Registered User

Joined: 6/30/2017

Posts: 1,227

|

Hi Bruce,

I didn't make that topic name up - got it verbatim from an article I was reading during lunch. LOL.

That said, the logic of the setup makes sense to me, and I wanted to trade it (with play money, of course) to see if it'll actually fly ...

-

I'd like a condition that I can use to sort, scan, or create an alert for tickers that are in the process of taking out a two-day high just above a whole number. Since we've only got 500 bars, let's make that a two-minute chart.

-

The next condition would create a conditional buy order at $0.20 above the whole number.

-

We can talk exits and stops later, if the entries are doable.

-

The goal is simply to buy a ticker that is breaking out to new two-day highs, if that price level occurs within $0.20 above a whole number, then sell it once it reaches $0.80 or so above the whole number (or $0.20 below the next whole number, depending on how you want to look at it) before hitting resistance at the next whole number.

In the example in the article (the chart below is from last June) Twitter made a new two-day high in the $17.00 - $17.20 range.

The trade was entered using a buy order triggered at the $17.20 level.

The trade was exited using a sell order triggered at $17.80.

What I like about this, besides the logic, is that it can be totally automated, so I can flirt with the barista all day and not miss a trade. :)

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

So something like the following for th entry?

C > MAXH389.1 AND C - (C - .499999) \ 1 <= .2

And something like the following for the exit (although I am guessing you would just put in the appropriate orders on entry)?

C - (C - .499999) \ 1 >= .8

It just checks for the value to be >= $0.80 above any whole number as I don't really have any good way to put the entry value into the exit formula.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Bruce, thanks! I'll give this a shot after dinner - need to run a few errands. Tonight I'll set up several (simulated) orders and watch what happens when the market opens. It'll be like a fisherman setting out several poles and wait to see which ones bite. :)

You're right about the exit - I haven't opened a TC2000 Brokerage account (yet) so I haven't used the order tickets a bunch, but from what I saw Michael do in class the exit should be doable using a bracket order.

And your exit PCF is fine, since this setup assumes the whole number used for the exit is the same as the whole number used for the entry, so it's not necessary to know the specific entry value to plug into the exit formula.

The initial recommended stop is $0.20 below the entry (in other words, the whole number, in Twitter's case, $17.00).

I didn't see any mention of a trailing stop, but I can deal with that later. Let's get this working first.

You're awesome!

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Hi Bruce,

Was thinking about this workflow last night. The whole point of this exercise is to golf, flirt, nap, whatever, during market hours instead of watching a screen. So the prep work is all going to be done during off-market hours anyway.

Last night I started with the Weekly Optionable list. Filtered it by my price and volume preferences. Then I was going to pull up a two-day-timeframe chart to look at the highs.

Can you write a 2-day-chart version of that first PCF? I'm assuming it'll be simpler, and I think I know the syntax, but a voicemail this morning threw a wrench in all my Friday plans. May get back to this this afternoon, or not. Might be the weekend.

That backward slash threw me at first, until I looked up the docs. Guess that's the integer-division operator. Cool.

My first test will be to just buy the underlying. If that works, then I'll simulate buying the option. If that works, then I'll look at buying new lows in addition to new highs.

With play money, I'll just let all the conditional orders that pass go ahead and trigger. Should accelerate my testing. With real money, I'll probably set up some OCA orders.

If I don't see you later today, enjoy your weekend!

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

The formulas wouldn't really change other than to possibly change the period of the MAXH389.1 portion.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

That's what I was thinking, so ...

For the entry, using a 2-day-timeframe-chart ...

C - (C - .499999 \ 1 <= .2

The exit (assuming I'm not using a bracket order) and a 1-minute chart intraday ...

C - (C - .499999 \ 1 >= .8

Is that correct? Don't want to assume. ;)

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

Not sure if the website cut out the closing parenthesis in each of the formulas or what.

