Registered User

Joined: 2/13/2005

Posts: 368

|

What are you guys thinking about market direction. Some of the guys I am talking to said the play on Friday was

Short the S&P at 1120, cover at 1100, and buy back in at 1090.

The chart of the S&P I am looking at looks like the close broke thru resistance at 1090 and kept going into the close. It broke the October high of 1101 and the next stop is the September high around 1080.

I'm thinking about how the market will react if Bernanke is replaced by Volcker...

Do you guys think there will be an oversold bounce or will the selloff continue?

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

As much as I would like the answer to those questions, I know that my trading does better when I don't try. It's also know it's important for me to know which time frame I'm trading, what system I'm trading, what trade I'm looking for, and how I'll know if the current is over. Something I won't know until it's done.

I'm short as of a few days ago. Currently +9.69% in the trade. My time frame is daily charts. I use a 2*ATR stop and my stop is currently at $7.27( which means all of my current profits are risked). As I'm a trend trader I'll be on this until my trailing stop hits. I obviously hope that won't be for awhile (as is always the case) -- but I also have no idea when it will be (usually much sooner than I want it to be). lol

I wish I could be of more help. But my style of trading actually prefers that I don't try and figure it out. :)

|

|

Registered User

Joined: 6/6/2005

Posts: 1,157

|

I forgot to mention I'm sort via SRS.

|

|

Gold Customer Gold Customer

Joined: 4/10/2006

Posts: 954

|

Here, I'v drawn the next Four days for you....

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

the market would puuke, short term, if volcker were appointed, he'd take the government kool-aid away. but that isn't going to happen, hes to old.

the corrections on, but the markets getting oversold. should bounce.

|

|

Registered User

Joined: 4/25/2007

Posts: 91

|

David:

" I'm short as of a few days ago".. I would appreciate your response on making this decision and identifying the criteria for downtrend. Breakdown on EMA's or Breadth indicator (%highs vs %lows) or any T2106/T2108 type indicator, or breakdown on key support level. Thanks and Regards, Jay

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (jayrama) David:

" I'm short as of a few days ago".. I would appreciate your response on making this decision and identifying the criteria for downtrend. Breakdown on EMA's or Breadth indicator (%highs vs %lows) or any T2106/T2108 type indicator, or breakdown on key support level. Thanks and Regards, Jay

i know you addressed this question to david but, i'd say "all of the above", plus, a high volume break of a reversal pattern, and longterm trendline. now you can see how fast the market broke to the downside, so the real trick is recognizing all this and making your move as soon as support is broken.

|

|

Registered User

Joined: 8/31/2009

Posts: 60

|

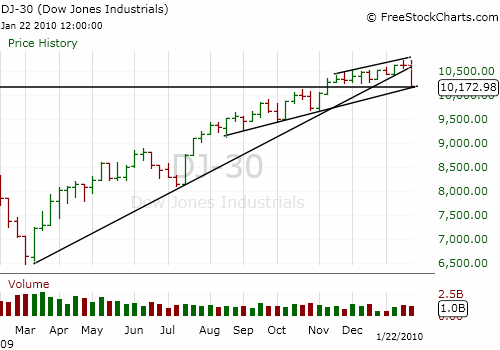

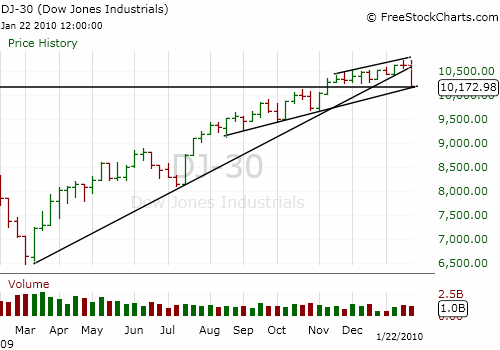

Here is the Weekly Chart of DJ-30. DJ-30 has broken the long term trend line. Not with increase in Volume though...

We can expect a bounce for tomorrow from this point.

But, Is this the signal of the beginning of a Major Correction ???

On a Side Note - Save Image feature in FreeStockCharts does not allow you to chage color of TREND LINES. Any one know of a workaround...

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (rysa) Here is the Weekly Chart of DJ-30. DJ-30 has broken the long term trend line. Not with increase in Volume though...

We can expect a bounce for tomorrow from this point.

But, Is this the signal of the beginning of a Major Correction ???

