Registered User

Joined: 6/30/2017

Posts: 1,227

|

Happy Friday Bruce!

I've been ignoring volatility too long. Time to add it to my toolbox.

I've heard of Implied Volatility, and I see it on TC2000 option chains, but ... what about IV Rank? Is there an off-the-shelf indicator? Is there a PCF formula?

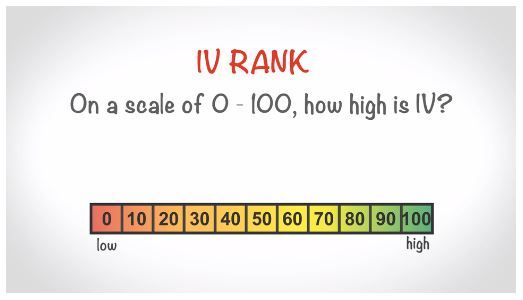

My (limited) understanding of IV Rank is that it is a measure of Implied Volatilty against itself, plotted on a scale between 1 and 100. I'm assuming the lookback period is a parameter based on personal preference.

We may not even need a PCF. One of the many oscillators we already have should have a 0 to 100 range. Maybe we can use a canned oscillator and change the data source from price to Implied Volatilty?

Of course, I don't want to reinvent any wheels. You and I both have better things to do this weekend. :)

So my first question is ... have you heard of IV Rank? Is there something already available in TC2000?

Inquiring baristas want to know.

Source: https://skyviewtrading.com/video-lesson-2-pa19ae/

|

Administration

Joined: 9/30/2004

Posts: 9,187

|

You could plot IV and Stochastics (or Worden Stochastics) on the same chart and set the data source on the stochastic to IV.

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Found this calculation on TastyTrade ...

100 x (the current IV level - the 52 week IV low) / (the 52 week IV high - 52 week IV low) = IV Rank

Source: http://tastytradenetwork.squarespace.com/tt/blog/implied-volatility-rank

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Going off-grid for a few hours. Might not make it back online until tomorrow morning.

StockGuy, thanks for the suggestion!

Bruce, when you have a minute I'd like your input as well.

Have a great weekend, y'all. :)

P.S. One question that just popped into my head is - do I plot IV on the equity's chart, or its option chart? (I'm guessing the latter, but don't want to assume).

Also, I'm assuming IV, and IV Rank, varies by Strike Price. I'm interested in studying IV Rank across all Strike Prices in an Option Chain. Doable? Can this be plotted? Or scanned for?

|

Administration

Joined: 9/30/2004

Posts: 9,187

|

That's the formula for stochastics. But you're probably not going to be able to use weekly data because the history on options contracts is limited.

|

Registered User

Joined: 6/30/2017

Posts: 1,227

|

Good point. Thanks! I'll just have to see what's available and see if it's viable.

There's more than one way to skin a ...

|