Entry:

C - (C - .499999) \ 1 <= .2

Exit:

C - (C - .499999) \ 1 >= .8

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Thanks, Bruce!!

I'm on hold on Google Voice, and on hold with online chat. LOL.

"Your call is very important to us" ... ROFL!

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

... and, fyi, I probably just fat-fingered those PCFs, though I'd like to blame the website. LOL.

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

So longer ago than I would care to admit I was on hold with Hewlett Packard... and the voice proudly proclaimed the on hold music as being composed by HP engineers. Now it wasn't absolutely awful, but talk about a cost saving move.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Yeah, incredibly frustrating day. Finally, some guy obviously from overseas who claimed his name was "Eric" (LOL! Not judging - just sayin') said to call back in a couple hours - they're experiencing system issues. No sh#t, that's why I called.

But you're the one silver lining, thanks! Need to decompress this afternoon, but I will set this all up in the morning when my coffee is fresh and my blood pressure is back to normal. Will set up a bunch of conditional buy bracket orders, then sit back Monday morning and watch the magic happen at the opening bell. This is going to be pretty cool if it works. It'll be even cooler if it's actually profitable. :)

Enjoy your weekend!

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

Have a great weekend.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

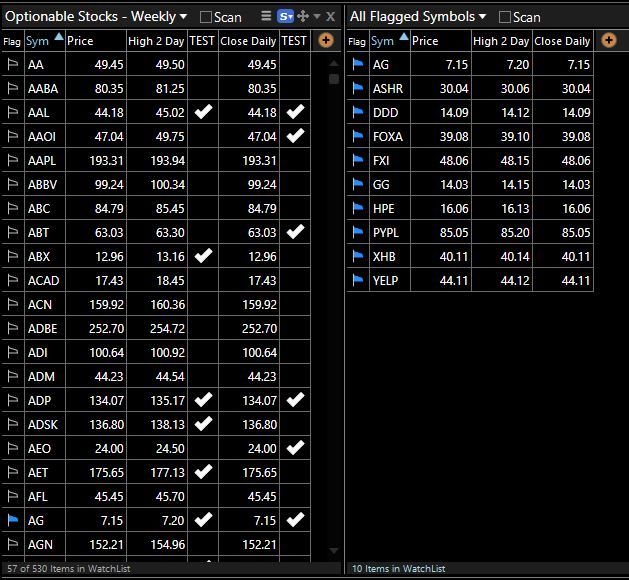

Good morning Bruce,

Need your Ninja non-coffee-addled PCF expertise.

The concept is simple, but I over-simplified the implementation of the entry.

I tried: C - (C - .499999) \ 1 <= .2

The results are in the second condition column. The issue is (for example, AAOI) the Daily Close meets my criteria, but the 2-Day High is obviously not even close to what I'm looking for.

I added the first condition column using: H - (H - .499999) \ 1 <= .2 on a two-day timeframe.

But then I run into another issue. See ADP. Both the 2-Day High and the Daily Close meet their individual criteria, but the dollar "handle" is different.

Since we're using two different timeframes, I'm not sure we can do this in one PCF, or if we need to combine multiple PCFs in a Condition Set, but I guess what I'm looking for is ...

-

The 2-Day High is between $x.00 and $x.20 AND

-

The Daily Close is between $y.00 and $y.20 AND

-

x=y

Hope that makes sense. I flagged 10 examples of tickers that should pass the entire Condition Set.

I have one short non-barista meeting today, otherwise I'll be around.

Thanks!

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

Please try the following.

C - (C - .499999) \ 1 <= .2 AND MAXH2 - (MAXH2 - .499999) \ 1 <= .2 AND (C - .499999) \ 1 = (MAXH2 - .499999) \ 1

It doesn't actually mix time frames. It looks at the most recent 2 bars (days in a daily time frame) to get a two day high.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Cool, thanks!

Gotta prep for that meeting.

