Registered User

Joined: 3/21/2006

Posts: 4,308

|

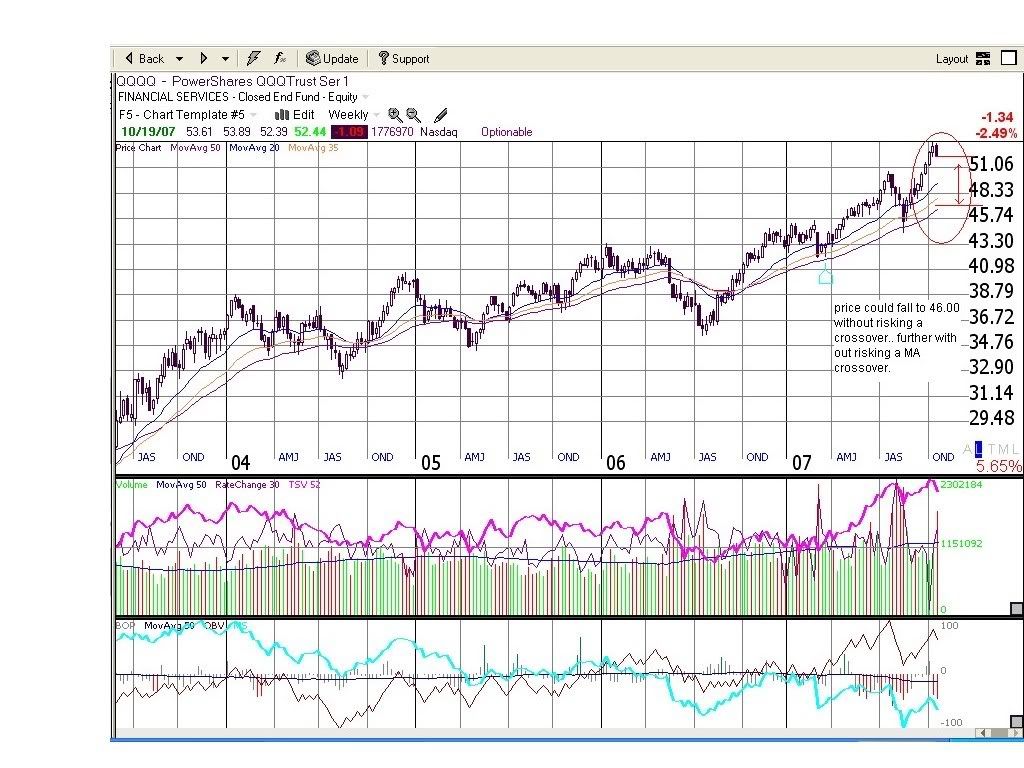

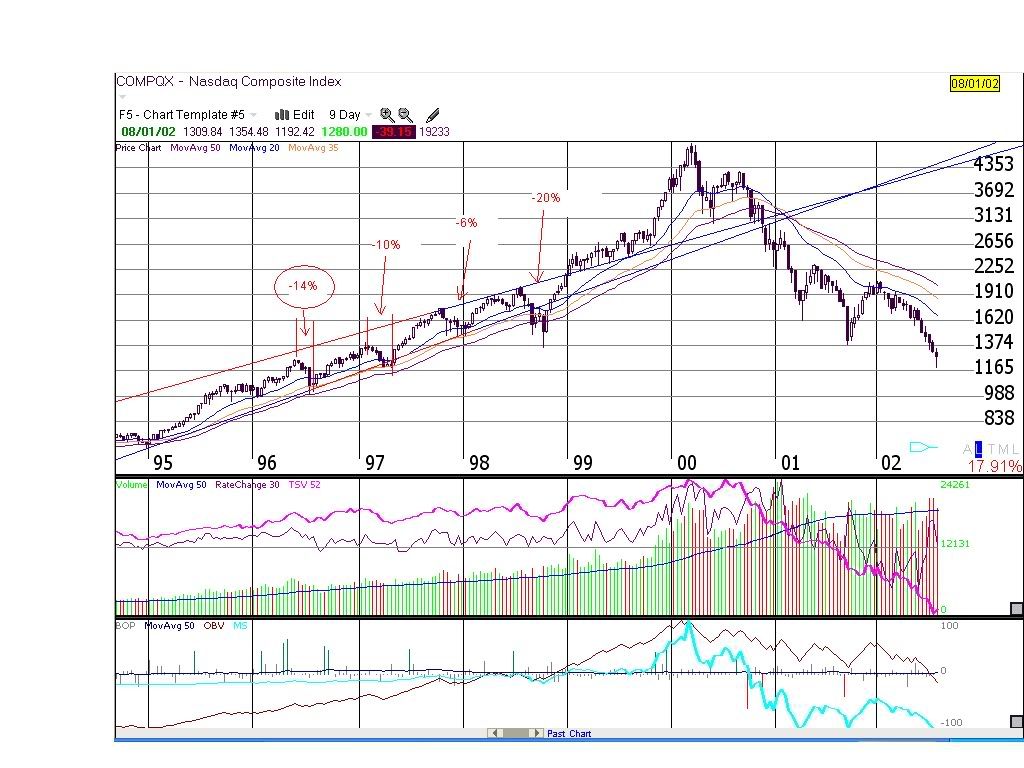

Not that this is important, but I will be away in the great White Montains of New England again until 10/30/2007 starting tomorrow. I just want to leave every one with my observations concerning the Nasdaq Index.

