| Welcome Guest, please sign in to participate in a discussion. | Search | Active Topics | |

Registered User

Joined: 2/25/2005

Posts: 2

|

On TSTC daily, some of the green candles on heavy volume are solid green and some aren't. What's the difference?Thanks

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

In TC2000 version 12, the fill of the Candle can be based on either Open vs Close or Net Change.

If it is based on Open vs Close then an Up Bar is when the Close is above the Open and a Down Bar is when the Close is below the Open.

If it is based on Net Change, then an Up Bar is when the current Close is above the previous Close and a Down Bar is when the Close is below the previous Close.

You can set if Up Bars and Down Bars are filled independently. You can click on Price History and select Edit to view or change your current settings.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 1/14/2005

Posts: 9

|

Bruce...

Is there an advantage using one setting or the other... say in Forex trading? Having traded stocks for many years, Forex has become my fix. I would think, having traded stocks using net/change for so long that this setting would best represent the spirit of the candle relative to the over all pattern, trend and so on.

Then I find, having spoken with several traders, Open v. Close is their setting.

Bill

|

|

Worden Trainer

Joined: 10/7/2004

Posts: 65,138

|

For the most part it is a matter of personal preference.

I don't generally use candles. I almost always use OHLC bars. The reason is because when I first started I found it easier to just look at a glance where the open was versus the close than trying to remember that a hollow candle meant the close was higher than the open and a solid candle meant the close was lower than the open.

I strongly prefer using Net Change to color both my OHLC bars and candles because then I can tell from looking at a single bar or candle both the relationship of the open to close and the relationship of the current price or close of the current bar to close of the previous bar. That said, people almost never look at a single bar in isolation, they view it in the context of the rest of the bars on the chart.

In a similar vein, I have found most candlestick practitioners seem to see an up day as the close being higher than the open and a down day as the close being lower than the open. If this is your mindset, then using Open vs Close to color your candles makes the most sense as color is the stronger visual clue.

I personally see an up day as the close being higher than the previous close and a down day as the close being lower than the previous close. It would make sense then that I would want the stronger visual clue to represent this instead of the relationship between the open vs close.

-Bruce

Personal Criteria Formulas

TC2000 Support Articles

|

|

Registered User

Joined: 1/14/2005

Posts: 9

|

Thank you.... I agree with you.

|

|

Registered User

Joined: 12/31/2005

Posts: 2,499

|

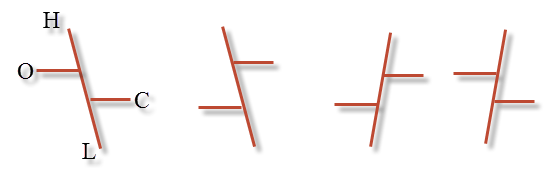

This reminds me of a suggestion I made a long time ago. That is to have the bar representation include the time relationship of the High to the Low. Thus the vertical portion of the bar would tilt, depending on whether the high fpreceded or followed the low I refered to it as the tilt.

Don't know if it would offer any insight, but it would be interesting to see if it does.

|

|

Registered User

Joined: 5/11/2009

Posts: 120

|

A tilt would seem kind of strange. A hollow or solid candle works very well.

|

|

Registered User

Joined: 12/31/2005

Posts: 2,499

|

QUOTE (tomson10)

A tilt would seem kind of strange. A hollow or solid candle works very well.

Your missing my point, a hollow or solid candle indicate an open to close relationship. I'm suggesting there is an additional releationship that could be expressed relating to when the high occurs timewise with repesct to the low.

The current method relate the time releation of open to close by definition. Also the relationship of the O, C, H and L pricewise is represented. The timewise relationship of open to high, open to low, high to close and low to close are represented. by definition.

What is "missing" is the timewise releationship of the High to the Low. Representing the "tilt" accomplishes this.

A graphical candlestick could also represent the tilt, filled ot unfilled.

Obviously to do this there needed to be an additional bit of information in addition the the O, C, H, L prices, to represent High Low time relationship.

|

|

Registered User

Joined: 5/11/2009

Posts: 120

|

QUOTE (jas0501)

Obviously to do this there needed to be an additional bit of information in addition the the O, C, H, L prices, to represent High Low time relationship.

If I needed to know the time relationship of the H and L then I would look at a smaller TF. A tilt does not tell me if the relationship occured early or late or near each other.

|

|

|

Guest-1 |