Will try this later this morning or this afternoon.

So exciting. :)

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Thanks, Bruce!

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Bruce, just had a thought for one more thing (I hope) before starting simulated trading this ...

Using the 2-day chart looking for a 2-day High and using your latest PCF on a daily timeframe is perfect for my off-hours pre-market prep and setting up my morning conditional orders.

Assuming this works (fingers crossed, but I'll wait for the data) I should be able to check in on the market a few times a day at the office. Can't sit there and stare at the screen, but after the market is open there could potentially be a whole new bunch of setup opportunities.

So I'm thinking - I can use your latest PCF for placing my pre-market orders ...

Then I could use another PCF intraday based on a two-minute timeframe & candles looking at "48 hour highs" (based on the 500 bar limit, I assuming one-minute bars don't go back far enough).

This way, I could login in from time to time, especially during lunch, and possibly place some conditional orders for the afternoon session.

What do you think? Doable?

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

I don't see any particular reason you couldn't use the 2-Minute formula given in my Thursday, May 31, 2018 2:48:49 PM ET post intraday.

You might even be able to use the daily version once the trading day has started for that matter if you want to test them against each other. It wouldn't cover a 48 hour span since you would only be part way through the current trading day, but I have no idea how that would affect the results.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Oh yeah, forgot about those earlier PCFs. :) My bad. Let me scroll up and check it out.

As always, thanks for keeping me on track!

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Btw, great idea on testing the daily & 2-minue versions side-by-side. I'm not putting real skin in the game until I get sufficient data, might as well explore both alternatives.

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

QUOTE (Bruce_L)

So something like the following for the entry?

C > MAXH389.1 AND C - (C - .499999) \ 1 <= .2

Bruce, I was just eyeballing this - doesn't it run into the same issue I had before? (It looks at Current Price, but ignores the Maximum High during the last 390 bars?).

Don't we need a 390 bar version of the PCF you posted on Wednesday, June 06, at 9:25:10 AM?

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Oh wait, I just noticed the MAXH in there. How did I miss that???

The barista must be slipping me decaf and not telling me.

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

While it does check against the high over the previous bars, it doesn't include the current high in that calcualtion. We can add it.

C > MAXH389.1 AND C - (C - .499999) \ 1 <= .2 AND H - (H - .499999) \ 1 <= .2 AND (C - .499999) \ 1 = (H - .499999) \ 1

I don't think it should make too much difference.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Cool.

Yeah, it may not make that big a difference, but every little bit helps when you're saving up for a yacht.

Have to go offline for a bit. Will try this tonight.

Thanks, Bruce! It's almost Friday.

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

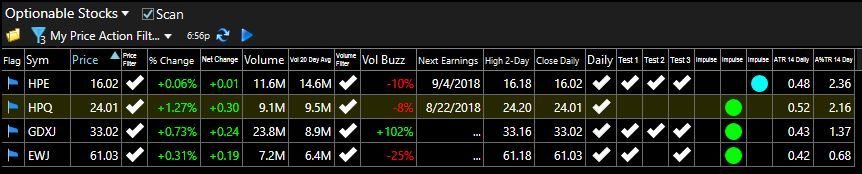

Hi Bruce,

All the tickers where the 2-minute bar's condition is true also have the daily bars with a condtion of true ... but the reverse isn't the case.

I'm still eyeballing some charts, but haven't figured out why. This is a Saturday morning screenshot, so the markets are closed.

Thought another pair of eyes (especially yours) might help. Are you noticing anything?

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

The 2-minute version is more restrictive. It requires the current two minute bar to have a current price above the high of the previous two days.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Makes sense. Maybe we (and by "we" I mean you, LOL) need to rewrite the 2-minute version.

What we're going for here, I think, whether it's a daily, 2-day, or 2-minute chart, is having a "48 hour" high between $x.00 and $x.20, and the current price also between $x.00 and $x.20, but the current price is less than the "48 hour" high. It's a potential "break out" but it hasn't broken out (yet).

