Registered User

Joined: 3/21/2006

Posts: 4,308

|

I have recently been in study of the mechanics of selling short. A Webinar on the Worden website hosted by Larry Connors was very inspiring and so given the current market condition I feel that I am ready to rock on the short side.

If you do not want to watch the webinar then at least check out a thread by Ben2k9 that spells out a great bit of Larry's methodology. Simply reversing the methods within the thread will give you the mechanics of going short in the market. Here is the link to said thread. -

http://forums.worden.com/default.aspx?g=posts&t=42329

One indicator not mentioned in the thread but one that Larry uses quite a bit is the 'Wilders RSI" with the period setting of 2. Use the indicator as an oscillator and of course the lower the value is than the more over-sold the price action is and then reverse that for shorts.

Here is a list that I compiled from my scans. Notice that everyone of these are Inverse ETF's. Not only does Larry prefer to trade them but the very fact that they are showing over-bought is a clue that soon we could see a bounce in the markets. How long of a bounce is anyones guess but here is the list.

Good luck.

|

|

Registered User

Joined: 4/28/2005

Posts: 59

|

Apsll would you be willing to share your %True Indicator formula?

Paul

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Hello Paul:

I have just revised the percent true indicator. You know me, always tinkering. I wanted to cut down on the amount of hits that I was getting in my scans because a lot of them were just not what I was looking for in the price action. I abandoned the "New high" and the New low approach in favor of just using the RSI2 value.

The new indicator formula tells me simply when RSI2 is > 80 and C>C1 I then put these stocks in a watch list that is already filtered by price and volume. Next I will monitor the value daily and with a second indicator will tell me when the RSI2 value tops 98

Here are both indicator formula's

100 - (100 / (1 + (((C1 > C2) * (C2 - C1) + 1 / 2 * ((C2 > C3) * (C3 - C2) + 1 / 2 * ((C3 > C4) * (C4 - C3) + 1 / 2 * ((C4 > C5) * (C5 - C4) + 1 / 2 * ((C5 > C6) * (C6 - C5) + 1 / 2 * ((C6 > C7) * (C7 - C6) + 1 / 2 * ((C7 > C8) * (C8 - C7) + 1 / 2 * ((C8 > C9) * (C9 - C8) + 1 / 2 * ((C9 > C10) * (C10 - C9) + 1 / 2 * ((C10 > C11) * (C11 - C10))))))))))) / ((C1 < C2) * (C1 - C2) + 1 / 2 * ((C2 < C3) * (C2 - C3) + 1 / 2 * ((C3 < C4) * (C3 - C4) + 1 / 2 * ((C4 < C5) * (C4 - C5) + 1 / 2 * ((C5 < C6) * (C5 - C6) + 1 / 2 * ((C6 < C7) * (C6 - C7) + 1 / 2 * ((C7 < C8) * (C7 - C8) + 1 / 2 * ((C8 < C9) * (C8 - C9) + 1 / 2 * ((C9 < C10) * (C9 - C10) + 1 / 2 * ((C10 < C11) * (C10 - C11)))))))))))))) >80ANDC>OANDC>C1

100 - (100 / (1 + (((C1 > C2) * (C2 - C1) + 1 / 2 * ((C2 > C3) * (C3 - C2) + 1 / 2 * ((C3 > C4) * (C4 - C3) + 1 / 2 * ((C4 > C5) * (C5 - C4) + 1 / 2 * ((C5 > C6) * (C6 - C5) + 1 / 2 * ((C6 > C7) * (C7 - C6) + 1 / 2 * ((C7 > C8) * (C8 - C7) + 1 / 2 * ((C8 > C9) * (C9 - C8) + 1 / 2 * ((C9 > C10) * (C10 - C9) + 1 / 2 * ((C10 > C11) * (C11 - C10))))))))))) / ((C1 < C2) * (C1 - C2) + 1 / 2 * ((C2 < C3) * (C2 - C3) + 1 / 2 * ((C3 < C4) * (C3 - C4) + 1 / 2 * ((C4 < C5) * (C4 - C5) + 1 / 2 * ((C5 < C6) * (C5 - C6) + 1 / 2 * ((C6 < C7) * (C6 - C7) + 1 / 2 * ((C7 < C8) * (C7 - C8) + 1 / 2 * ((C8 < C9) * (C8 - C9) + 1 / 2 * ((C9 < C10) * (C9 - C10) + 1 / 2 * ((C10 < C11) * (C10 - C11)))))))))))))) >98ANDC>O

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

It is funny because I did make an attempt to short the QID but got a red flag that there were no shares avalable to short on most of the invers ETF's....