On a Side Note - Save Image feature in FreeStockCharts does not allow you to chage color of TREND LINES. Any one know of a workaround...

only time will tell if this is the start of a long term correction. but given the data we have its very possible. each day will offer new data. as long as the long term trendline remains resistance the correction is in play. its important too take some profits at minor support levels, though, so even if we break back up through the trendline, and get stopped out, you'll still have a winning trade.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Great comments, funnymony

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

"I'm thinking about how the market will react if Bernanke is replaced by Volcker..."

What if he's not?

You should look at the market in terms of

Plan A

Plan B

(and maybe plan C)

Long

Short

Nothing hapens

If you put a gun to my head. I would expect a bounce soon

but as a rule the market doesnt consult me.

Thanks

diceman

|

|

Registered User

Joined: 2/5/2006

Posts: 1,148

|

QUOTE (tobydad) Great comments, funnymony

thanks toby, just my 2 cents, though.

dang, if ben's not confirmed i might have to get a new avatar. lol.

|

|

Registered User

Joined: 12/31/2005

Posts: 266

|

rysa or wwrightjuly4-

how did you insert the image into your post?

|

|

Registered User

Joined: 1/28/2005

Posts: 6,049

|

See my Sun. 12-27-09 post here:

http://forums.worden.com/Default.aspx?g=posts&t=43789

Thanks

diceman

|

|

Gold Customer Gold Customer

Joined: 4/10/2006

Posts: 954

|

driger,

Follow Diceman's link, serveral explanations amongst that thread.

Short answer is, its a pain.

1) you have to save the image to your hard disk

2) you have to have(or create) an account to upload to....i.e, picaso, flickr, etc.

3) you upload to your photo account

4) you get the url to the photo from that account

5) you start or reply to a post here and cllck the "insert image " icon above

6) copy your url to the edit box

7) wha' la, picture.

If you wish to comment on your PIC you use "MSPAINT" on the pic after you save to HD and before you upload.

Follow Diceman's link, serveral explanations amongst that thread.

|

|

Gold Customer Gold Customer

Joined: 4/10/2006

Posts: 954

|

My mud puddle says.... ( that's where I do all my prognosticating.)

I mad a lucky call a few weeks ago....but played it very light (because im a light weight, and I drink light beer). 3 contracts of XLI at 29 jun10 (jan8 order was in 1-2wks before), using the black-scholes tool I guessed the breaking point of 29. - 29.80 and put in a bid at 1.80, It hit on that big uptick and I started thinking oh crap, this could run up some more....then next 4-5 days later the weakness set in.... my target is 3.00 for the options, based on wishful thinking no real basis. That would be 26.80 XLI but hoping fear will sell the options, cause I don't think XLI will make it that far, at least on this run. 27.05-.10 my gut feeling which is the low from Nov 27. 00000 but 4377 friday may prove to be quite a bit of resistence given the strengthe we've seen.

I think there will be some cash come into the market who think they missed the last run and that there is some value here at these prices. However I sold pretty heavy Wed Thur Fri (stops) hoping to reposition, if this down turn does not have legs.

Life and times of a garage sale trend trader.

Hale, Trader Vic forever.

( from the audience)

I knew trader Vic. And you sir, are no "Trader Vic"

|

|

Registered User

Joined: 12/31/2005

Posts: 266

|

QUOTE (wwrightjuly4)

driger,

Follow Diceman's link, serveral explanations amongst that thread.

Short answer is, its a pain.

1) you have to save the image to your hard disk

2) you have to have(or create) an account to upload to....i.e, picaso, flickr, etc.

3) you upload to your photo account

4) you get the url to the photo from that account

5) you start or reply to a post here and cllck the "insert image " icon above

6) copy your url to the edit box

7) wha' la, picture.

If you wish to comment on your PIC you use "MSPAINT" on the pic after you save to HD and before you upload.

Follow Diceman's link, serveral explanations amongst that thread.

thanks, i was hoping there was an easier way since freecharts are a worden product.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Just to throw in a few more thoughts, I suspect the next couple of days will sort of slow the drop and/or level off. We might get a short bounce. I suspect we will, shortly thereafter, move on down to somewhere in the mid- to upper-9000's DJ-30.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

As of 10PM: S&P 500: +6.40; Nasdaq: +7.75; Dow: +47.00. Bounce? in the morning anyway?

|

|

Registered User

Joined: 7/1/2008

Posts: 889

|

news reports Bernanke now likely to be re-confirmed

|

|

Registered User

Joined: 4/13/2009

Posts: 122

|

Futures are looking up this morning, so these may have some leggs for a few days.

AEZS,CRXX,DGII,LDL,SMTX.

good luck

tiger1220

|

|

|

Guest-1 |