Is it my Imagination or am I seeing an ascending triangle here? The picture should come into better focuse when I return. I have taken measures to assure that my portfolio will not disintegrate in my absence.

Happy Trading to all and see you in a week..

Apsll.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

What I generally see/regard as an ascending triangle is few (to several) months long ....

But ... applying the same analysis to a much longer term ....

The top line on an ascending triangle is generally flat ... or very close to flat ....

This formation ... at least to me ... is much more representative of a "rising wedge" ...

Typically ... a quite "bearish" formation ....

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

Interesting... APSLL did you see my thread on dusting off the parachutes? Wether it's a triangle or not.. I have also read and understood this to be a negative signal. I hadn't noticed this formation before.

|

|

Registered User

Joined: 2/18/2005

Posts: 8

|

According to John Murphy, a wedge is an intermediate continuation pattern lasting from 1 to 3 months. This pattern looks like simply a long term uptrend.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

on Scecond thought the long term trend looks to me like it's getting ready to take off. there was a simiilar rising wedge in themid 90's... you could plot the trend lines several ways. I did it on a monthly chart and a 9 day chart just to be able to make the comparison to now....

Then we saw what looked to be the downside break out and a reversal...and it was off to the races with the Tech Boom. The longer tem Trend lines and and things look to me like ther are just starting to get cooking for current. I don't think we'll see anything like 2000 -2003 for a long time. That dosent mean we can't have significant corrections.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

If it is a rising wedge ... theoretical resolution would have the NASDAQ back to about 1800 ...

Which would probably put the Dow back to the 10,000-10,500 area ...

And the S&P back to around 1100 ....

Sounds about right ....

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

Realitycheck:

I don't think well see anything that drastic... At least I hope. I will grant that the Compqs is nearing territory I consider "Overbought" BUT that is subjective. I'm working more heavily base on the three moving averages ...just for me it's easy to see and grasp. They seem to work well enough on a weekly format as well So the further Price gets fromteh 20 bar moving avera either direction the more of an extreeme you have. Of course not all stocks cooperate with this and dance back and forth across it (to my irritation), some respond more the the 50 bar ma and others go on momentum runs where if you'r going to view them in this way at all you might consider tigher moving averages... such as DRYS. so momentum runs becmoe a different thing altogeather.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

This could be setting the low range of a consolidation range which would be a good thing for continued up trends. BUT if you compare a 9 day view with 1995 nothing looks out of the ordinary infact this correction could go deeper and still be in normal parameters for an up trend in the long term. As we go foreward I think we'll see more of these shocking dumps as the volitility increases and spills over into monthly and longer views.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

I see what you mean Scott ...

Clip your chart of the COMPQX back to 3/28/2000 ....

And tick forward a day at a time through the next 12 days or so ....

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

Nice charts, Reality - nothing better than spending a sat morning discussing tech analysis. I have a slightly different take (as usual). Bear in mind (no pun intended) that my style of chart reading is somewhat esoteric, so if my flights of fancy offend anyone, I apologize in advance.

That being said, after spending a couple of hours looking at the chart of the NAZ, I see some very interesting things and I tend to agree with Scott's second thought. Instead of a breakdown, we may actually be getting ready to take off. And here's why I'm slanted in that direction.

The first thing I did was take a look at the wedge chart. Immediately I saw two things. 1. The wedge pattern has already completed it's course. 2. At the end of it there was a failed breakout, quickly followed by a failed breakdown. 3. After the breakout/breakdown drama played out there has been a move into new territory.

From here I took a look at several views of the long term history, and found that on the arithmetic scale, if you discount the frenzied bubble run up, we're been trading in same channel all along. A channel we're recently broken out of.

Now, I know that's a stretch, and unfortunately, it will get even more bizarre. I have been reading a lot lately about parallel lines in the market and precision in analysis. the way I constructed the channel lines about was to draw the bottom one fist and then used the "create a parallel line" function. All of the trend lines in the following charts have been created this way.

When I moved in for a closer view of the end of the channel I saw a couple other interest things. Namely, the beginning of a new channel, which would support the "new territory" idea.

I also noticed that the top of the old channel and the bottom of the new channel are about to intersect, forming a potentially very strong area of support.

Thinking about another way of seeing where support might lie I did the following. I created another parallel line and placed it directly in the center of the channel.

Then, sticking with my mathematical interpretation, I decided to see what a fib retracement tool would do between the high and the low of the new channel.

As far as I am concerned, this worked very well. And if I remove the channels all together now, I see the fib lines have indeed been short term support and resistance.

