Registered User

Joined: 9/22/2005

Posts: 849

|

Would you consider posting your strategy (scan, indicators, etc) for your setup, similar to the ones

posted by apsll in Volume Spread Analysis IV for his Bounce and VSA strategies>

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Do I want to draw as much fire as apsll does? Just kidding.

Here's a start;

http://www.worden.com/training/default.aspx?g=posts&t=30752

Mammon asked something similar and I got started at this thread. Let's just combine them here.

I was going to do a review of how I would evaluated CALM a couple of years ago as it went into its big breakout. I know a lot of us have been trading this one on and off since then (now I wish I had just stayed in the whole time)

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Let me say that there are several ways that I use my approach to stock selection. I have, essentially, three groups that I am always seeking: (1) the big hitters, these take the most homework; I'm going to discuss one of those in this thread (Davidjohnhall may find this interesting, not because I am going to teach him anything but because it's simply more discussion on a topic he enjoys which is how to forecast the big movers); (2) the regular stocks that seem to have the potential to offer profits over and over again (GNBT has been a good example lately.....actually it might end up being a good example of both (1) and (2) above, time will tell; and (3) the stocks that have potential to give a quick 5-7% within a week or two, and may do nothing else for me but, who cares?, I got my 5-7% in a brief time frame.

OK, on to discuss CALM. Fabulous returns of late; but the question is, when we see a buy signal are we buying (referring to the numbers above) a (1), (2) or (3)? CALM turned out to be a (1). Was there a way to know about the probabilities ahead of time?

Also, OBV is trying to get over the LR255, good long term buying power beginning to change in the right direction...ours!.

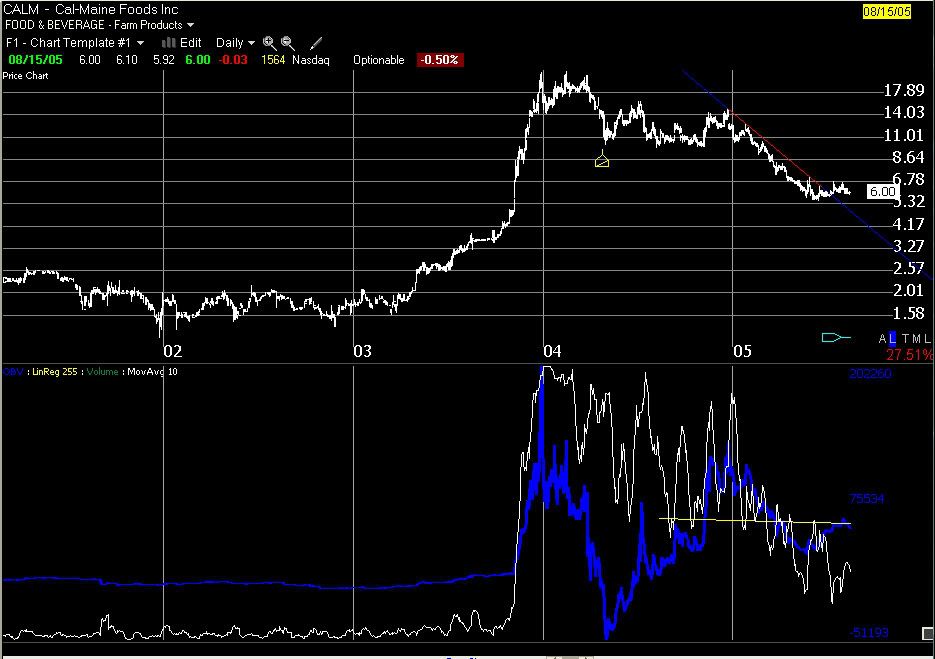

Please reference pics below:

First pic we see CALM broke through a downward (resistance) trendline. Again, remember, this is after seeing a buy signal (which we will define again later; also, review the other thread linked above). So in going back and looking at CALM's history, we are looking for evidence that this might be one of the big ones.

There is still another significant trendline over which price must climb before there is some open air above for free flight. I'm not using the term "blue sky" because many traders only think of that in the context of clearing the ATH and having absolutely no resistance overhead whatsoever.

