Registered User

Joined: 11/14/2008

Posts: 17

|

I could use a little help from the group to help me get my arms around a problem.

Yesterday I placed a BUY stop for AEZS at $2.83, a few cents higher than the close trying to catch a break out. The day high was $2.75 and the day low was $2.50. My order got filled one minute after the bell opened even thought the price was never filled. I called my broker (Zecco) and they said that someone had placed some sort of order which triggered my BUY stop even though the price was never hit.

I am a little shaken in that what is a stop order if the price never actually has to be triggered? Is this a shady broker or does this fall under "you pay you money and you take your chances"?

I have also seen members discuss "Conditional Buy Orders" instead of stops. I don't believe that my broker has this as an option. What is it and is it worth seeking a broker that offers this option?

Thanks for any input!

Azure

|

|

Registered User

Joined: 12/18/2008

Posts: 150

|

first, was it a day order, good till cancelled, weekly order, or something else?

anything can happen in the after hours because after hours and pre market still counts

also it varies from broker to broker as to when day orders are cancelled.. but most brokers close out day orders at 4:30, some at 5, some 6, and some 7.. it really depends but i've seen most close out at 4:30

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"I called my broker (Zecco) and they said that someone had placed some sort of order which triggered my BUY stop even though the price was never hit."

Did they say why?

Did they say it was a mistake?

I typically view this type of thing as a slip up.

A broker simply wouldnt be around to long if they started

deciding where to enter your orders on a regular basis.

(lucky it looks like your at a profit)

Thanks

diceman

|

|

Registered User

Joined: 11/14/2008

Posts: 17

|

It was a GTC order and yes, that one took a profit (wish I could say the same about all my picks yesterday). It was filled at 9:31:20 so it was during market hours. I looked at the ticks on Worden and it never spiked to the $2.83 price. One thing I forgot to mention is that it was filled at $2.66 even though I have a BUY stop at $2.83 (good for me).

The whole thing just seemed weird and the broker did not have a very clear answer. Maybe it was a slip up, these things happen. This just shook me a little in that money management is huge and this kind of has me reeling (even though I got some profit on this one.... who knows about the next).

I heard tobydad mention "conditional buy order" on previous posts. Is there any difference between the aforementioned and a buy stop?

Lots of thanks!!!

|

|

Registered User

Joined: 12/18/2008

Posts: 150

|

one thing is that orders that take place in the pre market or after hours dont show up on charts... depending on your broker, they may not show up on time and sales either or they can always show up delayed and struck out

|

|

Registered User

Joined: 12/19/2004

Posts: 415

|

QUOTE (azureflames) It was a GTC order and yes, that one took a profit (wish I could say the same about all my picks yesterday). It was filled at 9:31:20 so it was during market hours. I looked at the ticks on Worden and it never spiked to the $2.83 price. One thing I forgot to mention is that it was filled at $2.66 even though I have a BUY stop at $2.83 (good for me).

The whole thing just seemed weird and the broker did not have a very clear answer. Maybe it was a slip up, these things happen. This just shook me a little in that money management is huge and this kind of has me reeling (even though I got some profit on this one.... who knows about the next).

I heard tobydad mention "conditional buy order" on previous posts. Is there any difference between the aforementioned and a buy stop?

Lots of thanks!!!

Some but not all stop orders are triggered by the bid/ask unless you specifically make it a stop on trade. That has happened to me a couple of times, getting burned each time. So when I'm watchin the maket I have a market order in position and an alert to the trades(not bid/ask) and put it in IF the target is hit.

|

|

Registered User

Joined: 12/18/2008

Posts: 150

|

i just noticed that additional question.. theres a diff between a stop order and a conditional order...

with a stop order, its basically the same as a limit order EXCEPT its only executed when the price hits...

for example, if ABC is $95 and you have a buy stop limit of $100 basically when an order takes place on $100, your order will be executed at the market

with a conditional its slightly different, you can customize it so that orders dont go through unless a specified condition takes place for example if ABC is $95, and you want to buy at $100 but only if ABC trades at $105 you can place an order to do so. so once $105 hits, an order will go in to buy with a $100 limit

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

I became a conditional order fanatic because similar scenarios occurred several times to me in my trading. The important thing for me was to learn that a buy-stop order can be "seen" by other traders. Conditional orders reside at the broker and thus cannot be "seen" As wse said, the order is not even sent to Island, Arca or any other trading center until the conditions are met. They are absolutely the way to go.