Now we're going to get very weird, and I will apologize again for this detour into esoterica, but it might be interesting for someone, so why not.

I have also recently, been playing with the fib fan tool as a way of identifying support and resistance. What the fib fan does is, one a line has been drawn from a low to a high it then draws a fan based on Fibonacci numbers identifying mathematical ideas for future support and resistance. The same effect is created when used from the highs to the lows, and intersecting lines from a "low to a high fan" and a high to a low fan" are very important.

Here's what I mean... Here is a fan drawn from the recent august lows to the high before the correction. Notice how price has played around in the fan finding support and resistance several times.

Now look at a down sloping fan from the July highs.

Now here are both together.

Looks like we are at a very interesting juncture.

Going crazier still I decided to draw a fan from the high of the bubble down to the low of 02. Wow.

All I can say is wow again. This math stuff is crazy. Now do you see why I think we're in no man's land? The last fan arm has been breached and the next is the one is the old high. let's get closer.

Next I ran an UP FAN from the all time NAZ lows.

Where are we going? My guess would be 3500. But that's longer term. To help me figure out why we may have stopped and reversed during the shorter term I return to the fib retracement tool.

I know I keep saying this, but wow again.

Let's look at the daily chart.

Unbelievable.

If you made it this far, thanks for letting me go off on my tangent. It really is amazing what some of these tools in Telechart can do. I won't even get into the Fib Arcs tool. It is just as wild.

David John Hall

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Very interesting David ...

Since it is reasonable to assume that we're not going to see an unprecedented "disconnect" between the NASDAQ and the other major market indicies ....

Is it also your assessment that the Dow, S&P, and Russel 2000 are poised for this huge upside break ?

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

I see what yo uare getting at Realy. I guess technicaly that is a posibility...BUT I find it unlikely. I find and have had local economics and finance professors confirm that the stock market is a Leading measure of the economy. Prime example Allot of the realestate stocks started showing clear signs of topping in late 05' . I was just getting started then and straining my brain to understand candle logic So I had no idea then what a top looked like but it was called by Martha who runs the training service I used. I was dubious and itwas by first year and business cycle to watch..... If I knew then what I know now i'd have traded nothing but residential realestate short and probably have made a million. But I digress, one of the major warning signs was all the euphoria and talk of new paradigmes etc etc.... there is noe of that now.

However did yo see my thread on dusting off the parachutes? It's something to consider. I dont' know that we'll see a huge huge decline... but if we saw a moderate one it would still be ok. I think that is unlikely as well as we just had one. Now the angle of ascent out of the previous bottom was steep and the run up on low volume so to be honest something shouldhave been expected. I Usually call a correction and get a consolidation .... so this time I decided to hold  . But a week ago I was talking to my wife about how the volitility seemed to be increasing and after the move up (that din't bring me that much money) on such low volume maybee we should exit everything . I of course didn't ---- and chose now to start trying to hold things longer than I usualy do. . But a week ago I was talking to my wife about how the volitility seemed to be increasing and after the move up (that din't bring me that much money) on such low volume maybee we should exit everything . I of course didn't ---- and chose now to start trying to hold things longer than I usualy do.

David John Hall: I haven't read the above yet but thank youso much ... that took allot of effort.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Scott ....

Please forgive me if you feel this is out of line ...

You may have seen me post that my early days in this game were wrought with stress and frustration ....

Why I still have a wife ... and children that will speak to me ... is a much greater mystery to me than the markets ever were ... or ever will be ...

When I read your posts ... talking about parachutes ... and holding positions into a decline ... in the same paragraph ... I can't help but wonder if you aren't on the same kind of emotional roller coaster that I was once on ...

Is this spilling over into your relationship ??

Are things related to the market coming up in fights ??

Because if it is ... it just ain't worth it !!

You can never make enough in the market ... to even come close to what you could lose in your own home ...

There is NO shame in choosing not to play ...

Sometimes ... it's the ONLY way to win ...

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

Great question, Reality. With respect to the boom, I can hardly say it would be unreasonable to have a disconnect, because we can never say what is going to happen, but looking at the Dow, I must say that it looks like this indexes move already begun.

Without getting as crazy as I did in my last post here are a few visuals.

Looking at these charts I might have to say that the indexes move slightly less in tandem than I originally thought. I'll have to look at the s&p500 later.

David John Hall

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

Reality, you seem like you've been through a lot in the market. Thanks for sharing. your experience is much appreciated, as is your honesty. It takes courage, and I respect that.

