Registered User

Joined: 3/21/2006

Posts: 4,308

|

I have downloaded the new version of tradeguider and LEH came up as a top pick. It looks like todays action is confirmation of Bknights keen eye from yesterday. It looks like there is demand after smart money has been buying up supply. When I gave you my opinion yesterday Bknight I was looking at the last week or so and thought that the selloff would continue but today was a stong accumulation day so I would look for a reversal here.

|

|

Registered User

Joined: 12/19/2004

Posts: 415

|

The push down and then the reboud looks good for sure.

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

Hey Apsll,

LEH is in my unfiltered VSA listings today also. But, it is listed as a short for the next 3 trading days.

But, on my filtered list it is removed primarily because I filter out those stocks that have had

other significant volume spikes within the last 30 trading days.

The fact that it is filtered out of my list could mean that I am so suppose to do the opposite of

the originally suggestion -- which is to short it during the next 3 trading days with a target

of 28.20 (In other word, maybe I should be buying this one).

Without regard to VSA, it does look like a rebounding stock with stochastics turning up from

an oversold condition and accompanied by a green candle preceded by a red candle.

Tomorrow will definitely be of interest to me concerning LEH.

Thanks for the chart post!

mp

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Craig, do I have the Wordens permission to use their charts on other forums. I have been doing so for quit some time now and I know of one case where one of my friends from another site is on the 30 day trial subscription to Telachart.

Many different members on this site use many different charting sofware charts to display there opinions on different ideas. Why do you not quesstion every single one of them. I myself have used at least three different charting software charts for the last two and a half years and this is the first time that the subject has been broached (with my choice of charts). Why now???

This is the only forum that I use that does not alow one to post hyper-links to outside sorces or websites, and it has nothing to do with copy-rights. hyper links to outside sources are widley used on every website, on every chat room, on every forum, on every sports news sites. Basically every where throuout the internet exept here. Why??? I know you are thinking that I have the choice not to come here, but I have a lot of friends here and I would hate to lose contact with them.

I will call Tradeguider when they are open and ask them if it is ok to display their charts within the context of a trading chat forum. and get back to you on that. I will not post another chart until I receive said permission.

Apsll.

|

|

Registered User

Joined: 12/7/2004

Posts: 393

|

I wonder how many investor lawsuits and SEC investigations are in Lehman's future.

|

|

Registered User

Joined: 8/6/2007

Posts: 73

|

Nice run LEH today

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

JT, were have you been hidding? I missed you around here. I bought 1,000 shares this morning at $32 then sold at $33. I then bought back in when it whent down and started up again at $32.5 and I am still holding. Almost up $3,000 Already paid for the VSA program and about five years of Data-feed.

I love it when somthing pays for itself.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Craig, I received a call back from Gavin Holmes himself (the owner of Tradeguider), He was very impressed that I actually was asking for permision to use TG charts to discuss my trades. He said that he is very ok with me doing so.

Now for booker and Bknight. I spent about five minutes on the phone with him. Once I told him about LEH he got all exited. (With his deep Ausie accent it was all so surreal)... He looked up the chart and told me that March 17th was when the accumulation began. And that he regrets missing this one. He then asked me which forums I post on and mentioned that in the last few weeks his website has been getting double the hits as usual, I told him that VSA was a big topic on th Worden site and he got all exited again. He then turned me on to a forum that he and other profesional traders frequent. I am going to check it out.

Craig, do I have your permission to post the site? just this once so that VSA enthusiast might check out the master himself.

Anyway we owe it all to Bknight for finding LEH. How did you find this one BK? just curious...

|

|

Worden Trainer

Joined: 10/1/2004

Posts: 18,819

|

Thanks for checking. If it is a non-profit site (not a commercial site) then you have permission to post it.

- Craig

Here to Help!

|

|

Registered User

Joined: 12/19/2004

Posts: 415

|

QUOTE (Apsll) Craig, I received a call back from Gavin Holmes himself (the owner of Tradeguider), He was very impressed that I actually was asking for permision to use TG charts to discuss my trades. He said that he is very ok with me doing so.

Now for booker and Bknight. I spent about five minutes on the phone with him. Once I told him about LEH he got all exited. (With his deep Ausie accent it was all so surreal)... He looked up the chart and told me that March 17th was when the accumulation began. And that he regrets missing this one. He then asked me which forums I post on and mentioned that in the last few weeks his website has been getting double the hits as usual, I told him that VSA was a big topic on th Worden site and he got all exited again. He then turned me on to a forum that he and other profesional traders frequent. I am going to check it out.

