; 2) Delevering slows/stops when assets have been liquidated and/or sufficient capital has been raised to produce an equilibrium; 3) Raising sufficient capital depends on new sources of liquidity (or balance sheets) coming in; absent that, prices of almost all assets will go down--> only new source of liquidity available on the scale needed for a bull market anywhere is the Treasury. (Bill Gross at PIMCO)

- Frank Veneroso (via NC): The bursting of the commodities bubble will be the last one after Japan, Asia, technology, housing--> serious deleveraging process around the corner.

- McCulley (PIMCO): if all financial institutions deleverage at the same time the result is macroeconomic asset deflation--> only medicine is governement sponsored countercyclical intervention with both fiscal and monetary measures--> ensuing fiscal deficit is lesser evil!

- Satyajit Das: ABS CP conduits, SIVs and CDOs are being gradually dismantled and the assets returning onto bank balance sheets. Hedge funds have been forced to reduce leverage by between a third and a half times. Prime brokers and banks have significantly tightened credit, increasing the level of collateral needed even against high quality assets. Each 1 times leverage reduction in hedge fund leverage represents in excess of US$2 trillion of assets. This accelerates the de-leveraging process.

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

- Oct 22: In an extraordinary meeting, Hungary's central bank (NBH) raised the benchmark interest rate by 300bp to 11.5% in an effort to prop up the local currency

- The first emergency increase in five years came after policy makers left rates unchanged (at 8.5%) at their scheduled meeting on Oct 20

- Bebesy of Budapest Investment Management (via Bloomberg): This is a desperate decision; 'the size is fine, but what we got here is the evaporation of global liquidity, so it's uncertain if the rate increase will rev up demand for the forint'

- Danske: Shortly after the hike and the initial strengthening of the forint, the currency started to weaken once again - a clear indication that markets do not expect the hike to have a lasting impact on the forint

- Portfolio.hu: The focus of the rate hike was primarily to address the speculative side of the current financial turmoil, as it cannot really do anything about liquidity on the government securities market

- There is concern that the turmoil in Hungary could spread to other CEE countries, potentially forcing other central banks into raising rates to safeguard currencies (FT)

- Hungary's decision appears to have been motivated by concerns over the impact a weak local currency would have on the country’s huge existing stock of foreign currency debt

- NBH's focus is likely to shift from inflation concerns to protection of financial stability, as the Hungarian banking sector faces difficulties in accessing external funds and FX swap market - Gárgyán of Citibank (via Portfolio.hu)

- Hungarian inflation has exceeded NBH's 3% target since Aug-06

- Cenbank scrapped the HUF's trading band against the euro in late Feb to help fight inflation in the hopes that the move would result in currency strengthening

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

Argentina's government took over the management of $28.7 billion in private pension funds that sharply declined in value this year due to global turmoil. The government intends to increase the pool of money it can borrow from to meet debt obligations next year. As of now, retirement and pension fund administrators, known as AFJP, manage private pension accounts for 9.5 million depositors, of which some 40 percent are active contributors. Essentially, most mandatory funds that flow into the private pension system would now become part of the government's pay-as-you-go public pension scheme. The global financial meltdown has put Argentina's private pension assets in jeopardy. Besides that, the government would have access to some USD 1.2bn per year in new flows currently deposited in the system, a move would certainly help the government financially. The idea of using social security funds to avoid a default (or to pay the debt) next year should cause a sharp drop in confidence in the country and in this government

- Argentine bond yields soared above 23 percent and stocks sank the most in a decade as the government sought to take over pension funds, a move analysts said is a bid to seize assets and stave off the second default this decade. President Cristina Fernandez de Kirchner proposed legislation today to nationalize pension funds, which would give the government control of $29 billion in retirement accounts. Argentina has struggled to cover financing needs that have swelled as the global financial crisis pushed down prices on the country's commodity exports. Borrowing needs will climb to as much as $14 billion next year from $7 billion in 2007