David John hall

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

Reality:

Thanks for the concern, The home life is fine. The wife and I are close and despite our equity line goling all over the place "we" are ok. I'm actually a bit better in terms of the emotional swings. Really it's not so much that we are swinging all over the place but that we aren't getting any where. I make $1000 one week and the next, two stocks gap down and take it back. It's infuriating but i'm getting used to it. Friday hurt prety bad... and we were both calm about it. I think the biggest thing for me is that I have added pressure to myself since I have not found a job out here worth messing with. Though soon the wife's maternity leave will be over I'll be a stay at home dad for a while till my semester starts. But I still want to feel that i'm bringing something in ... advancing us. And it's been over a year and i've done nothing spectacular with our account except regain 2/3 of our heavy losses incurred at the beginning of the year. I will say trading now seems hard compared to 2006 up till november. Part of that could be in my head after getting battered so badly. I also realize that I didn't know allot then and was helped along by an easy market. I feel I've put that time to good use in learning to read charts better.

As far as calling corrections and decinding to hold, Well ... up unitll about two weeks ago I was having a really good time with my Joint Signal aproach and found that often despite the broader day being down I was generaly up. And It worked really well when I squireled away those gains. I'm attempting to make my purchases closer to bottoms and areas that I suspect to be trend reversals or lower risk buy points. The LOGIC is that if the stock is on track then the affects of a larger correction will be minimal. BUT most of my trades are prematurely exited... so logically it follows that I can afford to hold longer. I just picked a heck of a time to do it.

In terms of Calling a Large correction... i'm not shure I did... I only stated a thought that had come to me and pointed out an observation of some divergences that may be pointing out building weakness through divergences. BUT we all know that divergences are noting to bet the farm on. As there are multiple ways they can resolve their selves. Besides there are millions of people calling for doom and gloom and a crash bigger than we have ever seen for decades.... They weren't right then and probably aren't right now. I just think it's something to be aware of. Besides if we hit a a period of a rolling market for a year then that could adjust out that negative divergence. Or the divergence could fail... Elder writes in his "Trading for a Living" that when divergences do fail it is often with spectacular results to the oposite side!

David John Hall: I wish you would get into the Fib Arcs... those would be neat to see in action.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

That's great that you have it under control ... like I said ... there was a time that I didn't ...

But trade management is very, VERY important ... the market taught me that ... and you wouldn't believe what the tuition costs were ....

It doesn't matter whether the market retraces 5% and stays down a week .... or retraces 25% and stays down a decade ... good trade management will keep you protected ...

Although he called it an ascending triangle ... which is generally bullish ... I believe that Apsll recognized the pattern that he saw in the COMPQX as bearish ...

I believe that this is witnessed by ...

QUOTE (Apsll) I have taken measures to assure that my portfolio will not disintegrate in my absence.

I have seen days on the NYSE where 2100+ stocks were down ... and 2 were up ...

Very few can stand under a waterfall ... and not get wet ...

Good luck ...

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Apsll ....

What was your speculation regarding the chart of the COMPQX that you posted ?

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

I just started "The Right Stock at the Right Time" by Larry Williams and aparently going back to the 1800's years ending in 7 are universaly down... BUT they create "great buying oportunities" and the ensueing rally often lasts up to two years and is only eclipsed by the average performance of years ending in 05' Then somewhere around the 9th or 1oth year ending a decade a considerable delcine is marked the bottom of which is usually found in a year ending with a 2 or 3.

This may be all nonesense... but I just thought it was interesting.

|

|

Registered User

Joined: 5/1/2007

Posts: 158

|

Scott:

Longer term trades - do take into account the Presidential cycle. Typically, the markets are down the first 1-2 years after a change in political party in the White House. 1969-1970, 1977, 1980-1982, 1989-1990 (Bush was almost a party unto himself), 1992-1993 (started early and ended early), 2000-2002 (started early and ended early), 2007-????.

Based on this pattern, I'd call the bottom in late 2009-2012 (oh, I didn't mention 1929-1932). I regard this as most similar to 1979-1982. Probably the bulk of the oil price increase is behind us; if so, late 2009. But if we have more oil shock to come, as in a further dollar decline, the bear could continue past 2010. No target price, and there are plenty of buyinh opportuniities in the long side as well.

|

|

Registered User

Joined: 11/7/2007

Posts: 49

|

That is an interesting book - I read it a few years back. Interesting nonetheless, but it has its flaws. I am sure you will be able to tell those as you read on. And just keep in mind that the longer your capital is invested the more risk you take, and that cycles are difficult to measure.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

"that the longer your capital is invested the more risk you take" - - - you know I've been thinking that.. BUT Larry Williams says in a lecture he gave I saw on line that the biggest thing traders do to hurt their trades and probabilities is not give them time.. and I know Martha (I now you don't aprove of training and teachers...but aren't you one?) teaches that the longer time frames you trade the easier it is to be proffitable and the longer you are invested the better chances at big money you have. Looking at a few charts it's clear that there is more money in a 2 month hold verses a 2 day hold. BUT it's easy to look back.. and for me holding too long leads to overholding.

I think in the end it's probably similar... you may gain more on the trades you closed to early..but the others would have been bigger losses also. So go figure.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (tllucero) Probably the bulk of the oil price increase is behind us; if so, late 2009. But if we have more oil shock to come, as in a further dollar decline, the bear could continue past 2010.

I'm interested in hearing why you think the bulk of the crude price increase may be behind us ....