Craig, do I have your permission to post the site? just this once so that VSA enthusiast might check out the master himself.

Anyway we owe it all to Bknight for finding LEH. How did you find this one BK? just curious...

Actually it is borrowed from others, 21 day lows. And it was at the top of the list the day I asked. It looked like what you were referring. As I said I wasn't going to trade it I was just asking. But it did sky rocket yesterday, too bad I didn't have the resources to purchase it. The smaller decline today with the market as bad as it is, looks encouraging also. Keep'em close to your vest.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Craig I do not think that it is a commercial site. If you feel that it shoild be blocked then of course I will respect the Worden policy. Either way here is the link, please only the serious minded should register as a member. These are serious folks.

http://finance.groups.yahoo.com/group/Wyckoff-SMI/?v=1&t=search&ch=web&pub=groups&sec=group&slk=1

|

|

Registered User

Joined: 12/19/2004

Posts: 415

|

That won't last long.

|

|

Registered User

Joined: 12/6/2007

Posts: 48

|

On another subject - wanted to thank u for QTWW. Uncovered by VSA posts you brought to this forum. First note one 4-15, in on 5-2 after confirming spike .

TX _ MC

|

|

Registered User

Joined: 12/6/2007

Posts: 48

|

Opps sckipped one. APSL - QTWW was your props............

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

QUOTE (Apsll) I bought 1,000 shares this morning at $32 then sold at $33. I then bought back in when it whent down and started up again at $32.5 and I am still holding.

I love it when somthing pays for itself.

Apsll, don't take this personally. You are free to trade however you like.

But, I ask this question for the newbie's benefit so that they can see how other

traders might think. First a statement, then the question:

IMO, your getting back in was an impulsive move. Why would you get back in and

risk giving back some of the profits you made?

To me, it would have been better to take that $1/share you made and call it a day because there

will always be new opportunities tomorrow.

On the other hand, perhaps your new VSA software gives you probablilities on whether getting

back in is a good idea or not (because there is a way to know this). But, newbies reading this board

won't know how to do it. To me, your post is encourgaging them to be impulsive (e.g. to gamble).

You should want to lead them by example and I feel that, in this instance, this is not a good example

to follow. I say, 'Hit It Once and Move On'.

Again, don't take it personally. I am posting this only so that newbies can see that there is more that

one school of thought on how to 'DAY TRADE'. Most day traders are an impulsive lot, so you

are in good company. But, you don't have to be this way to be called a 'DAY TRADER'. This is why

most beginning day trader are on a fast road to a Zero ($0.00) $ bank account.

JMHO,

mp

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

So, the moral of this story is: "DON'T GET GREEDY".

Thanks,

mp

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

MP, First let me say that I am not a day-trader. I do day trade but I am not one of those guys. I watch the tape and when the tape speaks I listen. If I watch a stock with high volume and fast price action then I react fast, Buy or cell. If I have faith in a stock then I watchit like a hawk. (One of my favorite sayings). I almost did give up on it when I sold it the first time. to to the high volume and drop in price. But it bounced as quick as it fell, sill on high volume. Looking back in retrospect I wish that I had sold at 3 pm on the 5th, But I held over-night.

The 6th at the opening gate volume and price took off (I almost bought more shares, but did not) When price sterted to drop on low volume, I remembered my training (low volume rallies do not last) I held to almost the end of the day where the decline on heavy volume forced me out at $33.5 For my two day effort I netted $2,000

On the 5th I also played LVLT for a good profit Yesterday was a togh day.

A lesson to the Newbies. Do not Day trade, unless you know how. Do not trade, unless you know how. Do not be greedy always control your risk and capital. Pick your style and master it before moving onto others. Learn to control your emotions when you take a loss. Never put more into a trade that you are not willing to say goodbye to at least 20% of it at times, in most cases 10%.

Here is the chart to cronical my thinking during the trade.

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

QUOTE (Apsll) MP, First let me say that I am not a day-trader. I do day trade but I am not one of those guys. I watch the tape and when the tape speaks I listen. If I watch a stock with high volume and fast price action then I react fast, Buy or cell. If I have faith in a stock then I watchit like a hawk. (One of my favorite sayings). I almost did give up on it when I sold it the first time. to to the high volume and drop in price. But it bounced as quick as it fell, sill on high volume. Looking back in retrospect I wish that I had sold at 3 pm on the 5th, But I held over-night.