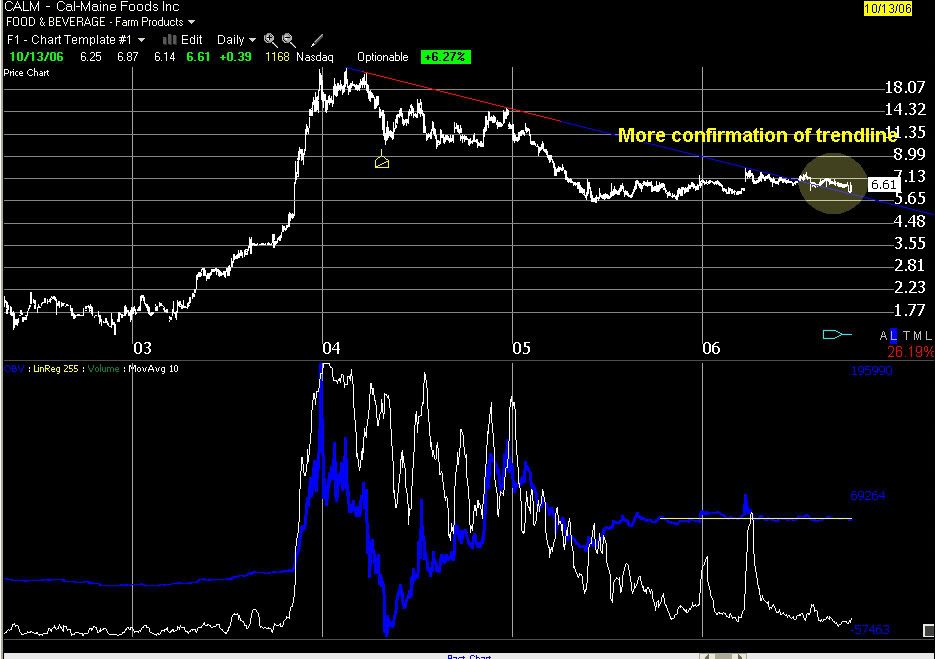

We can see in early to mid 2006 price took a big jump on a massive volume boost and, at the same time, clearly confirmed that this second trendline was a significant one. So now we know to keep an eye on what happens (or in this case, since we're reviewing the history of a stock's behavior, what happened).

Next pic, we get more confirmation that this is the trendline for the moment.

Next pic, once we get over the confirmed trendline, the action over the ensuing weeks, continues to confirm that this trendline is worth watching in looking for a breakout.

Next pic, now for a close-up and a look at the actual Tobydad profile, I think the picture sort of tells it all, but the key points are described in the other thread referenced.

Many more details to discuss, stop losses, modifications of selections for strong and weak markets, etc. but this should suffice to get started. Or at least I hope so.

Please present thoughts, contradictions and questions and we'll go from there.

Discussion of stops and exit strategy next. Possibly more important than any of the rest of it. The place where most of us screw up the most.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

QUOTE (tobydad) Do I want to draw as much fire as apsll does? Just kidding.

Here's a start;

http://www.worden.com/training/default.aspx?g=posts&t=30752

Mammon asked something similar and I got started at this thread. Let's just combine them here.

I was going to do a review of how I would evaluated CALM a couple of years ago as it went into its big breakout. I know a lot of us have been trading this one on and off since then ( now I wish I had just stayed in the whole time)

hindsight is alwayse 20/20 isn't it?

Thanks for this ..

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

OK, Scott, now a highly technical question for you....

What in the heck is up with that avatar of yours?

I mean, I'm just saying....

|

|

Registered User

Joined: 9/22/2005

Posts: 849

|

Tobydad

This not quite what I am looking for. I am sure I could search for Tobydad Profile and extract what indicators you use in each window, but it would require a lot of time and effort. I am inherently lazy (not exactly lazy - born tired and never got rested) so if you would post here which indicators you put in which window it would save a lot of time.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

QUOTE (tobydad) OK, Scott, now a highly technical question for you....

What in the heck is up with that avatar of yours?

I mean, I'm just saying....