How many consumers were there in the global marketplace 10 years ago ?

And how many will there be with the addition of the populations of China, India, Vietnam ?

When you look at your historical data ... where was the last place that the number of global commodity consumers tripled in a relatively short period of time ?

80% of the adult Chinese population expects to own a car within 5 years ....

India and Vietnam are moving that direction at light speed ...

This economy has not even begun to feel the effects of rising crude ... as it has not yet been reflected in the price of gas ....

Heating oil, gasoline, etc are only just beginning to "unwind" to the higher crude prices ....

|

|

Registered User

Joined: 11/7/2007

Posts: 49

|

Scott I started trading long time frames - heck I started with mutual funds as most folks do. Back in 1993 when the internet as it is today was just being borned. I use to go to the university lab to hunt for my mutual funds price data. There was no marketwatch, or ameritrade, or CNN as we know today.

The data was in text files, and if you want it to chart that - good luck. Anyways it took me a while, but I guess that like most folks eventually I did figure out I was wasting my time with mutual funds - not enough return in correlation to the hoding period.

If you take the 2 months that you are talking about and trade every turn you are definatelly ahead of the game of just holding from the beginning to the end of the 2 month (I think that is clear right?). If you even trade one single turn you would be ahead.

Hence I became a day trader as my capital started to accumulate, and I realized that I could move huge blocks of shrs for very little time and create returns that would take days or weeks under normal cirscuntaces in just minutes. The risk is always lower too. And of course you need risk/reward software to compute your ratios quickly for you.

There hasn't been a single time when even at a lost that if I have closed my trade as a daytrader should (end of day)I lost as much as if I did not. By closing your trade daily you limit your time on the market, and you limit your losses. Also the overnight price changes will not catch your fingers. Althought I suppose you can take care of that on a longer term trade by using options.

Look at ESLR - lots of activity there lately - I have made good cash there this last week - but look at what happened yersterday. Stock almost hit aroung $17 on Thu, and the same day after the market closed it was down to about $15.5. Next morning on Fri it tanked like a broken plane. No problem here - I was out as I am every night (and usually I am reluctant of trading Mon and Fri anyways). The long time investor would be a different story.

The risk your capital is exposed to the markets is directly proprortioanal to the time it is invested. It is that simple. The returns or profits on the other hand are not proportional to the time, but to the size of your trade.

If you are thinking of really going long term - make sure your candidates have good dividends and are optionable.

|

|

Registered User

Joined: 11/7/2007

Posts: 49

|

I am afraid you are correct reality. This is just, well not the beginning, but just starting. And those folks in India and China or Vietnam are not too enviromentally friendly either.

Here I still see folks driving their SUVs to work for show - don't have a clue. When you see those SUVs dished on the side of the road or for sale for $50 then you know the folks are getting it. I suppose as soon as the gasoline price hits $5 the show will really kick in.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

"as in a further dollar decline" - - - I've read article that assert that the declining dollar helps to bring our Import/Exports into ballance. It would apear that some forms of shipping are already booming. DSX, DRYS etc etc.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (tllucero) Scott:

Longer term trades - do take into account the Presidential cycle. Typically, the markets are down the first 1-2 years after a change in political party in the White House. 1969-1970, 1977, 1980-1982, 1989-1990 (Bush was almost a party unto himself), 1992-1993 (started early and ended early), 2000-2002 (started early and ended early), 2007-????.

Based on this pattern, I'd call the bottom in late 2009-2012 (oh, I didn't mention 1929-1932). I regard this as most similar to 1979-1982. Probably the bulk of the oil price increase is behind us; if so, late 2009. But if we have more oil shock to come, as in a further dollar decline, the bear could continue past 2010. No target price, and there are plenty of buyinh opportuniities in the long side as well.

An interesting subject ...

However, as is generally the case, the "reality" is generally much more complicated ....

For example ...

Ronald Reagan may have been elected in 1980 ... but he didn't assume office until 1981 ....

By the time that his advisors/cabinet were selected, approved by Congress, developed policy, turned that policy into bills, had those bills passed by Congress, and these policies had a chance to work their way into economic results ... nearly 2 years had passed ... from his election ...

You see ... although his first term may have begun with an election in 1980 ... the "effect" of that first term is better judged in the years of 1982 1/2 through 1986 1/2 ....

As you can see ... when reviewing this type of data one of the most important questions to ask is "Was there a policy shift ?"

The shift is not always caused by a presidency ... as it is often caused by a Congressional shift that effectively "neuters" the POTUS ...

I also tend to disagree with your assessment that fallout in 1929-1932 being similar to 1979-1982 ...

The 1920's produced a "credit bubble" ... that inevitably had to "unwind" ....

Not at all unlike what we are watching now ... and will continue to watch over the next several years ...

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

Reality, you know faaaar more than I do in this arena. However, regarding elections, don't think that the perception of what policies will be implimented, and their perceived effect on the economy is a much stronger driving force behind buying and selling at these particular times? I have read (I read too much) that the market is where (for the most part) intelligent people make emotional decisions and then find rational reasons for them afterward. Certainly, some of those future policies are priced in before the fact.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Well David ...