The 6th at the opening gate volume and price took off (I almost bought more shares, but did not) When price sterted to drop on low volume, I remembered my training (low volume rallies do not last) I held to almost the end of the day where the decline on heavy volume forced me out at $33.5 For my two day effort I netted $2,000

On the 5th I also played LVLT for a good profit Yesterday was a togh day.

A lesson to the Newbies. Do not Day trade, unless you know how. Do not trade, unless you know how. Do not be greedy always control your risk and capital. Pick your style and master it before moving onto others. Learn to control your emotions when you take a loss. Never put more into a trade that you are not willing to say goodbye to at least 20% of it at times, in most cases 10%.

Wow, great post Apsll!

Are you going to post more TG charts here? Seem to me that you have the OK to do so.

One question about this chart though: Why are all the volume bars green? It hard to see what

is sell volume vs. what is buy volume.

Thanks,

mp

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Yes MP, I will be posting more candidates. I am currently downloading my checklists in to the TG system. It is a national system so I have access to foriegn Indexes, Forexes, and Futures. I cannot find the Nasdaq or the NYSE Or the Russel Indexes in the way I am used to seeing them, although the companants are avalable in fragments. So far I have been able to download the SP-500 and the DJ-30 and the SP-1000

I have some work to do. What I like about the new edition is that you can scroll down the list and see what stocks have wich indicators next to them it is awsome you can see like 30 stocks in the window all at once and click on the most promising ones and then view the chart.

I can still putt together watchlists in TC and down load those as well (but only 255 at a time).

This program is well worth the money and I plan on have lots of fun with it. Not to mention the profits. I hope that it will give me the edge I need to see things that normal traders do not.

Now this is for Booker. I hope that you will forgive my outburst in the other thread and continue to help out with the VSA project that you started. I am sorry that I offended you with my momentary lapse in reason.

Apsll.

|

|

Registered User

Joined: 10/7/2004

Posts: 426

|

We're kool Apsll, I have been busy trying to eradicate a nasty computer virus I contacted a week ago. avg reports it as 'Vundo' but will not remove it. avast finds it under a different name but will not remove it. Spybot finds it as 'virtumonde.dll', and says it removes it but it's still there on the next check. A special Vundofix.exe program cannot detect it. I have run all these in safe mode and it is very time consuming to do this. When I go to normal mode and try to use the computer, I will get pop-up windows with ads even though pop-ups are turned off. This happens with IE and Firefox. Then when I run Spybot again, it reports about 13 different virus's. This is on my deshtop so I am presently using my laptop. I have always used a firewall and virus programs and I have never had anything like this. If anyone has gone through this before, please tell me what you used to fix it.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Booker, I am glad that we are cool, but more important than that is your current computer problem. I had a laptop a few years ago and it developed a virus. I brought it to my friends shop and he got rid of it (had to start with a clean drive, lost all my files). He then installed Norton anti-virus. 6 months later I sold it and the guy is still using it today after a few upgrades, but still virus free. All together it cost me $200. Since they were my friends I do not know if that is the going rate. My point is that just let a profesional handle it, why drive yourself crazy over it. Also I swear by Norton anti-virus now I use it on my home and work computers and no viruses. The yearly renewal is pretty cheap also.

Good luck with the computer and glad to have you back.

|

|

Registered User

Joined: 12/19/2004

Posts: 415

|

Looks like a wild ride to the downside today. I don't know why company executives DENY anything is wrong and then a few days later OOPS we might have a problem. They're setting themselves up for extensive lawsuits. I hope you hedged your bets Apsll

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (Apsll) I have downloaded the new version of tradeguider and LEH came up as a top pick. It looks like todays action is confirmation of Bknights keen eye from yesterday. It looks like there is demand after smart money has been buying up supply. When I gave you my opinion yesterday Bknight I was looking at the last week or so and thought that the selloff would continue but today was a stong accumulation day so I would look for a reversal here.

leh -10% today.

i guess this why some on this board consider your vsa analysis incomplete, and more of a form of gambling. lol.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Funnymony, did you not read the posts on the thread before you put your fingers to the keyboard? JT, and myself both sold already with good profits. That was the short term oppertunity. The long term outlook for this stock "VSA" wise is good. It is clear that the stock is swiching over to strong hands. even if there are pending law suits, this company will deflect such trivial setbacks. I expect price to test the March lows and then you will see another round of smart money buying. When the demand far outways the supply then they will run the price up. You have to show patience like with DUG the rewards will come if you are patient and know how to enter and exit at the right time.