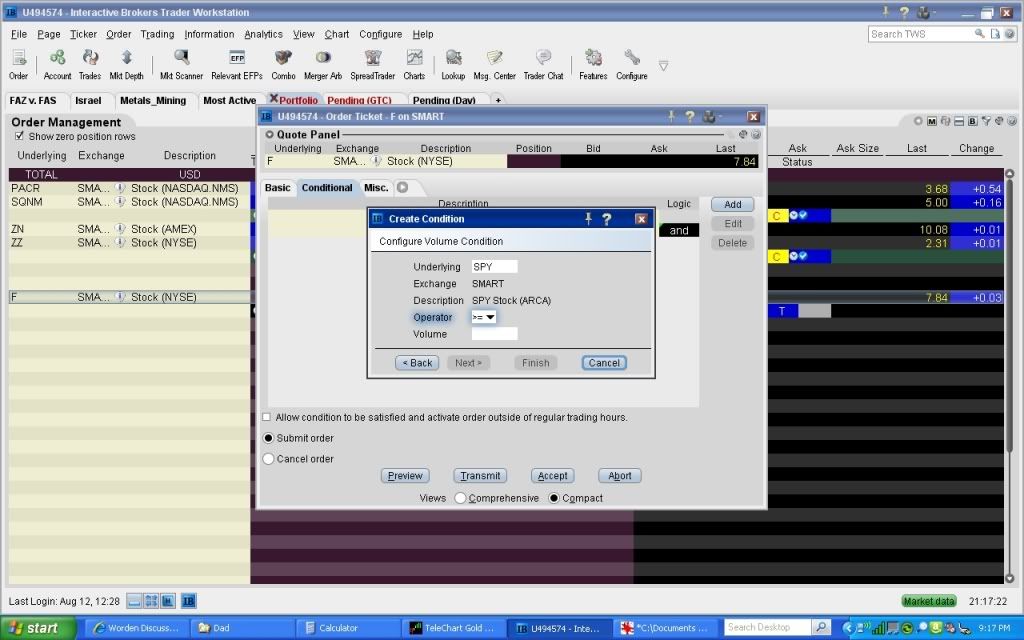

Other benefits of conditional orders, you can load in multiple conditions, so, as an example, if you wanted a certain volume to occur in lieu of or even in addition to your price condition, you can add that. I did some experimenting once with triggering orders after the market index or certain leading stock would do a certain thing. There are many, many ways to take advantage of the usefulness of the conditional order.