I couldn't agree more ...

I think that we'd all agree that the markets are driven by emotion ... primarily Greed and Fear ...

But somewhere in all of that is intellect ...

We have just watched markets react upward ... based on trailing earnings ... while staring at a growing financial crisis and impending inflation ....

And then react sharply downward ... on no new information ...

Everyone wants to have that last glass of champagne .... and STILL be able to get a seat on one of the Titanic's lifeboats ....

Even now ... most of us are anxiously awaiting a "bottom" .... so that we can run in and play for a few weeks .... before the next shoe drops ....

Knowing all to well that it's coming ....

|

|

Registered User

Joined: 10/7/2004

Posts: 319

|

Some of the higher volume ProShares Short and UltraShort ETFs are looking better and better aren't they? Gotta see something going up on the charts.

|

|

Registered User

Joined: 11/7/2007

Posts: 49

|

True David you are correct in some sense. The thing is that per example things can get so complicated that it is impossible to pinpoint the concrete future effect in some cases.

Per example - the subprime - propagation is slow and can't be pinpointed to specifics. Just too broadly spread that is out of control and the end effect can't be measured. It will be measured after the fact. That will be too late.

Another example - The carryover trade with Japan currency and interest rates - another out of control dilemma. Once you have so many players, so many economies, and so many factors working conjunctively or against each other it is hard even for the specialists to assess development.

Should I continue. What will be the effects of the extreme pumping of M3 into the US markets. Well we know that it will not be good - will lead to depreciation - it is already leading to depreciation of all assets. But how much depreciation will take place is hard to measure.

So those who say there is factoring before the facts are correct in some sense - the problem and questions is - how much has it been factored?

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Good points Bigblock ...

But ... let's backtrack for just a moment ... in hopes of finding the future ...

Back in the "Bernanke" thread ... there was a point where you stated that in your conversations with a professor, you had come to the conclusion that the net outcome of the coming debacle would be deflationary ....

I tend to disagree ... and allow me to support my position ...

Even though it is now unpublished (read as "hidden from the public") ... we both know what MUST be happening to the M3 money supply ... and that in itself is inflationary ...

Double or triple the number of global consumers competing for the same finite set of global resources ... is undoubtedly ... inflationary ...

But ... let's also look at the US Government's position on all this ... they have a National Debt ... financed to a large degree with short term money ... that has now crossed the 9 trillion dollar mark ...

In a short time ... or if interest rates were to rise to historically "normal" levels ... that debt would quickly become unservicable ...

So ... what are your choices ... first ... you could default ... but we both know that the US isn't going to do that ... and your only other option is to refinance your debt with longer term notes ... embrace inflation ... and let it consume your debt to more managable levels ...

While .... simultaneously .... devaluing the assetts of your population .... and effectively distributing the debt burdern to them .... proportionally to their worth ....

Your thoughts ?

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

The problem with the argument that the market has "factored in" much of this CDO, CMO, SIV crap is ....

It's all based on B/S ....

We've only had two CEOs that have even come close to disclosing the depth of these problems .... and what happened to them ?

So ... what do you think that all of the other CEOs are going to do ?

That's right ... hide this crap as long as they can ...

But you're thinking ... "How can they hide it ... after all ... you have to file reports, etc ... and if you falsify them ... you go to jail ?"

Well ... the answer to that comes from the "magic" of accounting ...

You see .... if they haven't disposed of the investments .... of if the investments are not already known to be in default ... they DO NOT have to "mark them to market" .... they can "mark them to model" ... which is what they are largely doing ....

So ... they take out a crayon and drew a pretty graph on the office wall ... and that's how they can determine their "value" ... right up until the second of total default .... or disposition ...

If you ask an engineer how much 2 + 2 is ... he'll tell you 4 !

If you ask an accountant how much 2 + 2 is ... he'll ask you how much you want it to be !

The other thing that you have to keep in mind is .... so far you've only heard from a few banks ... and a few investment banks ... but these things are EVERYWHERE .... money market funds ... mutual funds with an "income" aspect to them ... emerging markets ... etc ....

Everybody chased the higher returns so their performance wouldn't lag that of their peers ...

They're all in the same boat ... and it's got a big hole in the bottom of it ...

So ... can the market "factor in" what so many ... are working so hard ... to hide from them ?

I don't think so ....

|

|

Registered User

Joined: 11/7/2007

Posts: 49

|

Reality can you point me exactly where that professor post was. I can't recall line by line, and I have looked at the Bernake thread, but couln't find it there. Is it possible the moderator removed it for some reason?May be it was in a different thread?