- Argentine stock, bond and currency markets are expected to be hit hard if the government moves to takeover the private pension funds. President Cristina Kirchner is set to announce the complete nationalization of Argentina's private pension funds when she reveals reforms to the country's retirement system. In addition to decreased volume, the move is likely to add more downside pressure to capital markets, which are already reeling due to the international financial crisis. The pension fund takover is also likely to put pressure on the peso, and the Argentine Central Bank intervened heavily in early foreign exchange trading

- The collapse in commodity prices and the slowdown in global activity look to be placing the Kirchner administration in front of the nasty realization that their funding for next year is highly compromised. The government could look to nationalize the private pension funds. In 2001, Cavallo stuffed the pension funds with public paper to finance the deficit but at least he did not go as far as nationalizing them. Essentially, most mandatory funds flows into the private pension system would now become part of the government's pay-as-you-go public pension scheme. The reasons the government is likely to give is that the global financial meltdown has put Argentine's private pension assets in jeopardy. The truth is more likely that the government would have access to some USD 1.2bn per year in new flows currently deposited in the system, on top of the fact that some of 35% of AFJPs's USD30bn in assets are not currently in government securities. This move would certainly help the government financially, but its sets the clock back almost 15 years in terms of economic structural progress in Argentina. Under a PAYG scheme, retirees count on the tax payments made by future generations to receive their money. Given that the economic clouds are darkening in Argentina, their money is much less likely to grow or be returned under a scheme managed by the government (where the liberated funds are unlikely to be ring-fenced) than by a more diversified private scheme .

Oct 22, 2008

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

As banks default, many involving credit derivatives written on the defaulted company need to be unwound. E.g. a synthetic CDO repackages not a portfolio of bonds but a portfolio of CDS without owning the underlying bonds. Other structured products include that incorporate a large amount of credit protection selling as a means for leverage. Unwinding these structures requires to enter offsetting trades by buying credit protection. As an unintended consequence, buying protection in a systematic way is equivalent to betting against a company's credit worthiness (like shorting the stock in equity markets)--> this sends investment grade companies' CDS and borrowing costs higher. Regulators are looking at over the counter market. (WSJ)

- Fitch (via RiskCenter) October 21: The 'AAA' ratings of Derivative Product Companies (DPCs) are premised on the bankruptcy remoteness of their structures and are not linked to the ratings of their sponsors. Fitch is evaluating this premise following the voluntary filing for Chapter 11 reorganization by two DPCs in the Lehman Brothers corporate structure.

- S&P: (via Bloomberg): The collapse of Lehman, WaMu and the Icelandic banks, as well as the U.S. government's seizure of the mortgage agencies, will have a ``substantial'' impact on corporate CDO ratings.

- Oct 22 Baring analyst: ``The same kind of shudders that went through the asset- backed CDO market will probably go through the corporate CDO market. We'll see a pickup in default rates."

- WSJ Oct 20: Perhaps the weakest link in the market are specialized funds, known as "constant-proportion debt obligations" () which typically borrowed about $15 for every dollar their investors put in. They also contain safety triggers that force them to get out of their investments if their losses reach a certain level. Analysts estimate that most CPDOs reach those triggers when the cost of default insurance hits about the level where it is now.

- SIFMA Q2 update: Global issuance of CDOs from 2004 - 4Q2007 totaled $1.47 trillion. Only $17.3bn worth of CDOs issued in q2 2008 compared to $175.9bn in Q2 2007.

- SIFMA: CDO issuance by underlying collateral in 2007:

-$254.8bn structured finance CDOs (collateral pool consisting of RMBS, CMBS, CMOs, ABS, CDOs, CDS, and other securitized/structured products)

-$148.3bn high-yield loans (rated below BBB-/Baaa3) CDOs

-$78bn investment-grade bonds CDOs

- CDOs by issuance type in 2007:

-$86.8bn Market Value CDOs (triggers unwinding if net asset value falls below theshold);

-$51.5bn Synthetic funded CDOs (synthetic CDOs sell credit protection via credit default swaps (CDS) rather than purchase cash assets. 'Funding' requires from investors in CDO tranche a cash deposit as collateral);

-$347.4bn Cash flow and Hybrid CDOs (cash-flow CDOs pay off liabilities with the interest and principal payments of their collateral. Hybrid CDOs combine the funding structures of cash andsynthetic CDOs.)