Yes I could have went long on the "Pro Shares" but I had to stop and wonder just what is going on. If you look at my charts below you will see some telling signs in the Volume indicators.

On the Bear ETF's the BOP pattern is strong as apposed to the Pro Shares wich are sporting very weak BOP profiles. I know that BOP is a lagging indicator vs TSV & MS so I also checked them out as well. The TSV & MS profiles do seem to be turning over on the Bears side of things so I will just wait things out.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

PS:

Paul, I found that those formulas above were not as reliable as this one below. You can adjust the last number in the formula to fit your needs, for example you can change the "20" to a "2" or for over-bought conditions you can change the "20" to "90" or a "98"

100 * ((C > C1) * (C1 - C) + .5 * ((C1 > C2) * (C2 - C1) + .5 * ((C2 > C3) * (C3 - C2) + .5 * ((C3 > C4) * (C4 - C3) + .5 * ((C4 > C5) * (C5 - C4) + .5 * ((C5 > C6) * (C6 - C5) + .5 * ((C6 > C7) * (C7 - C6) + .5 * ((C7 > C8) * (C8 - C7) + .5 * ((C8 > C9) * (C9 - C8) + .5 * ((C9 > C10) * (C10 - C9) + .5 * ((C10 > C11) * (C11 - C10) + .5 * ((C11 > C12) * (C12 - C11) + .5 * ((C12 > C13) * (C13 - C12) + .5 * ((C13 > C14) * (C14 - C13))))))))))))))) / (ABS(C - C1) + .5 * (ABS(C1 - C2) + .5 * (ABS(C2 - C3) + .5 * (ABS(C3 - C4) + .5 * (ABS(C4 - C5) + .5 * (ABS(C5 - C6) + .5 * (ABS(C6 - C7) + .5 * (ABS(C7 - C8) + .5 * (ABS(C8 - C9) + .5 * (ABS(C9 - C10) + .5 * (ABS(C10 - C11) + .5 * (ABS(C11 - C12) + .5 * (ABS(C12 - C13) + .5 * (ABS(C13 - C14)))))))))))))))<20

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Do not forget to change the < sign over to a > sign for over bought conditions....

|

|

Registered User

Joined: 4/28/2005

Posts: 59

|

Apsll, thanks for sharing!!! I'll study your formulas with great interest as I too listened to the Larry Connors webinar and was intrigued enough to take a look at this approach and see if I can use in my trading.

Paul

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Paul, thanks for responding back. I hope that you decide to test these methods as I am currently doing. No one in my trading groups are brave enough to take on this contrarian style of trading. Most of them do not use Telechart either. It would be nice to work with someone that uses telechart so that we can help each other uncover tradable charts and compare notes or new ideas.

Once the markets return to sanity then I will continue my normal swing trading but now I will also have these methods of shorting and contrarian thinking to see price action in a different and more educated light....

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I am still new to shorting the market so when I first started this thread the markets were already over-sold (not the best time to sell stocks short, unless we are dealing with the Bear ETF’s)...

I need to make sure that as many conditions as possible are moving in the direction that I want to trade. Right now the Markets are entering into over-bought territory. I sold my longs on Friday (selling into strength), and now I am looking for "Sell Short Set-Ups".

Below is a list of stocks that I am watching very close and I will take positions when the time is ripe. I am still working on my entry strategy as my goal is to not let price drop to fast without me. They say that exit strategy is more difficult but I have that down already. My exit will be when price drops closes below the 7 sma.

Another condition for consideration is that price should be in an intermediate down trend and below the 200 sma. I some cases it is fine if price is wrestling with the 200 (just above or below).

Here is the new list.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Below you will see an anatomy of my set up or plan for shorting TMX.