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

Hello Reality,

My question would now have to be, how do we turn all of this knowledge into money? Into hard and fast buy and sells? If the point here is to merely point out the injustice of the whole sub-prime financial mess then (I believe) this may not be the best venue. However, if the belief that the worst is yet to come can be traded...how would you trade it? Which sector? Which stocks? Which price levels? It's a mess. I agree. In my business, I speak with homeowners on a daily basis who are losing their homes becuase they were bought with loans they simply didn't understand. Who is to blame for that? I am of the firm belief that we are all accountable and responsible for our own lives. So we're going down on the titanic. The music is playing. The deck chairs are being rarranged. Life is unfair... I am fairly sure we are not in the market because of our philanthropic natures. As you stated in one of your previous posts, the first million is the hardest...if you have made yours surely you know that each dollar earned was a dollar lost from another source. To be honest, I have read and reread your post at least 10 times. Trying to understand its aim. Are you angered at the mess? Are you simply stating a position? Are you saying stay away from the financial sector? Or short the financial sector? Are we still arging the validty of cycles? Or perhaps saying that the 4 year election cycle should not be considered until 2 years into term...hence pushing the cycle off by two years? I hope these questions nor this post are seen as argumentative. I am simply trying to understand the (your) fundamental approach. I enjoy all facets and angles of the many and varied approaches to the market. Your fundamantal knowledge far eclipses mine -- and I am wondering if it's aim is market timing, or...

David John Hall

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

Bigblock ....

Please forgive me ... I was obviously confusing a post the you made in the thread "Another Brick on the Wall" ... and one that scott had made in another thread ...

The search function here leaves much to be desired ... and I eventually found it by using the following google searches ... "deflation site:worden.com" & "professor site:worden.com" ...

But ... with that said ... how do you see this playing out ?

David ....

"Laying blame" doesn't really interest me much ... as I see it as being counter-productive. When your up to your ass in alligators ... does it really matter whose job it was to drain the swamp ??

When you're the victim of a fatal automobile accident ... does it matter whose fault it was ??

Here is where we are ... and it is from this point that we must move forward ...

Accumulating wealth is ... and always should be ... secondary to preserving wealth ...

You're always better off not to play ... than to play poorly ...

But ... back to subject ... who will benefit from all of this ?

Well ... the realtors who sold the houses the first time and profited ... will profit again when they sell the houses out of foreclosure ...

The people who are getting to re-write all of the loans ... for those who can afford it ... will profit ...

Mortgage companies ... which have all taken a beating ... will either survive ... or not ...

Those that emerge ... because they are backed with deep pockets ... will prosper ... as will their shareholders ....

When the "scare" finally sets in ... those who buy up the commercial paper at values less than their intrinsic value will profit ...

So ... whose going to lose ?

Well ... I think it's a safe bet that mortgage insurers are going to be handed their hat ...

Homebuilders will continue to be under pressure as these inventories may take years to subside ...

And this will effect those industries normally used by the homebuiders ... from drywall to shigles, from pickup trucks to porta-johns, from excavating equipment to door locks, etc ...

The only point that I was really trying illustrate about the presidential cycle was ... it is important to remember why the market reacts ...

It reacts (through greed) to the hope that there will be a policy shift that bolsters the returns of the companies ... and/or the investors ...

Or (through fear) to a policy shift that might cause a contraction in those bottom lines ... or bottom line return to investors ...

Let's look at the presidential election that we are facing ... for example ...

Nearly every Democratic canidate favors higher taxes on the "welathy" ... in the form of not only higher income taxes ... but also higher capital gains taxes ...

So ... if the election in November yields a Democratic majority in both houses of Congress ... and the White House ... it is a pretty sure bet that NOT ONLY will those taxes be raised in 2009 ... but the changes will be made retroactive to January 1, 2009 ...

This means ... everyone with profits in stocks will want to get out in 2008 ... take their profits ... and pay their capital gains at the lower rate ....

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

David ...

As I re-read my post ... I saw something that may be easily miscontrued ...

I didn't mean to imply that savvy investors would "wait" to see how an election turned out ... and then react ... as they are pretty sure ahead of time ...

I don't know if you realize this or not ... but ... behind the Superbowl ... the US Presidential election is the most highly wagered event in the world .... and, over time, has proven to be much more "pure" than any polling ....

For instance ...

Here are Centrebet's current odds for the US Presidential election, and Ron Paul has the same odds as Mitt Romney, and better odds than Fred Thompson. I am quite amazed.

For those who don't know, betting odds in Australia are listed as a straight return per $1 bet. So 11.00 is $11 for a $1 bet.

To convert that into a percentage chance of winning, divide 1 by the odds. so $11.00 = 1/11 = 9% chance. Hillary Clinton is currenly 1/2.00 = 50% chance. All odds listed here as a percentage chance add up to more than 100%, the amount over 100% is the bookmakers vigorish (overround, or profit).