- Geithner, NY Fed: The sheer number of financial contracts that would have to be unraveled in the context of a default, the challenge that a former colleague of mine likes to refer to as "unscrambling the eggs," could exacerbate and prolong uncertainty, and complicate the process of resolution.

Oct 23, 2008

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

- The cost of insuring Russian against bankruptcy (spreads of Credit default swaps on Russia's debt ) rocketed to 1,123 bps, higher than Iceland's debt before it sought a rescue from the International Monetary Fund (Telegraph) Although other emerging markets including Baltic countries, Turkey and CEE countries have higher external financing needs and run current account deficits, the reduction in Russia's reserves, the prospect of and deficits, the implicit and explicit state assumption of significant as the oil price slumps point to further risk.

- Russian sovereign bonds were already trading at higher risk than other EM sovereign bonds even before S&P lowered its credit ratings outlook to negative from stable citing the worsening outlook for public finance in light of lower oil prices and increasing government support of the banking sector

- Russia still looks stronger than some of its peers despite vulnerabilities (Uralsib) - strengthening capital outflows as deposits are converted into dollars which may prompt restrictions on fx transactions. Several other commodity export-led economies could face similar worries, yet they have not been downgraded - the difference may be due to perception of higher political risk and government-led consolidation in Russia

- The Russian banks’ dependence on wholesale and external funding is key to the economy’s vulnerability, which can be expected to mount if commodity prices fall further (Citi) Although the CBR's reserves far exceed Russia's short-term debt, they barely cover Russia's total external debt. Intervention to stabilize the rouble is depleting reserves rapidly (though the dollar rally also reduces the value of EUR and GBP holdings). Russia has to roll over $40b in debt this quarter and $150b in the next year. and the Government has promised over $200 billion in short and long-term capital to ease liquidity crunch and substitute for external finance

- Russia may run a current account deficit with oil in the $60-70 a barrel range given the ramp up in imports and reduction in oil inflows - capital flows have already reversed and Russian investors flight to USD has pressured the rouble.

- Weafer: An oil price in the $60’s/bbl should still mean a defendable ruble, but there will be a lot more pressure at $60/bbl, or lower. A combination of falling oil and a weakening currency will increase downward pressure on equity and bond markets. The correlation between the price of oil and the RTS was not very tight as oil was rising but it has increased on the downward trajectory.

- Lacking a developed domestic bond market, the only way for oligarchs to raise money at present is by selling their equity, contributing to massive equity selloffs. Russia's unique fragility is that over $1 trillion of debt needs to financed from a domestic capital pool of $600bn (Bond)

- Now that Russia's own sovereign debt is in question, and many other emerging markets are turning to the IMF to stabilize their balance of payments, markets no longer believe Russia is strong enough to guarantee the estimated $530bn of foreign debts accumulated by its companies during the break-neck expansion of the oil boom. (Redeker, via telegraph)

Oct 26, 2008

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

- Several Emerging economies and one advanced one are in talks with the IMF or regional institutions to provide capital in the face of global liquidity shortage. These countries tend to have high external financing needs (large current account deficits/GDP, etc); judging from the development in credit default swaps (CDS), other countries might soon have to ask for assistance (Danske), particularly those with large current account deficits

- Risk of contagion, especially in and Eurasia is high. With most countries not able to finance their own bailouts, some may turn to regional financing eg to the ECB, to the ADB or Central American countries to the ,rather than the IMF

- IMF rules allow it to lend up to 5x a country’s quota (amount deposited when a member state joins), but rules can be relaxed in a crisis

- Citi: The rise in default risk premia across CEEMEA may reflect the the greater likelihood of capital controls. Ukraine is most at risk of such a move

- Merrill: EEMEA banking systems remain structurally underdeveloped and not levered. Yet higher credit growth relative to deposits suggests that, despite comfortable loan-to-deposit ratios, EEMEA banks have been reliant on loans from foreign "parent-banks", which underscores the short-term risk of loans growth slowdown. Several foreign-owned banks in the region reportedly freezing credit lines even for CEE "blue chips" in recent weeks

