Registered User

Joined: 7/28/2007

Posts: 118

|

Being new to this game I was surprised to see IIVI take such a beating after what seems to have been a good earnings announcement before the bell. I am sure some of you have seen this so I would be interested in your opinions.

I was holding with an 8% gain then all of a sudden I stop out for a 1% loss!? Could it it be the charts are just telling us that there is information out there that the masses do not know yet? Judging by the depth of the drop could it be market makers taking out a wide range of stops for their own reasons? Is there a warning signal that I missed?

I bought back in at the price I took my initial position thinking market makers were the likely culprit, but I am not too sure. I'll be out very quickly if it drops again.....keep in mind I am holding longer term, or whatever it takes to get 20%+ gains, so not holding through earnings isn't part of my strategy though it may become part of it if this happens enough to seriously damage my returns.

Thanks for your thoughts.

Griz

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

i guess it best take some profits prior to earnings. it appears ivii had a pretty good run up prior to earnings. the old "buy the rumor sell the news". good news was obviously "baked in". technically, slight negative divergence in macd, overboought stoch, and declining volume. august-april was a continuation move, called a "measured move" and it met its price target as well.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

Dangit! my thread got droped.

I just wanted to say this sh** has been happening to me for the last year. don't feel so bad.

I also wanted to point out the importance of checkign multiple time frames. check out TSV on a weekly chart.. I use 52 period Exponential for weeklys but allot of people use 32 period. ANd moneystream on a 2 day or weekly view had colapsed several days ago. Also several negative divergences...

but don't let divergences make a major part in your decision making process.

I got Whipsawed on PTEC today.. similar deal. had a breakout buy above the 16th high.that

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Grizz, my friend. I feel sorry for you. All one had to do in this case is follow the technicals. Funnymony was correct, they were there to see.

Look at my following chart. An inverted hammer at the top of a rally or making a new high is a clear reversal pattern and you should have sold the next day for a 6% gain instead of 8%. TSV was in a clear negative divergence (as Funnymony said volume was decreasing as price was still rising). Lastly again as earlier stated MACDH was in a nagative divergence.

(IMO) because I am a pure technical trader, I would forget fundimentals, (still pay attention to earnings dates) but look at the charts right before the dates, Smart money knows what is in those reports and it will show up in the charts days or weeks before the report date.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Grizz this is not directed at you but I feel that this is a good time to slip this in.

To all the new traders - I have watched most of you ask questions over the last couple of years and then receive good advice from the veterans of this forum. You are in the learning stage so you are all like sponges right now. The best advice I think that you can take is to ask your questions and then settle on one idea; one approach and then work hard at attaining consistent results. Back test it, follow up with more related questions, paper trade it. Research related material. Focus on just this one thing, for that is going to be the key to your success. I see so often that a newbie will be asking questions about this and then about that and he will receive great advice and latter claim some success and thank everyone for their help. Next thing you know they are asking questions on a whole different approach. My point is that after a few cycles of this repeated behavior you will forget most of what you learned from your first round of questions and start making mistakes. My early success came from focusing on Stochastics and I was obsessed with it for a long time. Not only did this obsessive behavior give me success but also it helped me to understand trends, patterns and the idea of over-bought and over-sold conditions. Now I will use Grizzled1 as an example (Grizz you know I love ya) but he failed to see obvious technical warnings that he should have bailed on this stock earlier and I know that he has participated in related topics in the past. If you are to have success in these markets then you must have discipline. Think of the market as a machine with many moving parts and they all adhere to the laws of physics. These laws can never be broken, so all one needs to do to become a fine mechanic is to learn these laws, first focusing on one aspect of the machine until he has mastered it and then moving on to the next until a puzzle starts to form and every new aspect of his learning is just another piece to the puzzle. If he were to rush through his training and not retain earlier lessons before moving on to the next, then we are going to have one poor mechanic on our hands.

I hope that this analogy was helpful because I have seen the newbeis come and go and not a one has stayed very long (too bad because I liked a few of them).

Just food for thought.

Apsll.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

One good trend following system in a Bull Market might be the folowing. Check the last three rallies (could be two to four years) in a given stock and see what moving average held up the best for the given price action for all three rallies. In the case of IVII it was the 60 day xma In the middle window plot a 60,1,1 Stochastic and in the bottom window plot an ADX 12,10 not visable, but make sure you have a check in the plot DI lines box. Notice in my chart below that Price crossed the 60 day xma at about the same time that Stochastics crossed the 75 and that DI had a bullish cross-over. These three events at the same time to me would be a buy signal on a stock that I had been already following and matched other criteria before even making the watchlist, like volume, Institutional support etc. etc.