UPDATED NOV 6TH:

(Previous update listed beneath to compare movement)

code:

November 6th:

Odds % Chance

CLINTON, Hillary 1.83 54.6%

GIULIANI, Rudolph 6.50 15.4%

PAUL, Ron 8.00 12.5%

OBAMA, Barack 9.00 11.1%

GORE, Al 12.00 8.3%

ROMNEY, Mitt 15.00 6.7%

THOMPSON, Fred 15.00 6.7%

EDWARDS, John 21.00 4.8%

MCCAIN, John 21.00 4.8%

BLOOMBERG, Michael 36.00

HUCKABEE, Mike 41.00

RICHARDSON, Bill 67.00

RICE, Condoleezza 81.00

BIDEN, Joe 126.00

BROWNBACK, Sam 151.00

CLARK, Wesley 151.00

DODD, Christopher 151.00

GINGRICH, Newt 151.00

ALLEN, George 201.00

BUSH, Jeb 201.00

HAGEL, Chuck 201.00

KERRY, John 201.00

POWELL, Colin 201.00

VILSACK, Tom 201.00

COLBERT, Stephen 251.00

Previous Update:

CLINTON, Hillary 2.00 50.0%

GIULIANI, Rudolph 7.00 14.3%

OBAMA, Barack 8.00 12.5%

PAUL, Ron 11.00 9.0%

ROMNEY, Mitt 11.00 9.0%

GORE, Al 12.00

THOMPSON, Fred 12.00

EDWARDS, John 17.00

BLOOMBERG, Michael 34.00

MCCAIN, John 41.00

RICHARDSON, Bill 51.00

RICE, Condoleezza 61.00

GINGRICH, Newt 67.00

HUCKABEE, Mike 81.00

BIDEN, Joe 126.00

BROWNBACK, Sam 126.00

CLARK, Wesley 126.00

DODD, Christopher 126.00

POWELL, Colin 126.00

KERRY, John 141.00

HAGEL, Chuck 151.00

VILSACK, Tom 151.00

ALLEN, George 201.00

BUSH, Jeb 201.00

November 6th:

Surprise as betting sees Ron Paul firm past Obama, Clinton Firms slightly from 50 to 54% chance and Guliani firms from $7 to $6.50

|

|

Registered User

Joined: 11/7/2007

Posts: 49

|

You know reality, last night while thinking over this question I became to the same conclusions that what I just saw in the post "Another brick on the wall".

It is clear on the post that Fil thinks hyperinflation will hit first as the continuous pumping on M3 rises may give folks the sense that the party continuous on - But the inflation we are just starting to feel will drive them eventually dry. I look around often and hear the same thing over and over from folks - this is so much more expensive...., how much higher are prices going to go..., i can't afford this anymore..., etc

The price of comodities, oil, and energy will take a toll at one point or another, and home equity as it used to be is out of the picture. A lot of folks are in debt up to their eyes.

I assume that as it is right now, and as it is going to get much worse as far as the M3 goes, by the time those crooks stop boiling folks via inflation - there is going to be so much M3 that it is going to be cheaper to heat the house with the face of Washington (more paper on the $1 bil), than actually paying the bill.

Three things I like to mention that I think are important and may change things: bees, global warming, and middle east. Three bombs that may have (perhaps I should say "will have" extreme impact on this economy in a negative way.

Take this as a note - the ignorant human created pesticide for the crops, which in turn created a virus, which in turn is killing bee population representing a major set back for pollination and therefore to produce 2/3 of hour crops.

The same ignorant human is saying now that by changing the dna structure of the bee to match that of the King Bee in Africa - we will make a bee so powerfull and strong that will become inmune to the virus.

And I say just one thing - Nature always find its way. Anything touched by man only find its way to misery.

How do you thing this idiots are going to play god with bees?

How can folks who have Phd's think that they can fight nature?

The situation in the middle east is just waiting to explode with Pakistan and Turkey added to the mix. I am certain Oil will surpass $100 - Hell they better hurry up here and find some good way to oil independance or it is not going to be pretty.

And for Global warming we are alreay paying the bill on that - mentioned Katrina, Melina, Nino, Nina, whatever you want to call it - it is all the same - destruction, dislocation, deaths, and misery.

Some crazy world.

|

|

Registered User

Joined: 9/25/2007

Posts: 1,506

|

QUOTE (Alexandria) - there is going to be so much M3 that it is going to be cheaper to heat the house with the face of Washington (more paper on the $1 bil), than actually paying the bill.

Well ... let's hope it doesn't get quite that bad ....

The bees virus does represent a sizable problem ... but perhaps the solution is in it's origin ...

Many say that we didn't have this problem until we started importing bees from Austrailia ... which seem to be immune to the virus ... but can be carriers ...

Perhaps the answer is to start replacing our bee population with the Austrailian imports ...

The Middle East is a powder-keg ... and I fear that it is only a matter of time before some idiot over there pushes the big red button ...

And although I don't really subscribe to the mainstream Global Warming theories ... with the waning supplies of oil ... it'll be a non-issue soon enough ...

Even if the US was to substantially curb it's usage ... much of the world ... especially Asia ... would not ...

And China's oil usage will surpass ours in a couple of years ... if not sooner ...

And since we all share a single envelope of air .... it matters not what one country does ... if others do nothing ...

|

|

|

Guest-1 |