- FT: Countries in the Baltics and Balkans – including countries like and - have much larger funding gaps as a share of GDP than Hungary

- may receive $14b from the IMF in a move that could provide much-needed credibility. Ukraine's CDS spreads have risen to 1900bps points, more than 4x June levels. Ukraine's current account deficit might be as large as $15 billion. ->Citi: Aside from announcing extraordinary measures aimed at preventing a flight to foreign exchange, Ukrainian policy response requires additional credibility, and this should come in the form of an IMF program that reinforces needed policiesc regi

- is poised to receive $6bn in funding through a rescue package led by the IMF, along with central banks in the Nordic region and Japan (FT); Iceland's talks with Russia over a EUR4 billion ($5.5 bn) loan appear to have broken down after official returned home empty-handed; a rescue package is seen as necessary after Iceland nationalized its three biggest banks to prevent a banking system collapse and now faces the threat of national bankruptcy

- On Oct 13 the IMF pledged to help as needed after bonds, equity and the forint plunged the previous week. The central bank will pump unlimited funds to the interbank market through daily currency-swap tenders and scrap a limit on pension fund bond holdings to support the bond market. Hungary has received emergency funds from the ECB though despite early indications that CEE countries might be left out in the cold as Western European countries supported their own financial systems

- : Government asked IMF for a new deal, saying it would not necessarily seek funding from the lender, but an agreement to reassure investors that Serbia was safe.

- : Has requested credit from the IMF to uphold stability and economic growth rates amid global crises. The CB confirmed the request a day after Russia agreed to issue a $2b loan to Belarus while resuming negotiations on a proposed common currency between the two ex-Soviet neighbors. Foreign reserves fell in September to $4.9b, covering about 40% of external debt, from $5.6b

- Other countries that may face short-term funding issues but might not apply to international institutions include and

- Citi: We argue that in the absence of a strong policy response in — supported by a new IMF arrangement — the current sentiment is unlikely to improve and the lira is likely to weaken further

- Govt is seeking $10-15 bn loan for 2008-10 from IMF, ADB, World Bank and other bilateral donors like Saudi Arabia, China, U.S. to finance external debt payments of $3-4 bn during next 2 years; recently received $1.4bn from World Bank to fund its fiscal deficit

Oct 23, 2008

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

In spite of easing gas prices, tightening credit conditions and lending standards, worsening job losses, declining incomes and returns from stock market along with continued fall in home prices and high debt is affecting household wealth and consumer confidence. Consumer spending will contract in H2-08 exacerbated by credit crisis (esp. for mortgages and auto loans)

- The Conference Board Consumer Confidence Index fell to 38 in Oct (lowest reading since records began in 1967) from 61.4. This is the biggest decline since 1970s and is also below readings in past 4 recessions. Present Situation Index decreased to 41.9 and future expectations index fell to 35.5 (also lowest on record, biggest drop since 1970s)

- Cont: Labor market differential (share of people saying jobs are plentiful - share saying jobs are hard to get) continued to fall to -28.3%; share of people expecting more jobs in 6 months less fewer jobs declined to -34.1% (lowest since 1980); percent of people expecting income/job opportunities to rise in next 6 months declined; percent of people planning to buy automobile fell to record low

- Paribas: Extremely low consumer confidence indicates unemployment rate will rise sharply and retail sales will decline significantly so that consumer spending will continue to decline in the coming months

- The Reuters/University of Michigan preliminary index of consumer sentiment fell to 57.5 in Oct from 70.3 in Sep (biggest decline on record) as index for current conditions fell to record low, and index for expectations of future conditions fell to a 4-month low; decline in sentiment was led by high-income groups, older workers and in North-East region (impact of bearish stock market, financial crisis); spending plans esp. to buy home fell sharply though measure of inflation expectation improved

- The Reuters/University of Michigan final index of consumer sentiment declined to 70.3 from the preliminary reading of 73.1 but rose from the Aug reading of 63; index for current conditions and expectations of future conditions declined while expectations of future prices eased