Well . . . the only obsession besides the market that really gets me going is sculpture. I specalize in figure sculpture both secular and liturgical, and can apreciate highly compotent work in other sculptors. This turned out to be pretty small but if you look closely the guy has horns and cloven hoofs. He's a satyr from Greek Mythology. Today Satyrs have all sorts symbolic meanings. Unfortunately what jumps to the fore front of peoples minds is often some sort of demonic connotation, or paganism. While Pan was a pagan demigod (forgot who begat him) from the Greek and Early Roman era, since then satyrs have been much represented in classical sculpture from rennisance, baroque, and neoclassical times and even modern art sometimes represents them. I think today they are more symbols of fribolity and play, including sexual firvolity.

But ultimately I just thought this one was cool. I'm gong through a whole polymorph phase right now. Polymorphs are blends of humans and animals, so centaurs, mermaids, sphinxs etc etc. I've alwayse been drawn to the fantastical in art, Michael parks, Ian Norbury , Chad Awalt, Michael Christensen ETC. I'm working on a satyr now and this photo was part of a reference material collecting campaign, to get ideas and study materials for designing mine. It's not finished yet or I'd put it on as my avatar. Right nowit does look demonic because I first construct a basic skull to the porportions of the cranium and face right... noce that is "right" the details fall into place. I've been working on the boddy mostly becaue at 12" tall it's my smallest figure to do yet... and with all my distractions it's tough to get into modeling a 1/8" eye unless I can sit down and get into it. ... so I have a modeled body and a skull... it's kinda creepy. I'm hoping the use the exercise to expand my ability with hair as thier legs are usualy represented as fairly shaggy and they heads aer usually covered with a mass fo curly or also chaggy hair... so allot of work ahead.

I'll change it when I get sick of if or find something else better.. unless it offends? I have a few female nudes i've done. I find the male nude is more difficult than females...aside from the more subtle changes of plane in a female figure (which is actualy more difficult than a ripped muscular body), because it's not inherent for most guys to scrutinize the construction of another male body. But inthe end they are the same really... so it's a psychological hurdle I guess. the only difference from a constructive pont of view is the shape and porportion of the hips and pelvis and the length of the neck (which is actually an artist trick to make a figure imediately apear female)... the rest is fat deposits, even on the leanest of figures. So if I wan't to be able to sculpt realy good figures I need to be able to do both. Besides sculptors that only do female figures are just wierd to me.. think they are using "art" as an outlet for something else. Not all of my figures are nudes either.. but all of them start as a rough nude at least... becasue the underlying framework needs to be right to carry the piece off with believability and quality.

There that is it... in a nut shell I liked it, that is what is up with my avatar.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

OK, let's see if I can get you what you're looking for:

Indicators: I only use 2 windows (I just like the bigger windows and less to try to focus on...I'm too easily distracted). F12 template, daily shift-5 sets the scale but I can't remember what that's called.

top window: candlestick; BB20,20 solid lines; BB13,10 dotted lines; MA20 simple dashed lines; MA 50 simple solid line

Lower window: TSV26 exp solid lines; BB13,10 solid lines; MA13 simple dotted lines; Volume bars (light colors for visibility); MA6 simple on volume; OBV solid lines

F1; daily, hit shift-1 three times for the scale;

top window: candlestick price, not indicators (sometimes I think it's good just to look at a naked chart and see what you see)

bottom window: OBV; LR255 on OBV; volume (not visible); MA10 simple on volume

There are other templates I use but primarily for learning and confirmation. The two above are my primary selection tools.

Scans: It depends on market conditions. One of my favorites is the 200ma breakout:

C250 < AVGC200.250 AND C150 < AVGC200.150 AND C50 < AVGC200.50 AND C5 > AVGC200.5 AND C4 > AVGC200.4 AND C3 > AVGC200.3 AND C2 > AVGC200.2 AND C1 > AVGC200.1 AND C > AVGC200

Sort by the LR30 on price. When you get your sorted list, click on the arrow to the right of the "Sorted by... xyz..." at the top of the watchlist so it inverts, then press the "Home" key.