Notice the yellow trend line on volume. Price is moving up on fading volume. This action in relation to volume says to me that we could see a pull-back here. I do believe that the larger picture is very Bullish on this pattern but for now I am interested in the very short term action.

I will want to be there near the closing bell on Monday to see what kind of candle is forming. If we have a Bearish engulfing candle that breaches the low of Friday then I will "Sell Short" @ $14.60

Now just .40 bellow my entry I will have to contend with the 20 sma so I will want to "Buy to Cover" at that level. If you are in for 1,000 shares or higher then this will be a profitable trade. If you want to use a stop then place it around $15.00 but I will not be using one.

If at the close, price is not where we need it to be then we pass this trade bye.

It is all about putting the odds in your favor and using strict rules without emotion.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I covered all my shorts today and did ok. I am all cash now and will wait for another market extream before sell short or buying long. Drj is a new member that seems to know his stuff about the short side and I hope to pick his brains going forward. As for now though I am playing it safe.

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Hi ApsII

Sorry about communicating via another members thread. My wife would have know better, as she is a little more up to date on appropriate protocol. Thanks for letting me know.

There are some good short opportunities today. Real quick in and out, and back to cash at the end of day.

For instance, HAL hit my initial short entry price (anywhere between 29.80 and 30.23) with a HOD so far of 30.33. Unfortunately, I am unable to enter this, as I got all excited about HOG, and entered short position at 26.85 (38.2 fib line). Am looking for pullback to at least 25.30, but will take 25.65-70 in order to enter HAL at its HOD, whatever that may end up being.

Also, you may want to look at GS. It actually went positive a little while ago, with a HOD of 146.90. I did a quiclk check and found unfilled gaps from Friday and Yesterday at 147.45 through 147.67; 147.97; 148.32; 149.29 and 149.91. Now, it may not fill all of the above, but I think that it may at least fill the largest of the gaps at 147.45-147.67. Even if it only gets back to today's HOD of 146.90, the upside risk from there is a tad over 2%. Just a thought.

Get back in the game Maverick!

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Drj, Can you post a chart as to these gaps? I am not seeing them on the 1 minute charts and I would love to see what you are seeing. I found that I was not doing well with my scalping in these markets so I have not been doing so (for now). I have better luck scalping in more familiar markets, so that is why for now any way I am working with Larry Connors methods. I see that I have missed some good trades by not trusting his entries which in my opinion in some cases requires blind faith. Since that has never been my style then I am working on refining the entries to something more palatable but my profits are only meager at this time. At least that is better than the small loses that I was incurring trying to scalp on the intraday longs..... (And very few short scalps).

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Hey it's working!

Sorry about that ApsII. The site was not taking my posts for the last hour or so.. I finally had to restart computer. I am a little slow, as it relates to atttaching, transferring, posting, etc... especially from anything other than regular e-mail to regular e-mail. I am quite sure that you will tell me that this site is the exact same protocol, but I don't want to delay it any longer than I already have.

Stockcharts.com allows for transfer of the charts via regular e-mail, twitter, tweet on chart.ly, etc...Since the expert (my wife) is not here, would you mind giving me a brief rundown on how to do this? I guess I won't hear the end of this one, will I? Ha Ha!

Thanks:):)

Jim

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Jim, here is the standard explaination. Dvidjohnhall explained it best so why mess with perfection....