- Consumers will mostly spend on discount and basic goods while cutting back on homes, auto or other high value spending; retail sales have been declining since July after getting temporary boost from rebates in Q2

- Consumer credit contracted -3.75% (most on record) in August; household net worth declined $438bn to $56tr in Q2-08

- Personal disposable income and real personal spending have turned been negative since June

- The ABC News/Washington Post Consumer Comfort Index was at -47 in the week ending Oct 14 (more than 30% below-avg; 4 points away from record lows of -51); the index fell to -43 in Q2 (lowest since Q1 1992)

- Merrill Lynch (not online): Usually during recessions, consumer confidence gets a temporary boost from fiscal/monetary stimulus before trending down again as the job market hits a bottom; consumer spending will hit the mid-70s type downturn contracting during Q4-08/Q1-09

- Goldman Sachs (not online): In spite of easing (but still relatively high) gas prices, consumer confidence will remain at a low leading to contraction in consumer spending b/w 3Q08 to 1Q09, flat in 2Q09 and recovering in 2H09

Oct 28, 2008

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

Oct 28: Iceland’s central bank lifted the policy rate from 12% to 18% (Europe's highest) on the orders of the International Monetary Fund, highlighting the dramatic impact the organization will have on the country’s ability to control economic policy

This hike reverses the Oct 15 unexpected reduction in the policy rate by 3.5% to 12% in an unscheduled meeting after the nationalization of Iceland's three banks (See related spotlight issue: Iceland's Banking System In Turmoil: How It Got Here)

Rationale: 'it is considered unavoidable to provide the króna (local currency) with a firmer footing on the foreign exchange market through a restrictive policy rate' says Cenbank

Gullberg of Deutsche Bank (via Bloomberg) does not think 6 percentage points will make the krona any more attractive given the 'liquidation' in emerging markets; 6% isn't worth a lot if the currency drops another 15%

Karlsson also questions the effectiveness of the rate hike given investors' extreme risk aversion. Moreover, given the extremely high level of inflation in Iceland, he notes that 18% isn't exactly high

Landsbanki sees rate hike as a 'step in the right direction', paving the way for the ISK to stabilize and eventually for inflation to recede

Inflation reached 15.9% in October (an 18-year high) and inflation expectations remain high

Next prescheduled interest rate decision meeting is Nov 6

Iceland has had high interest rates for several years as the central bank has tried, unsuccessfully, to rein in inflation, which has exceeded the central bank’s 2.5% target every month since April 2004

Fitch: Effectiveness of monetary policy 'leaves much to be desired'. Double-digit interest rates have had little impact on real economy, but inflation still remains far removed from 2.5% target. Lack of effectiveness due in large part to indexation

Oct 28, 2008

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

WASHINGTON (Nov 7th 2008)-- A majority of financial firms say a lack of clarity about important aspects of the Treasury Department's rescue plan is diminishing their willingness to participate, according to a survey conducted by the Securities Industry and Financial Markets Association, the industry's top lobby group.

Treasury originally said it would start purchasing troubled assets within weeks of Congress's passage of the $700 billion financial-rescue package in early October. Now, however, the department's efforts are focused on a separate program to invest $250 billion of new capital into the banking and financial sectors.

Tim Ryan, president and CEO of Sifma, said Treasury needs to turn its attention back to creating a mechanism for the purchase and pricing of these assets. The idea behind the original plan was that removing bad assets -- such as mortgage-backed securities -- from banks' books would spur financial firms to resume lending.

"Our hope is that between now and the inauguration, this does not go into cold storage, because the system can't afford that," Mr. Ryan said. "We need them to stay focused and make some decisions."

The Treasury Department declined to comment.

A survey of more than 400 firms by Sifma and other financial-industry trade groups found that a large percentage of financial firms would be reluctant to participate without more details about any potential program. More than nine in 10 said they were less likely to participate in the so-called Troubled Asset Relief Program because of a "lack of clarity." Nearly the same number expressed reluctance if Treasury requires firms to issue warrants in return for taking assets from them.