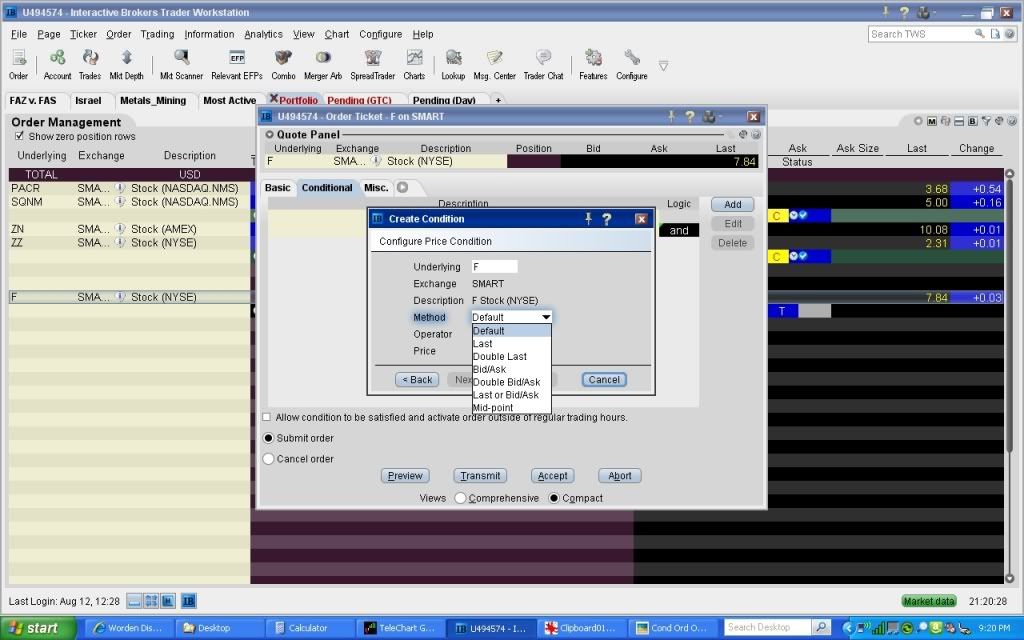

Finally, you might want to check the trigger method of your orders. Mine are set for double touch, the price threshold I set must be transacted twice by two different traders before my conditional order triggers and is sent to the markets where it can be "seen" by others.

I use Interactive Brokers which has gotten better and better over the last few years. When I first started with them, they were largely unheard of. Now I see their name come up more and more often.

This is the only way I swing trade anymore. I only use market orders on rare occasions if I have an hour or two to day trade FAS or FAZ or the like.

|

|

Registered User

Joined: 11/14/2008

Posts: 17

|

Thank you all. This is very informative and picking the right broker with the right tools really seems to be a necessary component to money management. I did not get burned on this one but I was really disappointed in how the system worked.

I may have to change my brokers based on the information below. Tobydad, would you mind sharing some thoughts on your favorite conditional buy orders (if you did not already) so we can trip over a few less hurdles along our journey.

Again, love this forum... thanks folks.

