Registered User

Joined: 3/25/2005

Posts: 864

|

prefer entry initially below Friday's close; secondarily below Friday's low.

Possible target by Thursday (hopefully before then) is 49.23.

mp

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

i'll wait var to hit 42 and buy gsg instead.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

VAR is a good pick MP, It is one of the stocks highlighted on my "VSA GAP" thread. GSG is not even VSA material (althought that is a bullish Doji sitting there).

Mp, try this percent true indicator to find these tyes of VSA formations. Let me know if you like it. - (h<l1)and(v>(v1*1.8))andc<o)and(c>l)

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

QUOTE (funnymony) i'll wait var to hit 42 and buy gsg instead.

GSG doesn't seem to be moving too fast. How long do you think you will have to wait

to see a decent profit, funnymony?

mp

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

Sure, Apsll. I'll write code for it and check it out.

Thought you were on vacation? I didn't plan to check in on Yahoo next week.

mp

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

My Vacation starts tomorrow, and I return Tuesday the 22nd so yes I will not be avalable for chess next week. I will have some answers to certain things when upon my return.

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (memorableproducts) QUOTE (funnymony) i'll wait var to hit 42 and buy gsg instead.

GSG doesn't seem to be moving too fast. How long do you think you will have to wait

to see a decent profit, funnymony?

mp

i guess i'm more of a follower of classical technical analysis. i try to avoid "scalping" or "day trading" which is what "vsa" seems to be.

but i'll keep an open mind and observe.

gsg not moving to fast? hmmm? coulda swore commodities have been the hottest sector in the market over the past several months.