Treasury is still formulating its plans to purchase assets and has yet to settle on a comprehensive approach, say people familiar with the matter. It hasn't yet hired asset managers. Treasury officials still need to determine how to price securities whose underlying markets are "pretty thin and not at all healthy," said Wayne Abernathy, executive vice president for regulatory affairs at the American Bankers Association.

The asset-purchase program was originally expected to operate as a reverse auction, with financial firms with toxic securities telling Treasury the lowest price they would accept to sell the assets to the U.S. government. But Treasury is considering other ways for the program to operate. Variations could include direct purchases of securities by Treasury or a system by which Treasury or its asset managers match the price paid for asset purchases made by private-market participants. Industry participants favor Treasury's directly negotiating and purchasing assets, according to the survey.

The issue is complicated by the wide array of now-illiquid assets that are held by financial firms, said Douglas Elmendorf, a senior fellow at the Brookings Institution think tank. Another practical concern is the limits on Treasury's purchasing power. Roughly $300 billion of the initial $350 billion chunk authorized by Congress is likely already tied up in the capital injections for banks and a foreclosure-mitigation program.

Even if Treasury spends the remaining $400 billion on purchasing illiquid assets, it would represent only a small percentage of the trillions of dollars of outstanding mortgage-backed and other asset-backed securities.

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

- Nov 20 WSJ: Analysts at Credit Suisse said two big commercial mortgages that had been packaged into securities in the past year were likely to default. The rapid deterioration of these loans fed worries that the weakening economy and higher unemployment rate would drag down the $800 billion market for commercial-mortgage-backed securities, or CMBS, which so far has withstood the credit crisis with low delinquency rates.

- FT Alphaville: Commercial-mortgage-backed securities are different fish to residential-backed bonds: the pools are far less granular. Which goes some way to explaining those apparently low delinquency rates. With CMBS, when trouble does hit, it is much more sudden and sharp. The delinquency rate might not be expected to smoothly move higher, it should jump. And it will do so when the real pain begins to bite in the economy-->Markit AAA CMBX spread went from 260bp to 550 within past 2 weeks

- Banks' exposure to real estate:

- At the end of Q2, Deutsche Bank held $25.1 billion worth of commercial loans. Morgan Stanley held $22.1 billion and Citigroup had $19.1 billion. Lehman holds largest exposure with $40bn worth of commercial real estate assets--> A large part of its portfolio is a high-risk loan known as bridge equity made with Archstone, a metropolitan apartment developer, and most of the rest are floating-rate loans, which are riskier, according to a person who reviewed the offering.

- CRE and CMBS exposures will likely exacerbate credit problems at U.S. banks but not as much as RMBS (except those banks specializing in commercial real estate);- default rates on CMBS collateral could increase toward the historical average of 80bp, roughly double or triple the lowest point of the credit cycle;- lax underwriting standards could increase rates on bank CRE loans further;- recent valuation declines in the CMBS market imply near-catastrophic and rather unrealistic credit conditions;

- CMBS troubles should not reach the 1980s levels. (Fitch and Interest Rate Roundup)

- Reuters: Commercial property prices headed for a great fall: Moody's as well as OTC traders expect 20% decline over next two years. MIT non-residential property index fell in y/y terms n past 2 quarters.

- Fitch August 1: 50% of CMBS outstanding are 2006/2007 vintages--> Borrowers would default on an average of 17.2% of securitized commercial mortgages over 10 years if U.S. economy dips into recession with 0.2% contraction in growth, compared with current very low default rates of 4% (i.e. +330%).

- One third of regional banks have commercial real estate exposure of at least 300% of equity. So far, non-current loans have increased in the construction&development category to around 5%; non-residential buildings, multifamily buildings, and real estate loans not secured by property are set to follow suit.

- Fed July Senior Loan Officer Survey: Record high share of banks, ie over 80%, reporting that they tightened lending standards wrt commercial real estate loans

- Bloomberg June 26: Commercial-mortgage backed securities (CMBS) offerings dropped to $12.2 billion in the first half of the year, from about $137 billion in the same period of 2007--> Analysts: "The market for CMBS has no real prospect of coming back."