Just got back from a looooong walk, so I may be zigging instead of zagging, but if price is already above the high of the previous two days, the ticker may start (or already be on) a run and that leaves less time to get the conditional order in.

Hope that makes sense. As usual, when I'm wrong I can count on you to be the first to tell me.

Didn't know you had WiFi on the yacht. ;)

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

QUOTE (Bruce_L)

The 2-minute version is more restrictive.

Welcome back, Bruce.

You'll see in my screenshot in my other post this morning that of the eight tickers that met your Daily PCF condition (in addition to my price & volume filters) only one met the 2-Minute condition.

I think they should be identical (or at least similar). The algo logic is the same, the only difference is one looks back 2 daily bars and the other looks back 390 2-minute bars.

Hope I got that right. Been a loooong weekend. Using toothpicks to keep my eyelids open.

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

They aren't the same because you requested the 2-minute version first and it required "breaking out to new two-day highs" which was calculated in a 2-minute time frame (not a daily time frame).

If you are interested in a 2-minute version of the following daily formula.

C - (C - .499999) \ 1 <= .2 AND MAXH2 - (MAXH2 - .499999) \ 1 <= .2 AND (C - .499999) \ 1 = (MAXH2 - .499999) \ 1

You would get the following.

C - (C - .499999) \ 1 <= .2 AND MAXH390 - (MAXH390 - .499999) \ 1 <= .2 AND (C - .499999) \ 1 = (MAXH390 - .499999) \ 1

But it isn't checking for a new high at all. Adding this requirement to the daily PCF would result in the following daily formula.

C - (C - .499999) \ 1 <= .2 AND H > H1 AND MAXH2 - (MAXH2 - .499999) \ 1 <= .2 AND (C - .499999) \ 1 = (MAXH2 - .499999) \ 1

And the following 2-minute formula (assuming you only want a 24 hour new high and not a 2-minute new high).

C - (C - .499999) \ 1 <= .2 AND MAXH195 > MAXH195.195 AND MAXH390 - (MAXH390 - .499999) \ 1 <= .2 AND (C - .499999) \ 1 = (MAXH390 - .499999) \ 1

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Thanks, Bruce!

I'll try all three alternatives side-by-side until I understand them all. It'll make more sense (to me) visually on a chart.

I think I want the first one. You say it doesn't check for a new high, but I see MAXH390 in there several times. I actually don't want a "new high" (depending on your definition) ... I'm looking for the current price to be less than the highest high during the last 48 hours.

Having both the max high and the current price within $0.20 of the same whole number handle is just the setup ... that gives me a chance to place a conditional order. If price breaks out to a new high, and breaks through the $x.20 level, that's the trigger for this algorithm. Won't know if it works, of course, until I test it.

Thanks for your help!. Will be offline a good chunk of today.

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Only four long candidates this evening, but at least all four have Weekly Options.

Not sure why HPQ is failing all 3 of the 2-minute PCFs. The "48 hour high" is 24.20. The current close is 24.02. Meets the criteria.

Also not sure why EWJ is passing the first and third PCFs, but failing the second, but I haven't taken a look. Made the mistake of treating my caffeine slump by consuming massive amounts of sugar. Not enough toothpicks in the world to keep my eyes open tonight.

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

I don't know why the daily and 2-minute versions wouldn't match after the market close other than possible rounding issues with the prices (during the trading day is a different story as the spans covered by the highs will be different).

Note that some of the condition formulas check for a new high. So if that requirement is not met, it won't show a check for those condition formulas.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Thanks, Bruce.

I'm not going to stress over the intraday PCFs until I test the end-of-day process. If that isn't profitable there's no use wasting your time fiddling with 2-minute PCFs.

Going offline. Bunch of errands to run, out in the real world. LOL.

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

You're welcome.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

|

Guest-1 |