Azure

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

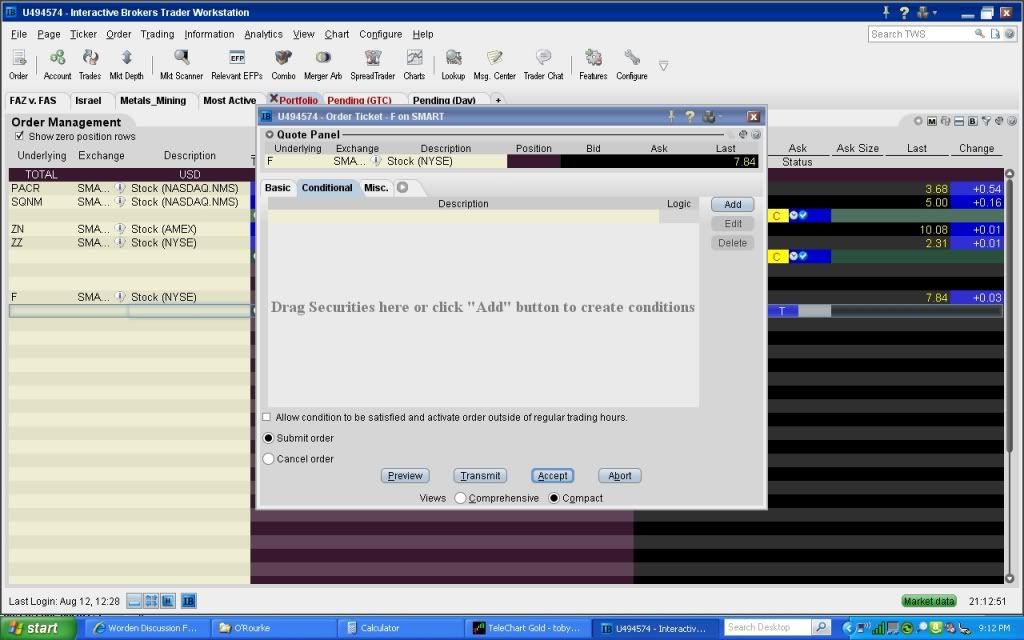

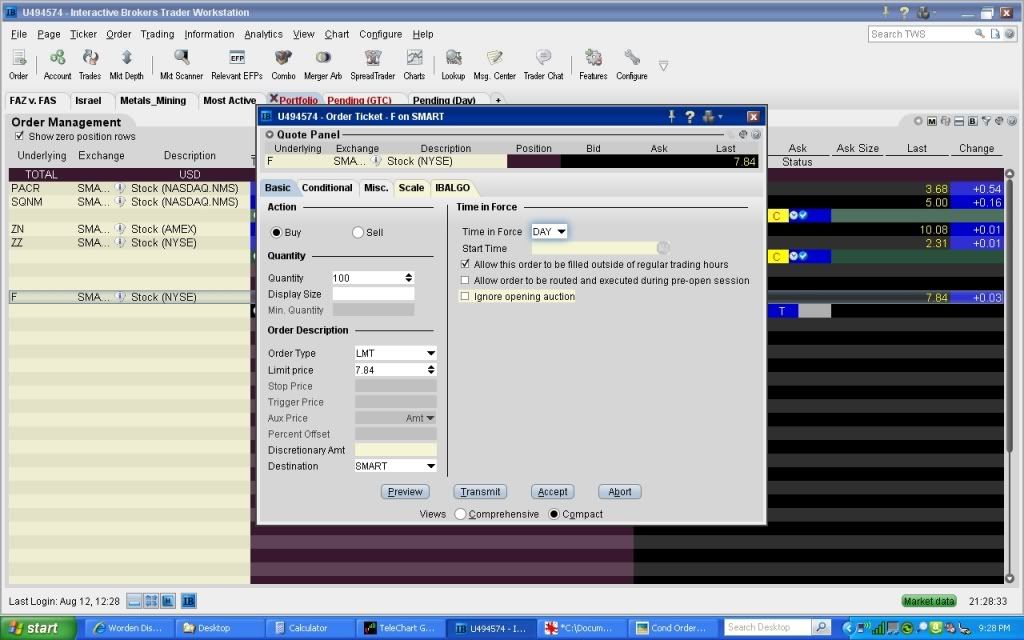

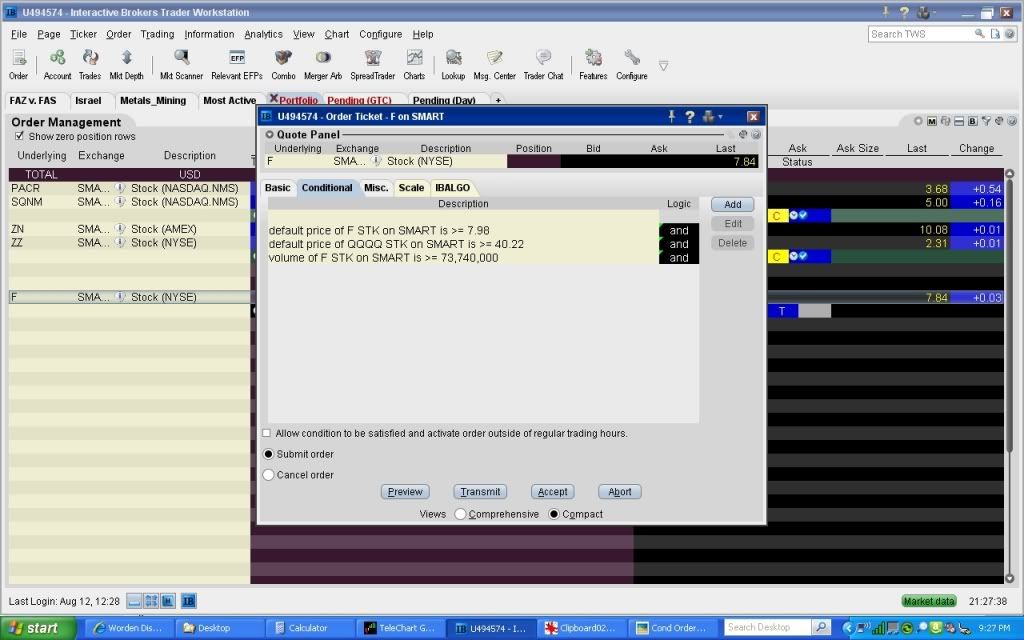

Here are a few screens from IB for conditional orders. Much to investigate, many tools.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

On the screen above, you can see that I have created a fictitious order (I am not buying F right now). In the example above, I have prepared to enter a limit buy order that will only be triggered when two people buy F at one penny or more above today's HOD and if two or more people buy QQQQ at one or more pennies above it's high of day and if F's volume is higher than today's.