Now you're looking for charts with, preferably, a doji or hammer close to the LBB20 and with as much direct support from the LR30 as possible. TSV26 should be coming hard up through the LBB13 (in good markets), up through the MA13 in mediocre markets and up over the UBB13 or, better yet, the 0 line in poor markets. If you get a shot of volume along with the TSV surge, so much the better but not absolutely essential with this technique.

Look for price to break above the high of the previous day and you've got a buy signal.

If you're unsure, buy 1/4 your desired position and see what it does. If it breaks out hard, add to it. If it drops to around the low of the previous day, I usually will still buy more, especially if the rest of the chart looks good (trendlines, etc).

The evaluation techniques depicted in the screen shots earlier in this thread are very useful in seeing where you find yourself in the progression of these stocks.

This is where apsll's VSA or something akin to it (I've discussed permutations on various threads, you could search by "volume"...if you ever get rested up that is.... :) .... comes in handy.

Additionally, it must be understood that this scan is, typically, going to produce a universe of stocks that must be watched. You may not find much that is ready for flight right off the bat (especially in a depressed market).

But the good part is that you can frequently find stocks that have broken upward out of a long term down trend, and may be getting ready to move up. BIG NOTE: Again, keep in mind that sometimes, we're going to get into some moves that are just a quick profit and then get back out. It may not be the time yet, but there are, frequently, quite a few quick profits to be had while watching for the big one.

Here's another BIG NOTE: There may never be a "big one". That's OK, I mean, who cares? If a stock has gotten out of a down trend and is now trending up and we ride it up every time that it bounces off of support, well, is that so bad?

Well, that should be enough to play around with for starters. If there's interest, I'll add some other scans and a little further discussion but let me, first, see if I'm hitting on your interests before going any further.

...born tired and never got rested....funny, very funny.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Scott,

first off, I assume you know I was just clowning around. But had a feeling maybe someone else was wondering, and besides, we're all friends here.

Now for the serious, no, of course, no offense, just seemed odd to see this very tan nude dude whenever I was trying to read your stuff. But now that I understand more it's very interesting.

So is this your sculpture? I mean, did you sculpt this? It's very good!

I was fascinated with Greek and Roman mythology in my adolescent years; read quite a bit.

Thanks, interesting to learn more about our forum members.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Scott,

first off, I assume you know I was just clowning around. But had a feeling maybe someone else was wondering, and besides, we're all friends here.

Now for the serious, no, of course, no offense, just seemed odd to see this very tan nude dude whenever I was trying to read your stuff. But now that I understand more it's very interesting.

So is this your sculpture? I mean, did you sculpt this? It's very good!

I was fascinated with Greek and Roman mythology in my adolescent years; read quite a bit.

Thanks, interesting to learn more about our forum members.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

I love when it posts twice for me.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

"...This turned out to be pretty small but if you look closely ..."

That's just it, until you explained, I was afraid to look closely. Wasn't sure who I was looking at and how much I wanted to see.

Sorry...just goofing around again.

Yes, I have too much time on my hands today. I better go find something productive to do.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

QUOTE (tobydad) Scott,

first off, I assume you know I was just clowning around. But had a feeling maybe someone else was wondering, and besides, we're all friends here.

Now for the serious, no, of course, no offense, just seemed odd to see this very tan nude dude whenever I was trying to read your stuff. But now that I understand more it's very interesting.

So is this your sculpture? I mean, did you sculpt this? It's very good!

I was fascinated with Greek and Roman mythology in my adolescent years; read quite a bit.

Thanks, interesting to learn more about our forum members.

I asumed you were clowning around. If not that's fine to .. I'm not homophobic... but many americans are. Don't get me wrong .. i'll never march in a gay rights parade.. but I won't block it or throw stones. I spent several years inthe Ballroom Dancing industry.. there are so many there that you either get used to them or get a new job. I find it amazing how many people even when looking at aret reduce it to sex. I can't see that..maybee it's me. It's a lump of wood, stone or bronze that represents the human figure... which in classical thinking is a work of beauty. Christian thinking could see it that was as well before it's all clouded up with the hyperconservative, fundamentalist thinking.