Do not think that stochastics entering the over-bought zone (above 75) is bad. I do not know where this myth got started? It is only when stochastics has broken back down through 75 on heavy selling that it is bad.

Anyway it is managing a basic system such as this with proper capital alocation and risk vs reward techniques that are the ticket to success. Know when to take a loss and move on, or wait for another entry. Know when to buy and sell and manage the trade. That is it and the best thing that any novis should start with. Master a basic system and you not only grow your portfolio but that is how your knowledge of the markets grow you stert to see why and when things happen. You can not do either of these things by jumping around trying to learn every thing all at once. Remember the Mechanic analogy I used above. Do like Tobydad has suggested many times. Right out a plan for success and stick to it one step at a time.

God bless and good luck.

Apsll.

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

grizz-

what you might try is find a short term price target within your 1:2 R:R ratio. it may be a resistance level or a price target based on a pattern analysis. once your target is met sell half your postion. the other half hold until you get technical sell signals, like a macd mid line cross or a 10x40 ma crossover.

i mentioned above ivii completed a "measured move" that occured from august to april. i know hindsight is great, but that was a good place to lock in some profit. not sure what it is with this voodoo but the sellers sure came in fast once the target was hit.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

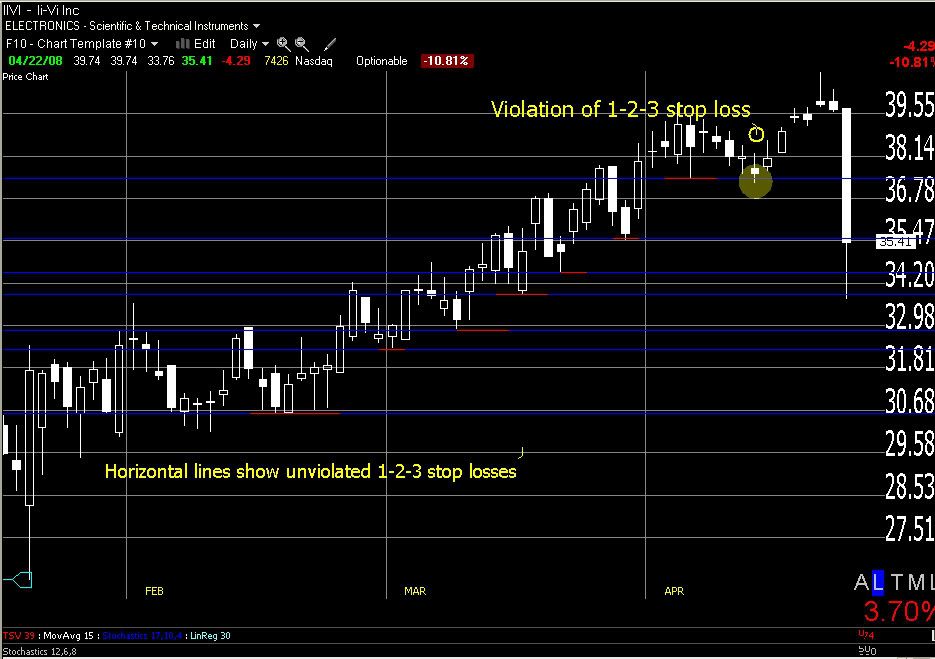

I will weigh in on this as it is, indeed, a great teachable moment. My comments will be, of course, from the perspective of one having entered this somewhere in late Jan 08. The pic below will show (by the horizontal lines) where I would have put my successive stop losses.

Again, these stop losses are based upon a 1-2-3 system ("2" being the lowest of 3 points and thus the latest support level in an ascending stock price). Let me point out that I will use this exact system to spot entry points for shorts; a 1-2-3 that has been established, then once the "2" is violated in a downward move, that becomes my entry for a short move.

So, in a long position, when this same thing happens, I consider this a great time to be out of a stock. In the case of IIVI, the final 1-2-3, for me, would have come on 4/3, 4/4 and 4/7 (the "2" being 4/4). This support level was violated on 4/11. The price never got support from the LR30 again. I would have been quite pleased to be stopped out on 4/11. And I would have found no reason to get back in which would have given me the delightful experience of missing that MCTTF on 4/22.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

"I do not know where this myth got started? It is only when stochastics has broken back down through 75 on heavy selling that it is bad." . . .

I think allot of people actually teach it that way..the whole over sold and over bought thing. ON rolling trendlines it makes a sort of sense. BUT I've noiced that allot of buysignals that preceded momentum moves tend to have a stochastics floating position... or stuck in the top band. This is I guess fine as it keeps allot of people out of it

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Tobydad, I should start paying more attention to your Template. It was a buy signal in late January, price was sitting right on the see-saw as TSV was breaking free from its moving average and the BB. In my first chart I show this and the second chart I just plotted a trend line that was breached on the 14th but I am not so sure how your 1-2-3 stop system works. Can you post the link to the thread that best describes it please. Just curious...