http://forums.worden.com/default.aspx?g=posts&t=27860

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

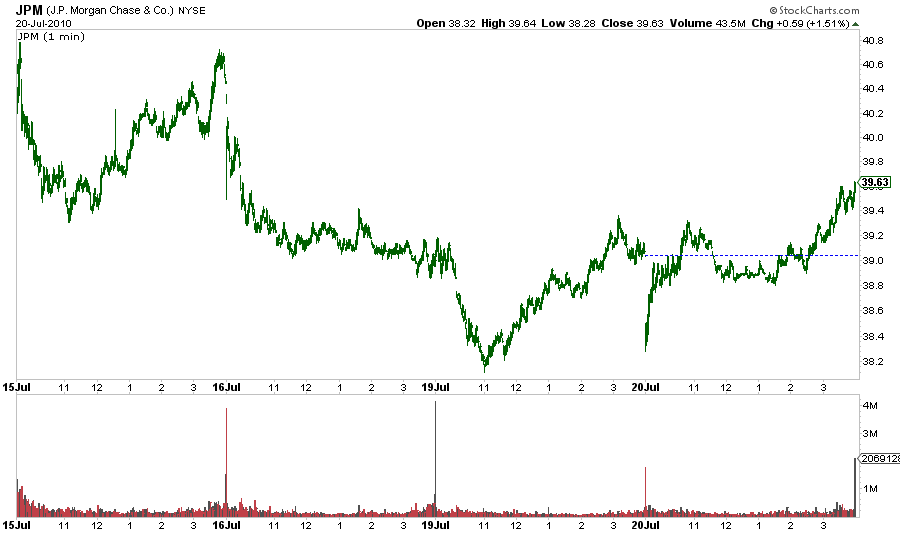

http://stockcharts.com/h-sc/ui?s=JPM&p=1&yr=0&mn=0&dy=4&id=p51818125896&a=204424193

Hey ApsII

I am soooooo confused. Will this suffice? If you are able to open it, you will notice JPM minute chart for the last few days. I deleted grid and changed color of print so that it would be easier to see. When on stockcharts.com, you type in ticker that you are interested in, hit annotate (flash) or annotate (java), and it brings up the tools panel. From there, I am able to set trend lines, fib lines, etc....However, I only use the magnifier glass option, and this is a must, as it relates to finding these gaps.

Please note that I recently noticed that if I set the amount of days to less than 3 or 4 trading days of data, the chart would not show some of the gaps (setting it to find gaps from one to twenty trading sessions back is not a problem). This may just be some random occurrence, but from now on, I will make sure that I try one day, all the way out to twenty days if I have to.

Having said all of the above, to some this may seem rather mundane, impractical, worthless, voodoo, or whatever, but since I have been doing this, I have been able to definitively determine if a stock is actually moving up and/or down (most of the time defying logic) secondary to fundamentals, news, etc..., or due to filling some unfilled gap. Believe it or not, the charts (like they are alive or something) don't like to have unfilled gaps. Oh by the way, unfilled gaps, and subsequent retracing of said gaps, seems to be necessary for 2 to 3 weeks prior at most. Also, from your experience, you will obviously figure out that a lot of obvious gaps never get filled in the near term, but eventually the stock will fill the gaps, even if it's several weeks or months later.

Let me know if you need anything else.

P.S. DId you notice GS price action? It retraced and filled 147.45 through 147.67; 147.97 and 148.32.. Only 2 more gaps to fill....149.29 and 149.91. It may not fill them, but now you know that it is okay to enter short position.

Later

Jim

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

http://stockcharts.com/h-sc/ui?s=GS&p=1&yr=0&mn=0&dy=6&id=p06157008083&a=204533323

Hey ApsII

Check that last GS message. I just went back and manipulated number of days viewed on the GS chart, and you will see that there are a couple more unfilled gaps, well actually one uninterrupted gap from 150.71 through 151.15. Even with HOD currently at 148.60, you can see that, should it decide to fill these upper most gaps, the upside % risk is a little less than 2%. Sorry about the confusion.

Jim

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Jim, in the link that you posted I can only see the daily candles. If you save your chart to your dest top and then up-load it to "photo bucket" then you can down load the link here per the instructions provided by Davidjohnhall.

Again I would like to follow along with your analysis and as they say "a picture is worth a thousand words"....

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Hey ApsII

Sorry about that. This is what I tried to send a couple different times, before my wife got home and showed me how to do it the right way. Let me know if you are able to visualize everything on the chart. As you can see, this is JPM one minute chart for the last four trading days. The gaps are pretty obvious. I obviously changed and altered some of my stockchart.com settings, in order to help you better visualize the chart.

Also, I have some information that I want to send to you, but it is not for posting. Let me know if there is a different way to send it, other than this site. Once you read and verify this information, I will let you determine who you want to share it with after that. If you were to read through and verify what I send to you, sometime tonight, you will see that, instead of protecting assets and playing it safe while waiting for the next market extreme, you can make as much as you want for the rest of this week, as well as any other week. This is not some type of advertisement, I promise. I do not provide market advice in exchange for money. I don't have the time, nor do I need extrra income. This is just my trading style based on 24/7 chart dissection. What can I say? I get one to two hours of sleep per night, and have always been that way. Take a look at the information. It won't take someone with your knowledge very long to see that the information contained in the document is priceless. And, if I was able to figure it out, as it relates to how the market actually works, there are numerous others who have done so as well. In other words, I'm probably the 5,000,000th person out of 5,000,001 who have figured this out.

