Registered User

Joined: 5/9/2010

Posts: 144

|

Okay,I am done with the homework for the week end. Unless, I see a good swing. Yes, I day trade options. So, I decided to do some scanning. If and when, the Market settles down. My scans tell me that CHKP just may be the new bull market leader. Does anyone have anything to add?

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

what exactly is it that tells you chkp is going to be a market leader?

it seems to pretty much track the qqq's.

|

|

Registered User

Joined: 5/9/2010

Posts: 144

|

I used the Secrets of Sector Rotation by Jim Farrish and Professor Michael Thompson. I wanted to see what was leading out of the new low from the SP-500 using custom date sort. Then I used Sector Rotation Using Relative Strength. It was presented by Professor Julia and Michael. I looked for good Relative Strength vs.Sp-500 and the out performers. (I would have like to have found another stock with decent fundamentals to back up MG820- Computer Software Services). Sub-Industries MG827 and 824 were what lined up with my rotation. Yeah, the base counts are overextended. (Due to history, if the Market slides down to a new low. Fundamentals mean squat.) Comparatively to QQQ, I see a stronger sentiment of lateral support. Look at the weekly chart and you will see the Sandwich Candle formation. Ah, re-looking at the weekly. I do believe. It undercut a Square Box Base. So, the count may be re-set.I wish the volume was stronger, but that is an engulfing pattern on the weekly:). If, we span out to the Monthly chart. From the high of 10/31/00 to low of 7/31/02. We will see the Base Building on top of the 38.2 re-tracement. Martha Stokes, C.M.T., also mention in one of her past webinars with the Worden Brothers Co. Using OBV with a simple moving average 25 on a monthly or weekly chart would help see bases forming a lot quicker. On the weekly chart, it looks delicious to me. It must be the Sandwich Pattern. Oh! If, you haven't checked out Ms. Julia's presentation. Here is what I have found to be "Oversold and Moving Up" with the Morning Star Moving Averages. Specialty Retail, Transportation,Computer Software and Services, Telecommunications, Internet, Chemicals, Energy, Metals and Mining, Consumer Durables, Financial Services, Real Estate, Materials and Construction. I got to go back into Materials and Construction to do some digging, LOL. I am hoping the farthest the retest in the Sp-500 takes us is the 1084 to 1094 level. That would strengthen up some of the bases that are forming. What do you think?

|

|

Registered User

Joined: 5/9/2010

Posts: 144

|

Sorry, that wasn't suppose to be Morning Star Moving Averages. My fault.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

QUOTE (Jpetesmith) Does anyone have anything to add?

Just remember, we need a bull market for a “bull market” leader.

(it would help if you put some spaces in your post, tough to read when its all bunched up in one block)

Thanks

diceman

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

well. i like the way it has remained above the 200 day. just need it to power above the 58 resistance level, complete the reversal formation with increasing volume, and more favorable market conditions,(agreed  ) and it might be a leader. ) and it might be a leader.

|

|

Registered User

Joined: 5/9/2010

Posts: 144

|

Uhm yeah about the spaces in the post, diceman. It automatically did that. I like my text to be at 16 for minimal eye strain. I will be sure to correct that in future posts. On the other hand, You are absolutely correct about the bull market needed for a bull market leader. Before Wednesday, I hope we see some Volume to the upside from Nas.

|

|

Registered User

Joined: 5/9/2010

Posts: 144

|

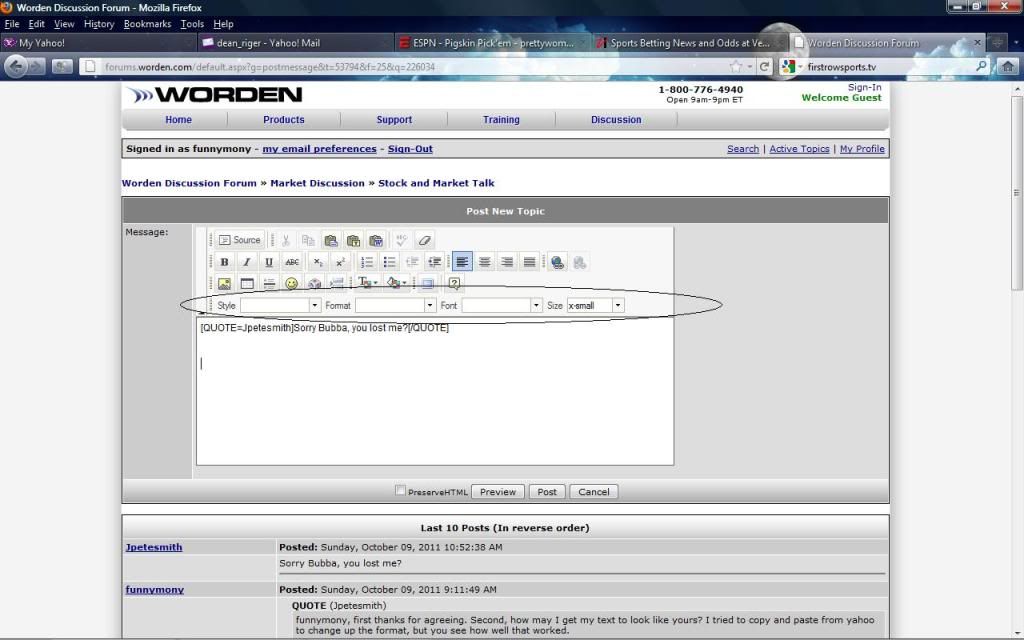

funnymony, first thanks for agreeing. Second, how may I get my text to look like yours? I tried to copy and paste from yahoo to change up the format, but you see how well that worked.

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (Jpetesmith) funnymony, first thanks for agreeing. Second, how may I get my text to look like yours? I tried to copy and paste from yahoo to change up the format, but you see how well that worked.

i just select x-small and default on the rest.

|

|

Registered User

Joined: 5/9/2010

Posts: 144

|

Sorry Bubba, you lost me?

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (Jpetesmith) Sorry Bubba, you lost me?

|

|

Registered User

Joined: 5/11/2009

Posts: 120

|

QUOTE (Jpetesmith) Uhm yeah about the spaces in the post, diceman. It automatically did that. I like my text to be at 16 for minimal eye strain. I will be sure to correct that in future posts.

Are you using Chrome?

That's a know problem with Chrome's copy and paste.

|

|

Registered User

Joined: 5/9/2010

Posts: 144

|

Well now I know too. Thanks Guys!!

|

|

Registered User

Joined: 3/27/2011

Posts: 56

|

I don't see it if you intend to day trade options. I'd keep my eye open for bottoms / potential rebounds - or simply accept these conditions and trade puts.

|

|

Registered User

Joined: 5/9/2010

Posts: 144

|

I like to look for good swings, too. Yep, I keep my eyes open for all of that. I want to understand how things are going in every Country, economic reports, politics, Index, Sector, Industry, and Sub- Industry. What's the historical performance compared to current performance. What's the Math and Psychology behind every move. The more I study. The more I may anticipate measure. I truly believe it is incredible that you may learn how the whole world works from studying the stock market, basically.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

QUOTE (Jpetesmith) I truly believe it is incredible that you may learn how the whole world works from studying the stock market, basically.

...or maybe how it doesn't.

Thanks

diceman

|

|

|

Guest-1 |