I've actually got a series of things I wan't to do that incoporate ancient christian ideas and symbolism. Having a professor of religion as a wife means the book shelves are full of cool obscure stuff about the evolution of christian thought, spread and decline of christian mysticism etc etc.

It is not my sculpture.. but a great example of well sculpted figure and a satyr. I originaly wanted to put my daughters picture up as an avatar but my wife is such a paranoid person she didn't want me floating pictures of our baby on the net unless we sent them in emails to friends. I know it's silly. She grew up in Communist Russia. Paranoia is ingrained.

|

|

Registered User

Joined: 9/22/2005

Posts: 849

|

Thanks Tobydad

This is exactly what I need,

Scott

Could you post a larger picture of your avatar so we can see the finer points of the sculpture?

|

|

Registered User

Joined: 9/22/2005

Posts: 849

|

Tobydad

I agree, the charts tou posted are very helpful in understand the reasoning.

|

|

Registered User

Joined: 9/22/2005

Posts: 849

|

I've got to teach this computer how to spell you and other short words,

It does pretty good on words like #$@% and &$!%.

|

|

Registered User

Joined: 4/18/2005

Posts: 4,090

|

There you go. Not shure who the original sculptor is. But it's good work

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

OK, well I feel better.

|

|

Registered User

Joined: 9/22/2005

Posts: 849

|

Tobydad

I lile this setup very much.

I set iy up as you suggested with thesr additional indicators

I added your 200ma breakout as a %true indicator (dark blue, invisible) in the top window. I sort my watchlist on this and choose the stocks which return a value of 100. This gives me a lot of flexibility in my choice of watchlists.

I also added volume spike (V>1.25*AVGV30) as a %TRUE indicator in the bottom window. This gives me an immediate idea of volume.

I ran this against my 1 to 10 dollar watchlist (1021 stocks). This setup returned 24 candidates of which one is suitable for consideration.

It is END. It bounced off the LBB20.20 on 04/03, closed over the previous day’s high on 04/08. It is also bouncing off the MINL10. TSV26 is cr0ssong up through it’s MA13 at TSV26 EQUA ZERO.

Four indicators confirming each, I think, is good enough for a buy signal.

I got in at 1.30. Target 1.88 Reward 1.88-1.32 = 0.56 (check weekly chart for resistance). Stop 1,28, Risk 1.3.1.28 = 0.02. Reward/Risk 0.56/0.02=28.0.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Just to clarify for others that might be reading, I would, normally, not get into this until price was supported by the LR30. That said, I do have exceptions to that rule and this stock, with all of its recent TSV activity would be a good example of a pretty safe time to catch an LBB20 bounce for a buy.

Good luck. Please continue to give me feedback on how you are finding this set up as I, too , am always learning.

tobydad

|

|

Registered User

Joined: 2/17/2008

Posts: 132

|

hi. i'm a total beginner to this. just wondering if you use the exact opposite strategy to find stocks to short? Also, now that we're in a bear market, what ratio of stocks do you short to stocks that you buy?One other thing...do you tend to keep hold of a stock during an earnings announcement, as some people say that the stock price might jump wildly either way on this day?

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

djd;

Welcome. We're glad to have you aboard.

First off, if you're a beginner, I would not short. That's just me but it's tricky business in my opinion.

As to your direct question, yes, pretty much the inverse for shorting although I have a very specific approach to making it as safe as possible. If there is interest, I may post some pics and explanations . But the caveat is, although I've developed a routine that has been pretty reliable, I don't short often so it is clearly not one of my strengths.

I know, in this market, that seems idiotic...I guess it is. But I keep averaging 7% a month so I stay with what I know.

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

bcraig;

by the way, nice additions to the profile. Those are some great ideas and ways to make it more flexible. I've added your concepts to another screen. I'll play around with it for a while and give you some feedback.

|

|

Registered User

Joined: 2/17/2008

Posts: 132

|

thanks tobydad. and do you keep hold of a share when that company is due to make an earnings announcement?

|

|

Registered User

Joined: 10/7/2004

Posts: 2,181

|

Typically a very poor idea; especially when shorting. Remember, with shorts, there is no limit to your losses. With longs, at least you can only lose your initial investment.

|

|

|

Guest-1 |