Let me know if the chart comes through okay, and let me know how to send other information.

Thanks

Jim

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"Also, I have some information that I want to send to you, but it is not for posting.

If you were to read through and verify what I send to you, sometime tonight, you

will see that, instead of protecting assets and playing it safe while waiting for the

next market extreme, you can make as much as you want for the rest of this week,

as well as any other week."

=================================================

This doesn't make a whole lotta sense.

In the "Opinions" post you said to Apsll:

"Thanks for all your advice/suggestions, as it relates to various stocks.

Up until I had my you know what handed to me in early May, I only knew how to go long.

What do you think? Could really use your input on this, just to confirm/refute."

==================================================

So if I have this right,

In May you didn't know how to short.

Now you have the "secret" of the markets, you don't have to play it safe,

you don't have to protect your assets, you can make money any week,

yet you still ask Apsll what he thinks, you seek confirmation from Apsll.

You ask for Apsll's input.

I would think if I had the "secret" of the markets I wouldn't have to ask anyone

anything.

Thanks

diceman

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Hi Diceman

Thanks for pointing out the above discrepancy/contradiction, and believe me, I am not offended by it at all. I deserved it. Simply a matter of being new to a post and asking for advice/knowledge, in an albeit unorthodox and chicken crap way. Sorry about that. Please accept my apology, and the same for any other member who may have already read this.

With regard to any market "secret," I doubt that. Like I said in the post, I am probably the 5,000,000th out of 5,000,001 that has figured it out.

What have I figured out? Nothing that the majority of you don't already know. It's just that the majority refuse to believe that it actually exists, and has existed for longe than you and I have been around.

In a nutshell....how to determine when to go long or short, any stock, any sector, and limit upside/downside risk to less than 1%. Usually 0.5% or less. Well, actually more times than not, within 0.3% or less.

If you still feel like I am full of it, you can pick a stock , as long as the stock is currently in the S3 up through R3 channe (pivot point/S/R channel), and we will see who gets closer to the top price that that particular stock reaches, before it becomes a full on, back the vault up, short sell stock.

Or, and I am sure that you and the fellow member's would appreciate this one better....you could give me 2 to 3 stocks that you are interested in (same thing, they must be in the S3 up through R3 channel), and I will tell you which stock to pick, as far as it relates to entry price and highest % gain over the next few days. In addition, whichever stock that I pick, and you will be able to verify this, will have 0.5 to 1.0% downside risk max, while it makes its way to the target price. And, if you are currently holding some stocks, you could let me know entry price and what you are hoping for target price. I will then evaluate and let you know whether or not that is possible in a reasonable amount of time, and will let you know what your max downside risk is.. If you know max downside and/or upside risk, you never have to set a stop. When you set a stop, those darn price spikes always seem to come and ruin your day at the most inopportune time.

Well? Let me know what you decide. I already have two current shorts (ESV and HOG), and will be getting a long position tomorrow. This particular long will net me a minimum of $20,000 on my $500,000 initial entry based on 7/20 closing price. That's just under 4% net guaranteed. No stops or puts needed, as the very minimal downside risk won't call for it.

Let me know what you decide. And don't worry, negative economic (be it global or otherwise) will not prevent your stock pick from reaching the target price that I pick (just like the market today). Time frame? By the time that the major indices (or sooner) fail to surpass the June 21 highs and head back down to break through the July 1 lows. If you really like the long pick, you can rest assure that it will be ready to short (again, with very minimal upside risk) when everything heads back down. That makes it real easy, doesn't it Iceman?

Once again, sorry for the earlier blog and the obvious dick move. Hopefully, we can start fresh and actually assist each other from now on. And yes, even though I have it "figured out," doesn't mean that I will ever stop wanting to know anything and everything about the markets in general.