- Fitch: Since '05 interest-only loans and loans with high loan-to-value ratios implying unrealistic future rent expectations

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

Why CitiGroup is About to Be Bailed Out and Not General Motors

Citigroup was once the biggest U.S. bank. General Motors was once the biggest automaker in the world. Now, both are on the brink. Yet Citigroup is likely to be rescued within days. General Motors may not be rescued at all.

Why the difference? Viewed from Wall Street, Citi is too big and important to be allowed to fail while GM is simply a big, clunky old manufacturing company that can go into chapter 11 and reorganize itself. The newly conventional wisdom on the Street is that the failure of the Treasury and the Fed to save Lehman Brothers was a grave mistake because Lehman's demise caused creditors and investors to panic, which turned the sub-prime loan mess into a financial catastrophe -- a mistake that must not occur again. But GM? GM is only jobs and communities. Citi is money.

The Street's view of the world is fundamentally flawed. Banks are important to the economy because they're financial intermediaries. They connect savers with investors and borrowers. This is a vital function, but there's nothing magical about it. At any given time the world contains a vast pool of money that can be put to all sorts of uses. Financial intermediaries simply link the pool to the uses.

To be sure, savers need to believe that intermediaries are trustworthy; otherwise, savers will prefer the underside of their mattresses. That's why governments regulate intermediaries, insure deposits, and do whatever else needs to be done to make savers feel safe. What governments and societies fear most are "runs" on banks -- panicked efforts by depositors to pull their money out all at once, before banks can possibly collect the money from all those who have used it to borrow or invest. That's what happened in the 1930s.

But the current panic on Wall Street is not a "run" in this sense. It has almost nothing to do with banks' roles as financial intermediaries. It's about money that's been lent to or invested in the banks themselves, in order to profit off of the banks' profits. Lehman's demise cost many investors and creditors lots of money, to be sure, but they were investors and creditors in Lehman, not in the real economy.

Before the asset bubbles burst, financial institutions were generating whopping profits, so naturally they attracted many investors and creditors. After the burst, the profits disappeared. These days, you'd be hard pressed to find many people who want to invest in or lend to financial institutions. Citigroup had a market value of $274 billion at the end of 2006. Now its value is about $21 billion. That's awful news for Citi, its executives and traders, and its investors and creditors. But it's not necessarily awful news for the economy as a whole. Even if Citigroup were to go belly up, the real economy would not be seriously harmed. The mutual funds, pension funds, and deposits overseen by Citi would be safe; fund managers would find their way to other banks.

In other words, Citigroup is not much different from General Motors. It's a company that once made lots of money but, through a series of management blunders, is now losing money hand over fist. Just like the shareholders and creditors of GM, Citi's shareholders and creditors are taking a beating.

So why save Citi and not GM? It's not clear. In fact, there may be more reason to do the reverse. GM has a far greater impact on jobs and communities. Add parts suppliers and their employees, and the number of middle-class and blue-collar jobs dependent on GM is many multiples that of Citi. And the potential social costs of GM's demise, or even major shrinkage, is much larger than Citi's -- including everything from unemployment insurance to lost tax revenues to families suddenly without health insurance to entire communities whose infrastructure and housing may become nearly worthless. I'm not arguing that GM should be bailed out; as I've noted elsewhere, GM's creditors, shareholders, executives, and workers should have to make substantial sacrifices before taxpayers should be expected to sacrifice as well.

Nonetheless, Citi is about to be bailed out while GM is allowed to languish. That's because Wall Street's self-serving view of the unique role of financial institutions is mirrored in the two agencies that run the American economy -- the Treasury and the Fed. Their job, as they see it, is to keep the financial economy "sound," by which they mean keeping Wall Street's own investors and creditors happy.

Because the public doesn't understand the intricacies of finance, it's easily persuaded that this is the same thing as keeping credit flowing to Main Street. That's why the public and its representatives have committed $700 billion of taxpayer money to Wall Street and another $500 to $600 billion of subsidized loans to the Street from the Fed -- bailing out the investors and creditors of every major bank, including , momentarily, Citi -- only to discover, at the end of this frantic and unbelievably expensive exercise, that American jobs and communities are more endangered than they were at the start.

