| Welcome Guest, please sign in to participate in a discussion. | Search | Active Topics | |

Registered User

Joined: 4/10/2006

Posts: 954

|

I've been working through "Trend Trading" curious if anyone has converted filters to stockfinder

I am 30% through the book.

Curious if some of his filters map to the videos, I have not sifted through all the vids.

The Backtesting has shown some success. My problem is trade size. vs. return. i.e. $8-10 commissions.

If the Average return is 2-3% that is great but for my trade size @ .5% I am break even and if you get too many of these spasmatic signals then those .5% and below add up to losses.

Standard problem. But really dont feel comfortable with a system yet to up the trade size.

The last 7mo. makes any system look good...so trying to take that into account.

|

|

Registered User

Joined: 4/10/2006

Posts: 954

|

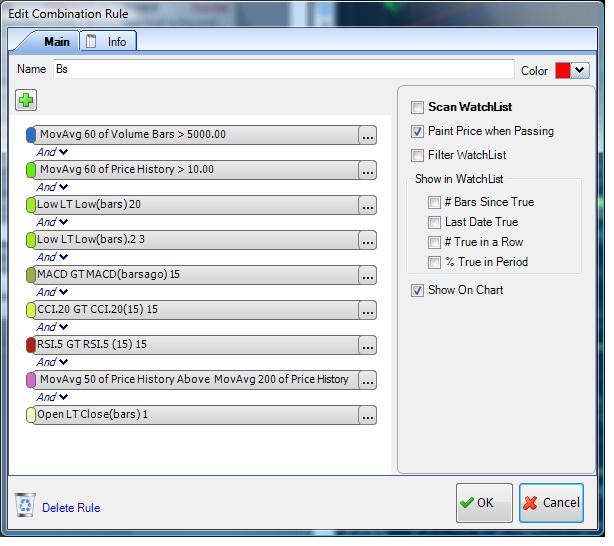

Here's a Bullish Divergence scan.

|

|

Registered User

Joined: 6/23/2008

Posts: 38

|

Who pays $8 to $10 in commision per trade?

|

|

Registered User

Joined: 8/31/2009

Posts: 60

|

If you want to trade Stocks less than a Dollar and want to buy large lots - say 10,000 +, You get hit with huge commission with most brokers....

10,000 Shares : Fidelity, Schwab, Zecco... : $0.015 / Share : $150 (approx)

10,000 Shares : Scot Trade, IB : .5 % / Share : $ 50 (approx)

Any broker suggestions for Large Lot traders...

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

rysa; IB will allow you to elect which type of commission structure you prefer: variable "per share" pricing, or fixed whole lot pricing. The distinctions and pros and cons should be obvious.

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

I don't know how your commissions are set-up but if its based on shares

you may want to look into higher priced stocks so you buy less

shares.

If you cant handle the position size then you may need to

wait until you have more equity.

Focus on systems that hold longer.

Your only alternative would be to use leverage.

Options or 2X ETF's but of course that would open

a different can of worms related to risk/knowledge.

Thanks

diceman

|

|

Registered User

Joined: 4/10/2006

Posts: 954

|

Very, Very part time.

I mostly have played longer term tactics due to lack of corn in the cubbard.

Made good money this year on fsys, isrg, amzn, mstr. But this year of coarse is exceptional, so must rely on value investing coupled with some timing. And our run may be topping out.

Very tiny,small positions as indicated, but the trading systems I have tested work best with smaller stops.

|

|

Registered User

Joined: 11/22/2006

Posts: 100

|

What videos?

QUOTE (wwrightjuly4)

<snip>

Curious if some of his filters map to the videos, I have not sifted through all the vids.

<snip>

|

|

Registered User

Joined: 4/10/2006

Posts: 954

|

But back to my, new Layout. This picked up these bullish Divergence, I added the exit rules and I thought it did not look bad.

Wish I had JAS expertise with the excel analysis, I really need to pick this apart and determine what the minimum positions sizes would be and equity needed.

And finish the other layouts and try to determine what they would return based on the Market Conditions

Bullish strong trending

Bullish Weak

Bearish strong

Bearish weak

Range bound

All in all I've been pleased with the book. Which is pretty basic, large print, and light reading. What I was looking for was some Trend trading Screens and that is what I found. After I finish this I will try to find some others....Always looking for a method for small positions and huge schwab commissions. (longer, and larger trends) If only I could find an apple ready to take flight, not these gravity bound stocks I find myself trading because they are small priced.

|

|

Registered User

Joined: 4/10/2006

Posts: 954

|

Tutorials Etc.

Stockfinder videos, from the http://www.stockfinder.com/Videos.aspx

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

What does the "LT" and "GT" mean?

Thanks

diceman

|

|

Registered User

Joined: 4/10/2006

Posts: 954

|

Less than, greater than

so,

if price.low < price.low(20) then pass

if price.low < price.low(3) then pass

etc.

|

|

|

Guest-1 |