Jim

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Good day ApsII

Thanks for keeping an open mind at least. And don't worry, everyone is a skeptic, including myself. It's a protective mechanism and entirely appropriate.

I will get document to you sometime today. Just look it over, research and verify for yourself. Don't believe everything that you hear, including what you hear from me. Again, I am the same way. If I hear about something, be it rumors or market information, it doesn't exist until I verify it. That is just plain common sense. If, after researching, backtesting and verifying for yourself, you want to call B.S., you've got to do it! I would. It's only fair. But, before anyone can call B.S. on anything, you've got to put the effort in to try and refute. Don't be like tomson10. Just kidding... If you like what you find out, and choose to apply it to your own trading technique, go for it. And you can even pass it on to tomson10 if you want. I believe in helping out our fellow traders, because we all know that it's a never-ending battle, as it relates to trying to beat the market. Or should I say, Big Money and the Black Box.

I am currently busy keeping watch on price action for watchlist, as well as major indices. Charts show evidence of another end of the day rally, so prepare accordingly.

With regard to recent posts, go back and backtest some of the information that I provided, keeping in mind the day, as well as time of day, when figuring out total returns, as well as maximum risk, based on my calls.

For instance, I advised yesterday that GS (price at time was 148.60) was good long candidate up until 151.15 due to unfinished business at the 150.71 and 151.15 levels. So far today, it took out the 150.71 hurdle, and HOD thus far is 150.97. Chart shows that it will take out the last hurdle today, and will most likely give another 0.5% before petering out. If you got in when I advised yesterday, and get out when it takes out 151.15 later today, that is not a bad ROI. But don't hold it through tonight. That's just playing it safe.

Advised on Sunday morning that CMS was not safe short until 16.00, at which time, the upside risk (remember, short term one to two trading session time frame when I am quoting safe entry price and max risk) was 2%. Tuesday morning around 4:00 a.m EST, advised that, if still holding off on CMS, you could wait until 16.08. So far today, it hit 16.06, and by end of day will take out 16.08 and should end aprox 16.12. Or if you want, you can play it from current price right now (15.83) as a long, and then exit when it gets to 16.12. It will reach it, and will also reach the 16.50 level, with no more that 2.5% downside risk (and that's completely stretching it-----more like 1.0% to 1.5% downside risk max) in the not so distant future. But once again, remember that we only want to operate in the 1 to 2 trading session time frame max!

Advised yesterday that JPM was safe long until at least the 40.59 level due to unfinished business, as well. At the time that I advised of such (when I was having difficulty getting chart sample to you) , JPM was trading less than $39.00......something like 38.90 or so. Today it has HOD at 40.25 (already more than 3% gain since advising you at the sub 39.00 level). If you got in, get out when it challenges (may or may not surpass today, but it will) today's HOD. If you are unable to get out today because it doesn't challenge HOD, don't worry, keep the long position and get out at 40.31, or 40.50 level during next market rally. Again, chart says it will reach 40.50 level (at least), so that is what will happen.

Also go back and review ESV and HAL advice, once again, keeping in mind that the advice is valid for 1 to 2 trading sessions max. But guess what? So far, 2 to 3% minimum is not bad ROI, as it relates to recent posts. Just extrapolate, as it relates to per week, per month and per year.

To all the skeptics and naysayer's, it is perfectly appropriate response. Like I said before, I would do the same. But give ApsII time to go over information, and let him be the bearer of the good and/or bad news.

Gotta go....

Happy Trading everyone!

Jim

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

P.S. Short CRUS (anywhere between 19.20 and 19.30) with everything that you have, and everything that you can get your hands on... Go to Grandma's and take the money out of her secret hiding place (aka the sock drawer). Do not hold overnight!

Jim

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Hello ApsII

I hope your trading day went well.

As you can tell, I pulled out my crystal ball, or at least that's what it felt like, gave it a good rub, and posted advice on what I refer to as a, "back up the vault," and dump every single penny into shorting CRUS "anywhere between 19.20 and 19.30." At the time that I posted (1:21:31 PM EST), CRUS was trading at exactly 19.17. Exactly 45 minutes later (1:57:00 PM), CRUS hit its HOD for the last time, when it hit 19.35.