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

Nov 23: Federal government agreed to rescue Citigroup by helping to absorb potentially hundreds of billions of dollars in losses on toxic assets on its balance sheet and injecting fresh capital into the troubled financial giant

- Details: Citigroup and the government have identified about $306 billion in troubled assets. Citigroup will absorb first $29 bn in losses. After that, remaining losses will be split between Citigroup and the govt, with the bank absorbing 10% and the govt absorbing 90%. Treasury Department will use its bailout fund to assume up to $5 bn of losses. If necessary, FDIC will bear the next $10 bn of losses. Beyond that, the Federal Reserve will guarantee any additional losses (NYT)

- Essentially, taxpayers will be on hook if Citigroup's massive portfolios of mortgage, credit cards, commercial real-estate and big corporate loans continue to sour. In exchange, the govt will get $27 billion of preferred shares paying an 8% dividend. In addition, the Treasury Department will inject $20 bn of fresh capital into Citigroup. That comes on top of the $25 bn infusion Citigroup recently received under TARP

- There will be no management changes; there will be some compensation limitations, but those have not yet been made clear

- Criticism: Plan is arbitrary and cannot possibly set an expectation for future deals. In particular, by saying that the government will back some of Citi’s assets but not others, it doesn’t even establish a principle that can be followed in future bailouts (James Kwak via Economist's View)

- This is not a particularly good deal for American taxpayers (Robert Reich via Economist's View). Exercise price for government warrants is $10.61, while Citi closed at $3.77 on Nov 21 (James Kwak via Economist's View)

- Citigroup by the numbers: (WSJ Nov 24)

Total Assets: $2.05 trillion

Off-balance sheet assets: $1.23 trillion (of which $667 billion in mortgage-related securities);

Market Cap: $20.5 billion

Q3 2008 Revenue: $16.68 billion

Dividend Yield: 10%

Share Price: $3.76

- Dangers of a Citigroup Failure: The failure of a single major financial institution could result in losses to the OTC derivatives market of $300-$400 billion, a new working paper finds. What’s more, since such a failure would likely cause cascading failures of other institutions, the total global financial system losses could exceed $1,500 billion (Singh/Segoviano -IMF)

Background

- WSJ: As share price fell, Citigroup’s credit-default swaps, a measure of insurance against debt default, rose to reflect a cost of $470,000 to insure $10 million in bonds against default for five years

- Nov 19: Citi agreed to acquire a further $17.4 billion of assets held by structured investment vehicles advised by the company. Citi was forced to bail out seven troubled SIVs in December, assuming $58 billion of debt out of a total $87bn, as a slump in credit markets eroded the value of their assets

- Fitch, Nov 6: Citigroup has indicated that Citi-branded net credit card chargeoffs could exceed their 1992 peak of 6.44% in coming quarters, particularly if the unemployment rate remains under pressure

|

|

Registered User

Joined: 3/16/2006

Posts: 2,214

|

(copyrighted information posted without permission, removed by Moderator)

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"Because the public doesn't understand the intricacies of finance, it's easily persuaded that this"

----------------------------------------------------------------------

Neither do the people running things.

"Essentially, taxpayers will be on hook if Citigroup's massive portfolios of mortgage, credit cards, commercial real-estate and big corporate loans continue to sour."

-----------------------------------------------------------------------

Ive never been "off" the hook.

Thanks

diceman

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

They let Lehman fail and now look at how the markets have collapsed. It would have been much cheaper to throw them a lifeline, in hindsight.The Treasury & Fed will not make the same mistake x20 by letting Citi fail. Just like a trader must do, one must acknowledge the realities of their current position and say "what's the best way forward."Taxpayers are on the hook every which way if all these loans sour. if not directly, then indirectly when credit is scarce, and deflation wipes out more wealth.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (ben2k9) ..and deflation wipes out more wealth.

Oh ... don't worry ...

The National Debt is right now over $10.655 TRILLION ... and growing with each new "feel good" program passed ...

The Fed as increased their balance sheet from $900 billion to nearly $3 TRILLION in the last couple of months ....

It now exceeds the cumulative net worth of EVERY household in America ....