Who on this forum (other than yourself and Bigblock) think that VSA is gambling? Just because the concept is over your head do not attempt to judge. You only make a fool of yourself. I guess that is where your sign on name comes from. You actually are pretty funny.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

I"m switchign from Norton to PC-Cillin as a friend uses it for home and work and swears by it. I also runn the free version of Adaware se. When I run Norton and adaware they catch different stuff. One spyware is not enough anymore. You might also check into a registry maintenance software. I highly do not trust thesebut havn't had problems with "Registry Patrol" V3.0

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

My VSA pick for the next couple of days is MCHP it is showing more demand than supply and is bouncing off a support level. The volume, spread and close all look like smart money accumulation. Is this going to be a rally or a day trading event? Lets find out together.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

PS: LEH looks like it had more accumulation yesterday. The spread was narrow (that means that th buying was absorbing the selling and more shares are now in the hands of smart money. The float is decreasing which increases demand. 168 million shares traded yesterday.

Keep an eye on this it could bounce to fill the gap. I still expect a testing of the March lows at some point but this stock is not being accumulated for nothing. A rally is not far off (IMO).

|

|

Registered User

Joined: 12/19/2004

Posts: 415

|

Apsll, here's a couple to look at

GPI, RIO, PPC, TEN, FITB, BBT,--just longs

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I like PPC and GPI, they show the clearest signs of VSA out of the bunch, thanks for showing them to me. I will keep an eye on both of them.

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

Apsll, I would love to see an Elliot Wave analysis on this one from Booker.

This looks like one of the classic Elliot Wave charts where all the waves are visible (I think)

If this is true then the current wave is wave 4 (the retracement wave from a very long wave 3)

And if this is wave 4 then the retracement may not be done until it drops at least to the support line

you have drawn (but perhaps even further down)

Just Curious,

mp

|

|

Registered User

Joined: 12/19/2004

Posts: 415

|

QUOTE (Apsll) I like PPC and GPI, they show the clearest signs of VSA out of the bunch, thanks for showing them to me. I will keep an eye on both of them.

Of those two I like PPC better as it has re-bounded.

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

leh down another 7% today. looks like the smart money is still moving in.