There are an almost endless number of ways to configure the order. It's pretty much limited by one's imagination.

|

|

Registered User

Joined: 11/14/2008

Posts: 17

|

OK, after January I think I am a believer. I have been getting killed by placing buy stops a penny or two above the previous days close just to have it spike and have the floor drop out. I think there may be something to this "hidden order" and "conditional buy order" theory.

I think (hope) more money management and more control of how/when orders are executed are going to make a big impact on making better trades. I am moving my accounts this weekend to an unnamed broker that gives more control on how my orders are executed.

TD - I saw where you were going with the scenario above (making sure YOU were not the only person buying at X price, making sure the QQQQ was moving in a particular direction so you don't fight the tape and get faked out and there is an amount of volume you are looking for). Great stuff, I had a total e

piphany when I looked at yoru example.

There are so many choices. I would be be very greatful if you could share some basic stratigies for order execution like the one above. Thanks so much!

Azure

|

|

Registered User

Joined: 12/28/2008

Posts: 26

|

Azureflames,

The same thing happened to me on a buy seconds after the starting bell. I went back over the records and the price never reached my buy order and was actually a few cents away on a single dollar stock. I called my online broker and they explained the "ask" price popped up for a moment to pick up a high price order, mine!!

I was BS'd so I opened an account at IB that day and transferred half my money out. Now, I'll study what TD does above and hope for the best. By the way, was your broker TD Ameritrade like mine?

Steve

|

|

Registered User

Joined: 11/14/2008

Posts: 17

|

I formally used Zillow. IB's interface is a little tough but once you do your homework, you can do almost anything. I have been playing with protection by making my orders double bid/ask so I am not the only guy buying at X price (somebody is doing the same thing at the same price), this will hopefully reduce the scenario you laid out above.

Today's lesson: Placed a stop buy for PARD at 1.21. It executed from 1.21 all the way to 1.29, I presume dut to being thinly traded. IB offers a stop/limit order where once a stop is hit, it only buys/sells at a limit price you decide. Would have saved me this morning.

Been an expensive year learning. To the more advanced..........

ANY HELP WITH ORDER GUIDANCE WOULD BE APPRECIATED!!!! :)

Thanks

Azure

|

|

Registered User

Joined: 6/23/2008

Posts: 38

|

Knowing your platform will save you money, not taking the time to learn will cost you money and yes I learned the hard way. I am with IB, I liked TS but IB seems to finds more shares to short as I am more comfortable shorting than going long this was a big consideration. I am not familiar with Zecco, when I was with scottrade years ago I never seemed to get the best of the price.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

I think most of us learned the hard way, I know I did. I recommend TradeKing for my kids that are getting started as they don't have the minimum funds required to open a IB account. Once they've traded up to a few thousand dollars, I recommend they move over to IB with me.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

QUOTE (azureflames) I formally used Zillow. IB's interface is a little tough but once you do your homework, you can do almost anything. I have been playing with protection by making my orders double bid/ask so I am not the only guy buying at X price (somebody is doing the same thing at the same price), this will hopefully reduce the scenario you laid out above.

Today's lesson: Placed a stop buy for PARD at 1.21. It executed from 1.21 all the way to 1.29, I presume dut to being thinly traded. IB offers a stop/limit order where once a stop is hit, it only buys/sells at a limit price you decide. Would have saved me this morning.

Been an expensive year learning. To the more advanced..........

ANY HELP WITH ORDER GUIDANCE WOULD BE APPRECIATED!!!! :)

Thanks

Azure Did you enter a conditional order? If so, then go to the Basic tab and enter your Mkt, Limit, Stop, Stop/Limit or what have you.

|

|

Registered User

Joined: 3/8/2010

Posts: 63

|

QUOTE (azureflames) Today's lesson: Placed a stop buy for PARD at 1.21. It executed from 1.21 all the way to 1.29, I presume dut to being thinly traded. IB offers a stop/limit order where once a stop is hit, it only buys/sells at a limit price you decide. Would have saved me this morning.

Are there really brokers that don't offer a stop limit order? I had assumed this would be one of the standards across all of them.

|

|

|

Guest-1 |