As you and everyone else can see, even from the time that I posted, the maximum upside risk never exceeded 1.0%. And, if anyone out there had actually waited until the "anywhere between 19.20 and 19.30" bugle call, the max upside risk was obviously quite a bit less. In fact, I am currently rubbing my secret crystal ball calculator (it came with my secret crystal ball stock picker), at least that's what it feels like, and entry at the 19.29 price (because I said "between 19.20 and 19.30") resulted in maximum upside risk of 0.03%.

Anyhow, at exactly 3:02 P.M., CRUS hit its LOD at 18.56. Therefore, from the time that it hit 19.35, until the time that it hit 18.56 (65 minutes), shorting CRUS resulted in profit of 3.3% up to 3.8% (depending on entry price somewhere "between 19.20 and 19.30").

Hey tomson10.....are you interested in my secret crystal ball now? Did you take my advice; raid your grandma's sock drawer, and let everything ride on CRUS? Just kidding! Even a broken clock is right two times a day, right?

Gotta go rub the crystal ball for tomorrow's pick!

P.S. And yes, 1,065.25 at 3:03 PM to 1,070.37 by 3:51 PM can be considered an end of the day rally.

Jim

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I had a good day.

I am looking forward to checking out the mechanics of your system. Cannot wait until you post them...

Apsll.

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Good morning ApsII

You got it.

In the mean time, check out HOG. I found unfinished business between 27.72 and 27.83.

Back up the vault. It took out 27.72 early. It may or may not take out 27.83, and the chart says that max HOD is aprox 28.10, and that is if all the bull stars are aligned. Will never happen. Not in this market.

If you are lucky enough to get in somewhere between 27.55 and 27.70, snag it quick. This is just a quick in and out by closing bell trade. Look at yesterday's candlestick and you will see that there won't be much price action above yesterday's high, and will probably have LOD somewhere south of yesterday.

I already have 11000 shares for me, and got 15000 for my mother in law. The difference is that her margin account is a few hundred thousand more than mine. Plus, if the trade doesn't work out, it is a subtle way of getting back at her. HA HA!

Anyhow, verify 15 min through daily stochastics for yourself (as well as yesterday's candlestick), and you will see what I mean.

BACK UP THE VAULT MAVERICK!

Happy Trading!

Jim

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

P.S. CRUS is back up the vault again, just like yesterday. I found that it had unfinished business at 19.21 for sure, as well as possible unfinished business at 19.30. However, as with HOG, look at daily candlestick from yesterday, and the same applies. Chart says that max HOD today is aprox 19.66, but looking at this morning's price action, someone would have to shove an M-100 up its ass (and light it of course), and I don't see that happening.

As always, review indicators, yesterday's candlestick/price action, and if you agree, just like yesterday's advice on CRUS, it applies today as well....large capital expenditure and in and out by closing bell.

Also, do not use stops on these trades. The price action is figured out, and when you do that, the only way that you will get burned, is if the company is an acquisition target. You do not want one of the big money/black box spikes taking you out.

Happy Trading!

Jim

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Hey ApsII

I usually mind my own business, but I can't resist.

I saw your post this morning on that Dan Zanger bada bing bada boop, or whatever it is. Are you crazy?

Candidates for long term investment? I hope you aren't talking stocks. And if you are, I hope by long term, you mean 1 to 7 days max. You know, about the amount of time that it takes for a nice quick parabolic run, and then getting out before even the first sign of weakness. Come on Maverick. Did you hit your head on the canopy when you ejected.

You know that I am just busting your chops........about hitting your head on the canopy.

Jim

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Drj,

the markets are telling me to sit on the sidelines for now any way. You appear to be a day trader and although this is a day traders market I am just not good enough doing so. I am a believer in protecting capital when the markets are not to my liking.

When I do stick my toe in the waters it is always with small lots so as not to upset the integrity of my capital base.

In my real account I will not be investing just yet but since I have given up all hope of using the simulator that we are now stuck with then I will just buy PWER and ENTR and just hold them until the end of the contest. It is my plan to be holding both stocks soon if/when the Bulls take control of this choppy Market.

The current Bear channel that the SPX has followed is now broken by the Bulls and in my opinion the ball is in their court. This is not to say that the Bears will not steal it back though.