I love having dialog with you, because we are among the few here that design trading systems that work and do not mind sharing with others. Most here will give their opinions on someones stock pick (and that is good) but I love to see a nice trading sytem in action.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

PS: Did you participate in this one?

|

|

Registered User

Joined: 7/28/2007

Posts: 118

|

Thanks for the input all, I agree that one should focus on a strategy and learn it intimately so that you can prove to yourself that you can do this before trying to learn a new and perhaps more profitable method.

Still being a newbie I see where jumping from strategy to strategy, indicator to indicator, web site to web site serves a purpose in the beginning as you are assaulting your brain with data. This has served its' purpose for me and I have now settled into the CAN SLIM method of investing as I mentioned in another post. Everything I studied up until January '08 has led me to make this decision. The only tinkering around I have done since '08 is play with the QID and QLD during periods of extreme volatility. I don't even do that now...

For now I'll stick to the rules for the most part, avoiding most all indicators with the exception of a couple MA's, Relative Strength, BOP, price and volume, and trendlines. I am doing this precisely APSLL for the reasons you mentioned above, to focus on one strategy cutting out most noise. In other words I am not looking for the quick profits that I know you seek. I do not mind holding for a much longer time frame. I love this stuff so I can't insulate myself totally from it of course, but I can maintain discipline. I also have very detailed buy and sell rules written as well which have served well me thus far.

If after several months this method fails to work for me consistently, I have a couple of profitable systems to fall back on, thanks to Technitrader, you and others on this forum. Not wildly profitable, but enough that I know I can get back into swing trading if the need arises and work to perfect these systems. Thanks again.

Griz

|

|

Registered User

Joined: 7/28/2007

Posts: 118

|

Now back to IIVI, I agree funnymony, that the even 40.00 price (psychological I guess) along with 40.00 being the analysts price target, combined with the fact that most in this sector got murdered yesterday, were the primary factors that led to the huge sell off. However as I mentioned in my post yesterday, It looked as though this stock found strong buying support to finish the day at the 50dma so I bought my position back at 35.51. Looks like I was right, at least this time, up 9.5% in one day. Many other tech stocks did not enjoy this bounce back.

I would normally have looked for IIVI, which is a leading stock right now, to sell off in light volume from time to time during a run up, which I would have held through of course. I am not looking to catch swing highs, I am looking for longer term bigger gains, that is why my stops are pretty wide. If this method proves not to work well, I will go back to taking profits quicker, for now I'll sit tight when I can.

Yesterdays sell off was an anomaly....I hope. I still can't help but wonder if there wasn't some sort of market manipulation taking place. I do not know of any indicator that could predict such a violent one day sell off....sell off yes, but not what happened yesterday.......Now watch it go to $20 in the morning.

I know this forum is dominated by short term traders, but I would also be interested in views from some of the longer term holders...Thanks again to all of you for your responses.

Griz

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Grizz, I am glad that you are mastering one trading style and have settled on that idea. I tried CANSLIM and do not like it, but that should be irrelevant to you, stay on course my friend because that is how you find out what works and what does not. You will not be qualified to discuss what works or not if you do not have experience to back up your claims.

Reading the technicals is not a system, it is like reading a message that contains information of details for a planed course of action by a group if people in the know. You can use any system but (IMO) things can change against you rather quick like and the warning signs will first appear in the technical reading of price action on the chart.

I too belive in intermediate to long term time frames but not in a proven Bear market. Just as a Bear can and does profit from short term short selling of stocks in a Bull Market, so to can a Bull trade short term long positions in a Bear market. When this Bear Market is over than I will return to my prefered methodes of longer term time frames.

And (IMO) you bet that the recent price action in IIVI is manipulation. If you look at an intraday chart of the very day of the sell-off then you can still see signs and times of great buying right as price hit rock bottom the smart money was there to get bargain prices, a good example of VSA in action. It is market phsycology, profit taking followed by bargain price buying. The earning report was strong on an idustry leader. This type of action was not expected but also no big suprize.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Apsll;

As to 1-2-3, see if this helps: http://www.worden.com/training/default.aspx?g=posts&t=29655.

We can discuss more if you'd like. This was a discussion on shorting, obviously. So the concept applies to implied weakness on a long position and, thus, a good place to set your stop.

In essence, the point is if price drops below a proven support level, it's a sign of weakness and a good time to be out of a stock; at least in this market.

|

|

|

Guest-1 |