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

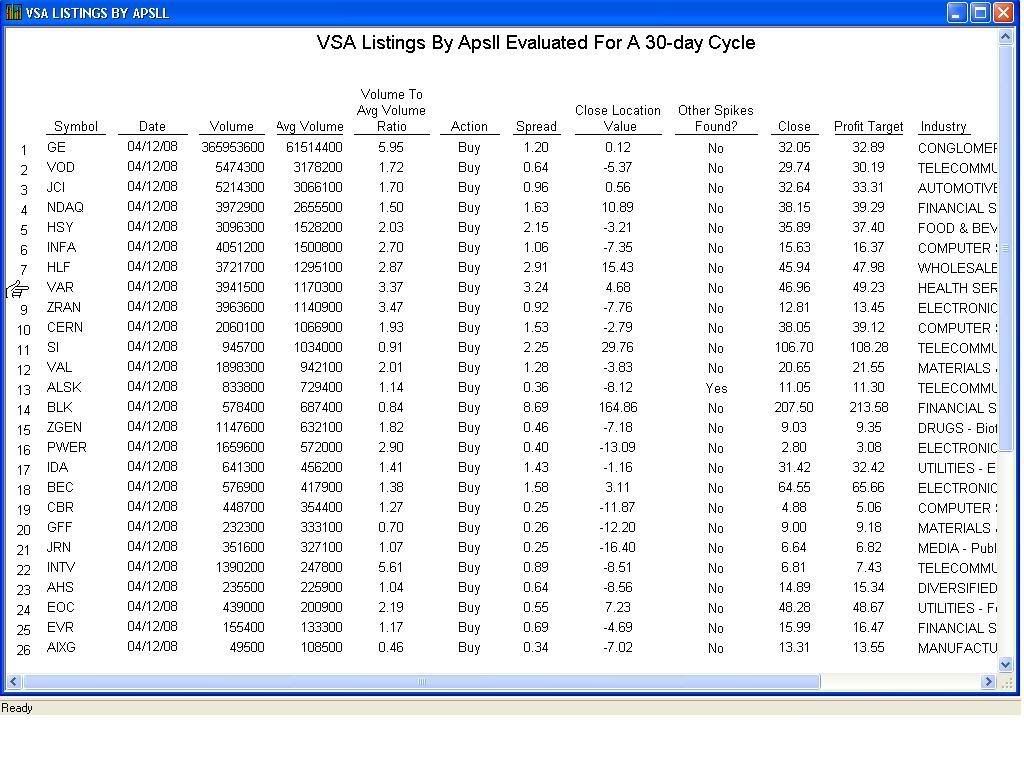

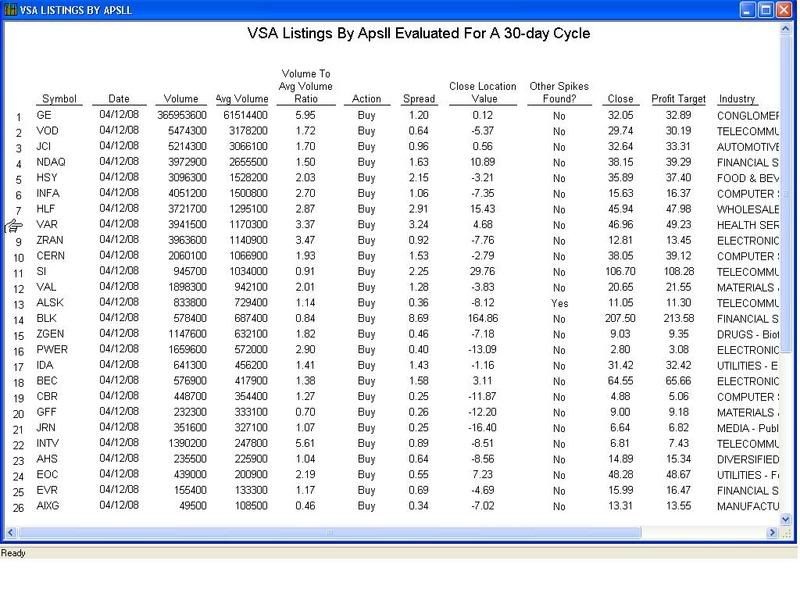

Does this listing look familiar to you, Apsll (missing about 13 entries at the bottom)?

http://i241.photobucket.com/albums/ff2/memorable_products/apsll_listings.jpg

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

Funnymony,

My VSA picks are not meant to be day trades unless my profit target is hit in the same day that I've placed the trade at which point, of course, I will grab the profit intraday and move on to another stock. But, my duration expectancy on these is for up to several days.

You don't have to babysit these VSA picks as you would in a daytrade. Instead, you can setup a bracket order and go on about your other business.

And, I thought commodities had cooled off?

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

VSA is just as valid a classical Technical Analysis tool as any other, and is not defined by any time frame. Like all technical analysis it can be used on all time-frames. VSA is simply put a technique that smart money uses to accumulate shares during the down trend of price action. This action can be usefull for day trading, swing trading or position trading. You just have to know how yo read the signs and when to react.

GE is another good candidate for. in this case - Day Trading. In the two charts below you will see what I mean (if you have read the threads and other possible sources on VSA).

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

Test:

[IMG] http://i241.photobucket.com/albums/ff2/memorable_products/apsll_listings.jpg [/IMG]

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

Apsll,

How do I get my images to post directly like yours?

mp

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Mp, look at the first examople. you have to copy the second choice highlighted in red -

Direct Link

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Then you follow the directions below to insert your pic to the forum. -

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

Cool! That'll work. Thanks!

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Now you have to adjust your pixels so that you do not distort the width of the thread, Scott, you need to do this also.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

I see what you mean, Aspll. Thanks!

|

|

Registered User

Joined: 12/27/2006

Posts: 36

|

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

Apsll, you ask me to tell you what I thought of your list.

Let me show you instead (these are the ones that made my cut base on the current spread being equal to at least 1.00 and the Close Location Value being greater than 0.00):

If I further apply my volume spike ratio requirement to the above list, VAR would still be the last stock standing.

mp

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Mp, I looked at the ones that were not already on my list becauase clearly we agree with the ones on both of our lists. BEC & BLK I like a lot. SI is to gappy for my taste (I do not like stocks with little candles that gap almost every other day) I think that TMB, ECH, Have more to go on the downside, they just now turned down from a rally. We will re-visit this when I return on the 22nd.

Good luck next week my friend.

Apsll.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

PS: How could you leave CERN off your list. Think about day trading it Monday or Tuesday....

|

|

Registered User

Joined: 3/25/2005

Posts: 864

|

I didn't take anything off the original list. My program filtered it out based on criteria for any negative close location values or spreads that were less than 1.00.

I'll put CERN on my day trade watchlist for Monday, though.

Enjoy your vacation!

mp

|

|

|

Guest-1 |