As to your analysis above I still do not see your point yet. Please get to it so that I can share with you my opinion...

Thanks

Apsll.

|

|

Registered User

Joined: 5/9/2010

Posts: 19

|

Good morning ApsII

Hope all is well.

I am definitely not a day trader.....nor a swing trader.....nor a buy and hold, be it short or long positions.

I just try to adapt to the current market conditions, and as you can see, there is a tad bit of uncertainty, and thus the triple digit DOW, as well as the double digit S&P/NASDAQ gains/losses, on what seems to be a daily basis.

Even though I always try to get to all cash, and advise people to do the same, by the end of the day, I have no problem holding a stock overnight, regardless of economic uncertainty, if I didn't get the gain that I wanted on that day. There is always the next day.

WIth regard to the information, I forgot to write down your contact information when you posted it the other day (thinking that it would always be here), and when I came back to site, it was no longer here. Maybe I am not looking in the right place. If so, I apologize.

If you want to look at some good ol' Big Money/High Freq Trader manipulation, go to ESV chart (intraday), and look at the aprox 9:32 a.m. and 11:34 a.m time frames. That is a big hint about near future direction, and these are the exact clues that will allow you to predict price action to within a few pennies (like I did with CRUS and HOG yesterday, as well as CRUS on Wednesday). It is also these types of clues that will allow you to forget about stops (once you learn these intentional and manipulative actions inside and out), which will do nothing but cause you to get taken out by these same intentional price spikes.

Remember the main purpose of these spikes, and trade accordingly (e.g. enter position with any % of upside/downside risk that you choose).

Happy Trading! And once again, sorry that I forgot to copy that Skype info the first time.

Jim

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Hello Drj:

Yes, just skype me as (contact info removed by moderator - as your followup comment notes, you know it is against the rules and did it anyway - continued deliberate violations could result in a permanent ban).

the forum moderators do not like folks sharing private information. The logic escapes me but I do not own the forum so it is not my call. Hopefully you can grab it before they do. As far as the local trolls like tompson10 and johnlc, just ignore them. None of them know how to actually trade and they spend most of their time telling others how crazy they are or lame or other such juvenile themes.

I actually wish that you would just share your strategy with the group here as I am sure that you have peaked their interest, otherwise the trolls would not be responding....

Talk to you soon and have a nice trading day today...

|

|

Registered User

Joined: 6/15/2008

Posts: 1,356

|

DrJ,

one of my goals is to at least learn one thing every day. it seems that you are referring to some sort of pivot point support/resistance indicator. I'm very interested to read about it. (contact info removed by moderator)

or ApsII if you got the privelege of deciding whether to distribute it or not, put me on your list :)

have a great day.

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

I sure will Pthegreat.

In the mean time I have a chart that I want to share. In another thread I examined the "Bull Short". It was something that was shared with me and it seems to have some merit when the spike in volume and price is "News" related. The stock is AEIS and their earnings release was yesterday right before the opening bell. It was very good news and price reacted well.

My question would be in reference to statistics. In other words; we all know that news is fleeting and supposedly factored into price before the event, knowing this as we do "?", what do the back-test results show us? We know that sometimes price will fall on good news and rise on bad and the reverse is also true "at times"... We know why the Bull Short works "Sometimes" because the volume is mostly made up of weak traders and speculation since the "Smart Traders" have already been absorbed into price.

Any way here is the chart if any care to treat this as a "Bull Short" or a "Break-away Gap"

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

Grow up and stop insulting each other or I will start banning people (maybe even permanently) instead of deleting posts. If you can't make your point without a personal attack, don't post (as the entire post will be deleted, not just the personal attack even if the post otherwise had merit).

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 1/12/2009

Posts: 235

|

Just a question, but if you are banned from the forums permanately, does that mean you lose your subscription to TC as well?

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

No, it just means you can't post in the forums.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 3/21/2006

Posts: 4,308

|

Drj, I can think of no way for us to deal with each other but only through this venue. I do not want to risk the privilege of posting here over this thing.

I think that you are either going to have to share with us all or just let it go....

My apologies to the forum for my lack of restraint in previous matters.

Apsll.

|

|

|

Guest-1 |