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

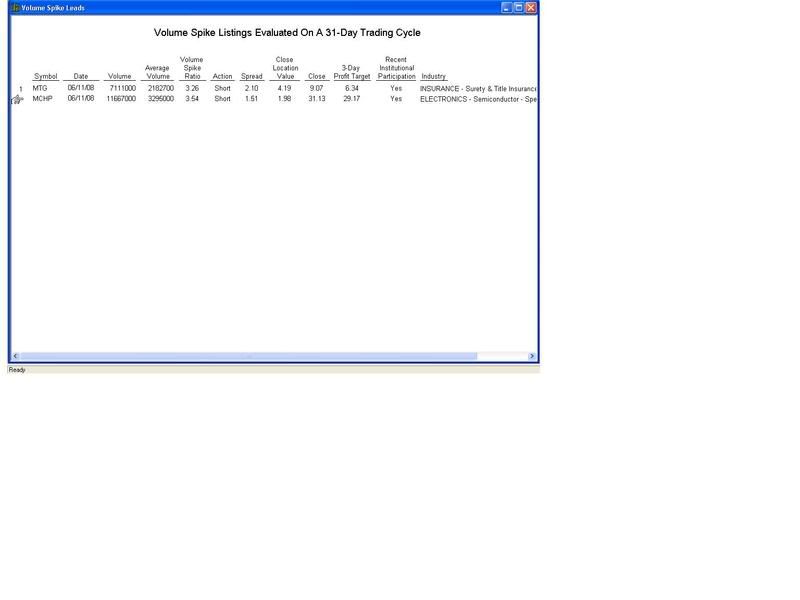

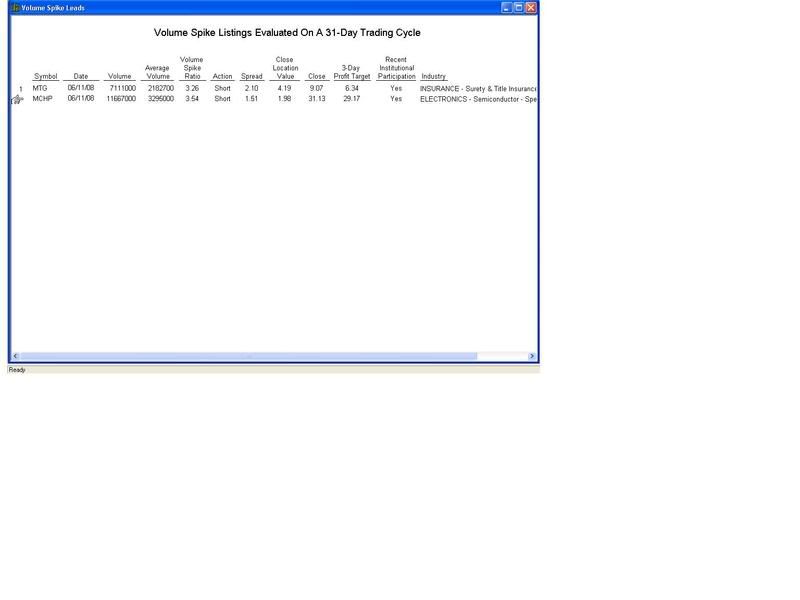

Apsll, look what showed up on my VSA list today as a short with a target price of 29.17:

|

|

Registered User

Joined: 12/19/2004

Posts: 415

|

QUOTE (memorableproducts) Apsll, look what showed up on my VSA list today as a short with a target price of 29.17:

Are you using the same software as Apsll?

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

No. I write my own software.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

MP, this stock might not have been a good choice. after looking back at past action I think I made a mistake with this one (maybe)

Funymoney, give it up did I not mention that the march lows were going to be tested. And yes smart money is still buying shares. Maybe instead of spending your time attempting to push my buttons, you should have been shorting this stock and making some money-funny....

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

QUOTE (Apsll) MP, this stock might not have been a good choice. after looking back at past action I think I made a mistake with this one (maybe)

.

Not at all Apsll.

If booker has any expertise in elliot theory like he claims to, he would tell us what he sees here.

Since he is too chicken to share his "claimed" experience in this theory.

I will again repeat some of what I see might be forming here:

This is the retracement wave (wave 4) in Elliot Theory.

To me, it looks like it doesn't have much further to drop before the turn-up wave (wave 5) begins.

Stochastics is bottoming well below the 20.

I would enter this stock when I see a green candle preceded by a red candle or preceded by a red then a doji and accompanied with a stochastics reversal (e.g. the stochastics starts turning upward).

Curious, did you already get in this stock?

mp

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

MP, no I am not in this one. Booker is wrestling with a computer virus and will be out sick for a while, I recomended that he go see a Doctor, maybe he will return soon I hope.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"MP, this stock might not have been a good choice. after looking back at past action"

-------------------------------------------------------------------------------

I thought when I first saw this stock listed as a VSA pick that

it was quite "newsy".

With housing stuff, economics, credit, jobs report, subprime ready

to send this thru the roof or over a cliff all types of positions are

taken.

Just my 2 cents but I would try to keep this type of stock out

of the scans.

When something comes up this "charged" just drop it.

Obviously that would be in the eyes of the beholder.

Thanks

diceman

|

|

Registered User

Joined: 10/7/2004

Posts: 426

|

Apsll, I have fixed my computer problems. The Vundo virus I had created havoc with IE and also really made a mess when my auto update tried to update my computer to SP3 one night. The MS help is full of people that had the same problem that I did. Luckily, one of the MS service people wrote a file to address the problem. It cleared the halfway installed SP3 and fixed all the necessary .dll's so I could install SP3. As far as the Vundo virus, I have only found one program that would remove it.

I will not go to these so called 'computer pros'. They are all geeks in disguise that just want to reinstall the original OS that came with the computer. I might eventualy do that as my registry has grown to over 7000 entries, while my laptop only has 463 entries. That is the primary reason a computer slows down. In the mean time I am gathering all the sofware that I would like to reinstall in a fresh OS just in case I decide to do that. So anyway everything is cool.

|

|

|

Guest-1 |